June 23 – June 29 (Published July 2nd)

PERSPECTIVES by Todd White

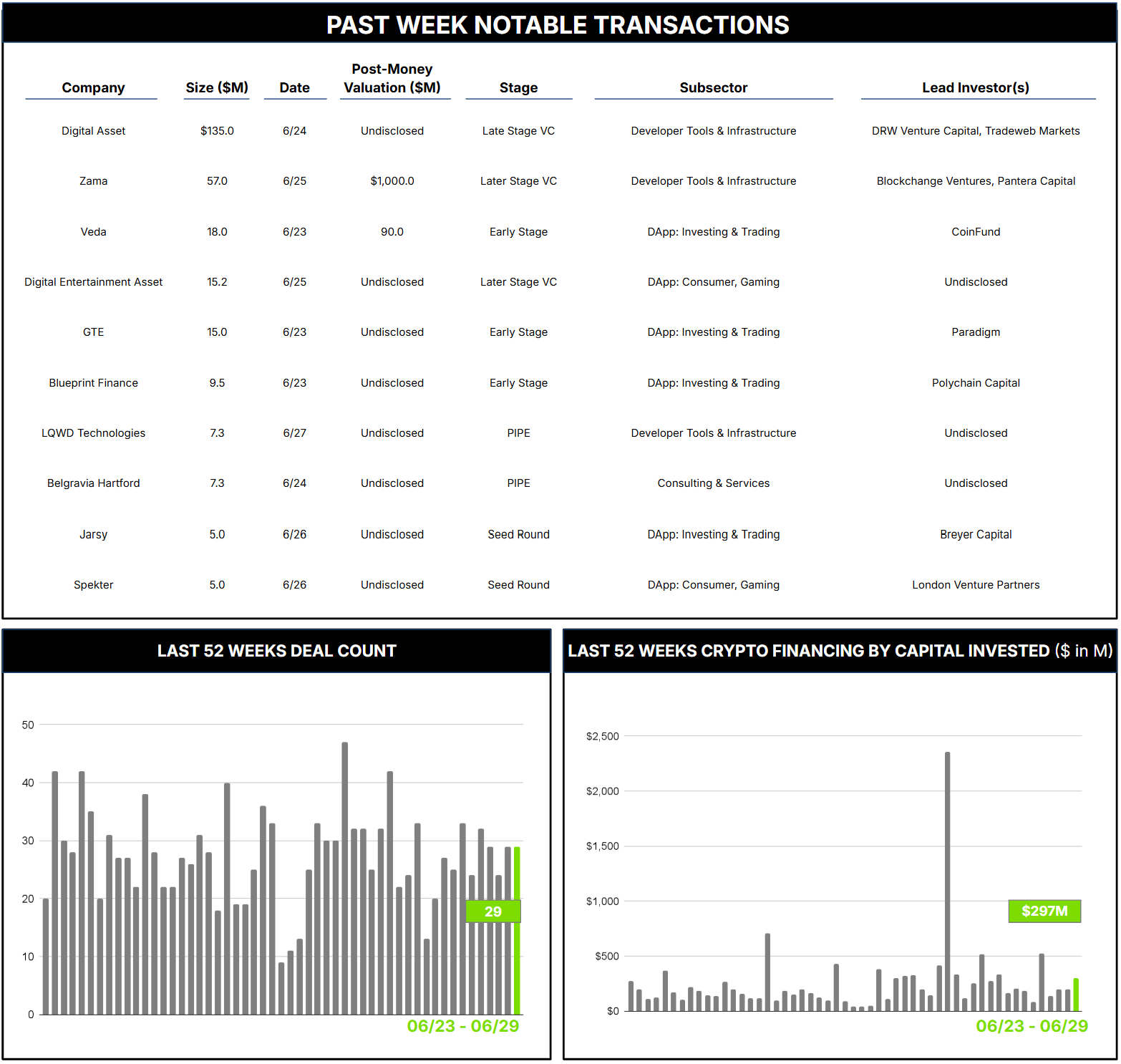

29 Crypto Private Financings Raised: $296.6M

Rolling 3-Month-Average: $260.7M

Rolling 52-Week Average: $257.0M

The convergence of traditional financial markets and blockchain technology may finally be becoming reality. It is often said that innovation happens gradually, then suddenly. For more than a decade the prospect of tech-driven disruption in capital markets seemed perpetually just over the horizon. Many smart teams built clever solutions, yet momentum and adoption failed to materialize, until (perhaps?) now.

This season has been dubbed “stablecoin summer,” with much buzz about digital payments finally attaining product-market fit, bolstered by steady improvements, legislative tailwinds, shifting political sentiment, and a banner IPO. Across the sector a wave of announcements, long in the making, is now arriving by the day, hour, or minute: projects are getting off the ground, capital rounds are being completed, collaborations are brewing, and deals are being announced and closed. The summer may now be entirely owned by the stables.

At its core, crypto and blockchain present the first prospect for a wholly new system of financial infrastructure in a very long time. Regulated financial institutions, once skeptical of most things crypto, are increasingly interested in how blockchain infrastructure and payment-and-settlement rails can enhance their businesses. The largest institutions, however, face strict requirements for privacy, auditability, compliance with AML and other regulations, and the need to control transactions and limit access. Some, such as JPMorgan, responded by downplaying traditional crypto while building their own private chain, now known as Kinexys, on which they can manage secure transactions and launch products like the JPMD deposit token, an innovative twist on stablecoins available to their institutional clients. But because it is available only to JPMorgan clients, Kinexys and JPMD are not interoperable and may have limited application for inter-bank payments and broader non-JPM-led markets.

This tension between privacy, control, and interoperability has been a particular challenge, but solutions are emerging. The Canton Network, created by blockchain-infrastructure company Digital Asset, is a public, permissionless Layer 1 designed with the privacy, compliance, and interoperability requirements of global capital markets in mind. Unlike most public blockchains, Canton is structured as a collection of applications running on separate Canton ledgers that can choose to connect to other applications and users, or remain isolated from them. The applications are written in Daml (Digital Asset Modeling Language), a purpose-built, open-source smart-contract language. Together, Canton and Daml aim to deliver privacy and data control without sacrificing the efficiency and interoperability of public blockchains.

Digital Asset’s reported metrics suggest strong product-market fit: more than 4 trillion dollars in tokenized real-world assets, over 2 trillion dollars in monthly transaction volume, and 12 billion dollars in digitally native security issuances. Participants in the Canton Network already include major banks, asset managers, custodians, exchanges, and infrastructure providers, with notable collaborations involving Broadridge, Goldman Sachs, HSBC, HKEX, Nasdaq, Tradeweb, Versana, DTCC, Euroclear, and others.

Last week Digital Asset announced a strategic funding round of 135 million dollars led by DRW Venture Capital and Tradeweb Markets, with participation from Goldman Sachs, Citadel Securities, BNP Paribas, DTCC, Circle Ventures, Paxos, Polychain Capital, and others. The round marks a convergence of traditional-finance and crypto-native investors and could accelerate adoption and scaling of the Canton Network. Chief Executive Officer Yuval Rooz stated that the capital moves Digital Asset from “momentum to scale,” enabling rapid client onboarding and global market expansion.

Will Mr. Rooz be proved correct, and will global capital markets adopt a public blockchain that offers configurable privacy and decentralized governance? Time will tell, but with many key market players already at the table as collaborators and strategic investors, the prospects look good.

Contact ryan@architectpartners.com to schedule a meeting.