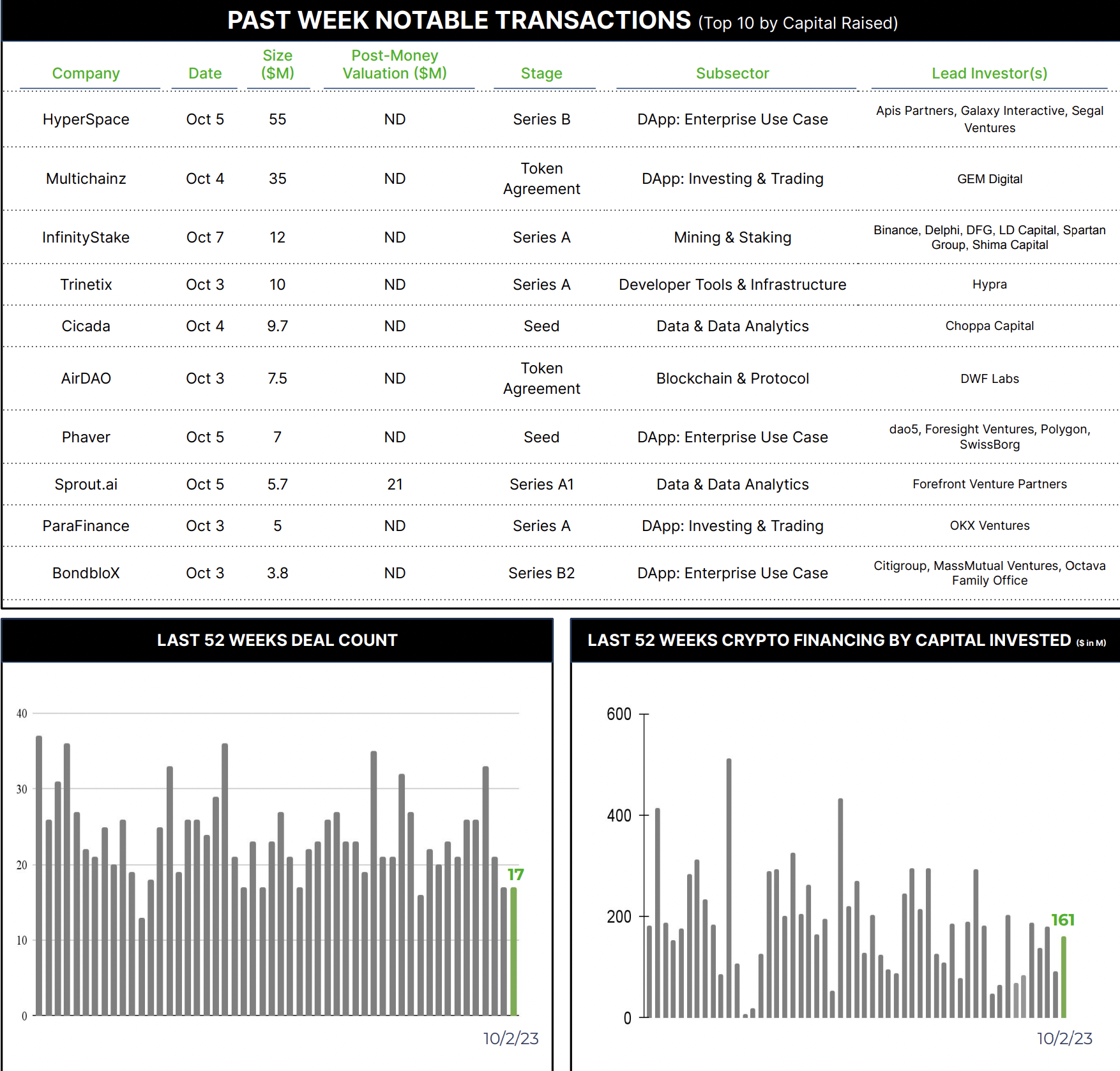

17 Crypto Private Financings Raised ~$161M

Rolling 3-Month-Average: $142M

Rolling 52-Week Average: $188M

Deal count remained steady at 17 this week, though some larger raises in the Metaverse and DeFi sectors pushed proceeds well above recent weekly averages. This week also saw a shift towards DApps, with both investing and enterprise use cases receiving support.

Selected Highlights

HyperSpace, a Dubai headquartered digital entertainment company, closed a $55M round led by existing investor Galaxy Interactive with participation from Apis Partners and Segal Ventures. The blockchain-native company builds and operates digital entertainment parks that integrate augmented/extended reality into a physical space for an interactive and immersive experience. Their flagship location, AYA, is a 40,000 square foot facility that opened in a Dubai mall last December. Proceeds of the new round will be used to complete two larger parks in Riyadh and Dubai in the next few months, expand internationally (including the US) and develop additional proprietary tech.

Why Notable?

Linking the virtual to physical reality, particularly in a non-gaming context, has been the source of much hype and speculation, but with little palpable traction. HyperSpace is at the forefront of digitally immersive entertainment with purpose-built physical gateways to the metaverse, and 480,000 tickets sold in their first 9 months suggests a fit with consumers. Time will tell whether this initial interest can be sustained.

Web3 lending platform Multichainz received a $35M commitment from Bahamas-based GEM Digital. Multichainz runs a DeFi protocol to lend, borrow and stake crypto and tokenized assets across several chains including Ethereum, Abitrum, Polygon and Avalanche. Funds will be used to expand RWA offerings as well as custodian and tokenization partners.

Why Notable?

$35M is an impressive round for a community-led DAO raising capital through a structured token subscription, amid increasing legal and regulatory scrutiny of DeFi generally, particularly in the US, and an overall down market for capital.

InfinityStake, an Australian DeFi staking platform, closed a $12m capital raise from undisclosed investors. InfinityStake’s smart contract mechanism enhances its users’ returns by arbitraging multiple staking pools. The company’s platform helps to discover flexible staking opportunities and provides liquidity and referrals across multiple chain programs.

Why Notable?

As with Multichainz, InfinityStake’s successful round seems a noteworthy vote of investor confidence during challenging times for DeFi.

Patterns

The concentration of DApp financings this week is a marked shift from infrastructure’s recent dominance and continued momentum for DApps in 2023. The later stage and large rounds also contrast recent trends, with this week’s total capital regaining ground against this past year’s weekly average. While perhaps encouraging, it is too early to tell whether this represents a shift in investor sentiment, or a sustainable trend as we approach year-end.

Conferences & Events

Architect Partners is co-hosting an event with The Tie on Thurs Oct 19th at The Tie’s office (link here to register). We will also be at Money2020 (October 22 – 25).