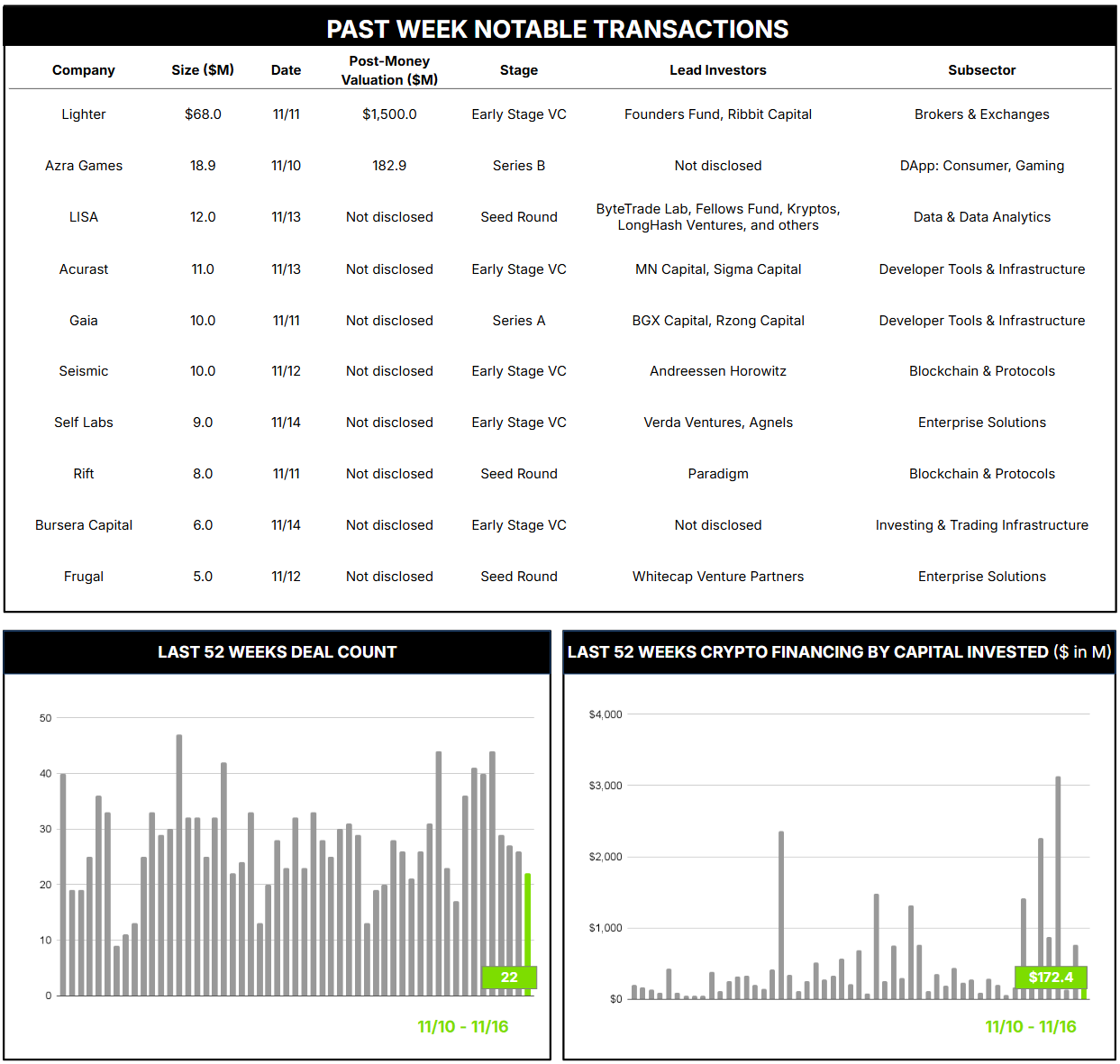

November 10 – November 16 (Published November 20th)

PERSPECTIVES by Steve Payne

22 Crypto Private Financings Raised: $172.4M

Rolling 3-Month-Average: $633.0M

Rolling 52-Week Average: $479.8M

Looking at the numbers above, both deal count and announced capital raised dropped significantly last week. Some may think this is a function of the recent tumble in crypto prices (BTC is down roughly 30 percent from its 2025 high just six weeks ago). But note that these investments were greenlighted and negotiated weeks or months ago. It remains to be seen how deal activity and valuations will be affected in the next few months if crypto prices stay depressed. We have already heard of some deals being canceled due to market uncertainty, so stay tuned.

In the largest financing last week, Lighter raised $68M in equity and token warrants at a post-money valuation that Fortune reports at about $1.5B. Lighter operates both a DEX and an Ethereum Layer 2 network. It supports, and is best known for, perpetual futures contracts (“perps”), which allow traders to take long or short positions without expiration. Lighter states that its Layer 2 infrastructure is intended to minimize gas fees, enable instant settlements, and provide auditable proof of every trade.

Several aspects of this deal are notable:

- Lighter’s CEO, Vladimir Novakovski, entered Harvard at age 16 and joined Citadel at age 18. He is a serial entrepreneur and, in an interesting twist on the current trend, pivoted from AI back to crypto instead of vice versa.

- Lighter is already one of the top five Ethereum L2s, with more than $1.1B in TVL. It competes in the DEX perp market with Hyperliquid, which has its own L1 and has recently filed to raise up to $1 billion in connection with a SPAC merger involving Rorschach I LLC. According to data reported by The Block, perpetuals now make up roughly three quarters of total CEX trading volume, with nearly $49 trillion in notional traded, compared with about $14.8 trillion for spot and $1.3 trillion for options. Binance and OKX are leaders on the CEX side.

- The investor set here is quite strong: Founders Fund and Ribbit Capital led this fundraising, with participation from Haun Ventures and Robinhood. Dragonfly, Haun Ventures, Craft Ventures, and Robot Ventures reportedly participated in a smaller prior round.