Bakkt announced Q2 earnings this week, reflecting for the first time its April 1 acquisition of Apex Crypto. Bakkt’s revenues of $347.6M, up from $14.0M in 2Q22, include $335.3M in crypto services revenue and $1.3M in gross profit associated with Apex. This reflects “principal” revenue recognition, where Bakkt must recognize the entire transaction volume, rather than “agency” recognition which would only report the transaction spread amount. According to Bakkt, this is in accordance with GAAP standards, and there are similar offsetting gross-ups on the asset and liability side of their balance sheet for custody of institutional amounts reported as “safeguarding assets”.

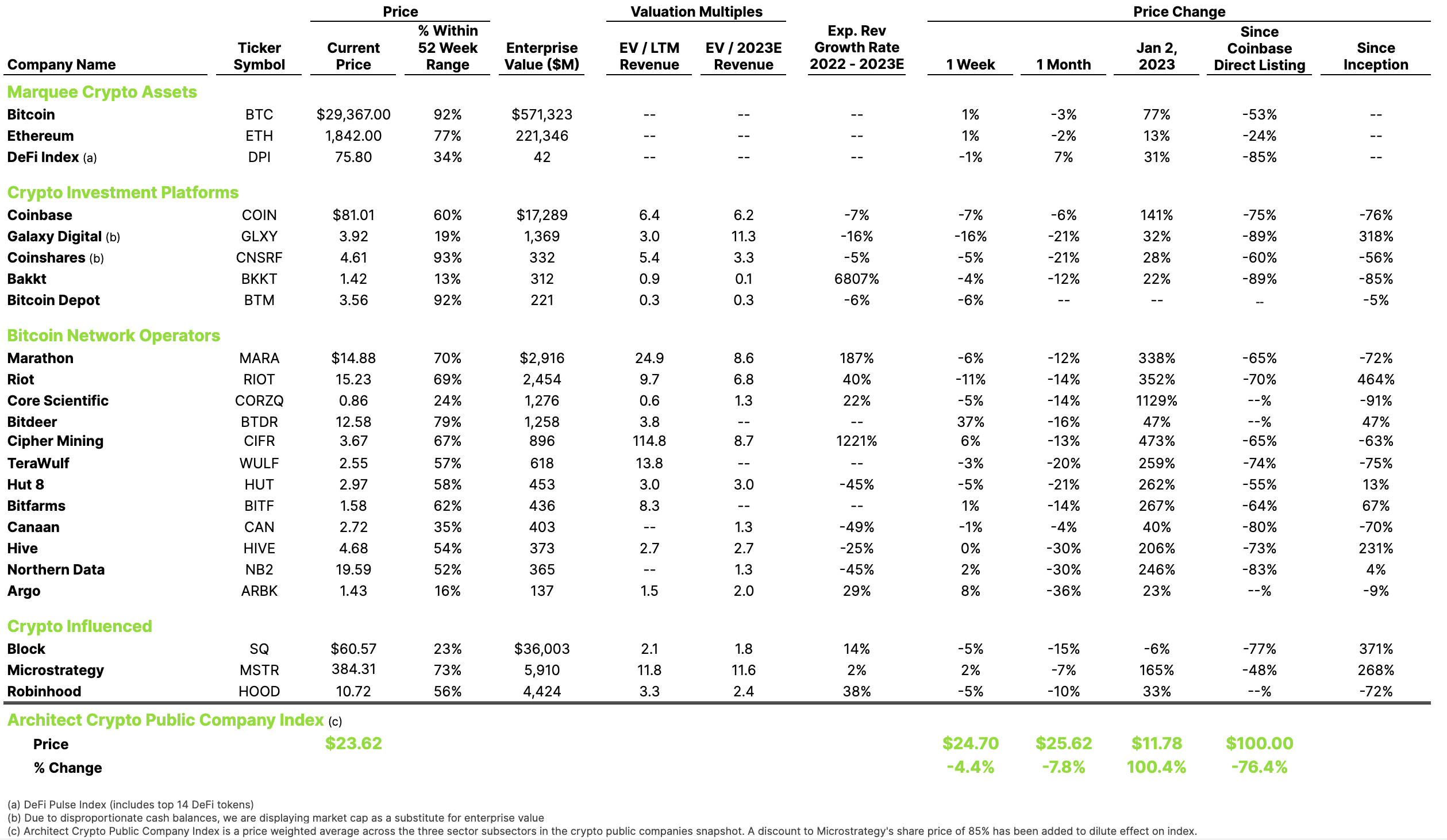

For Bakkt, this “principal” revenue recognition will result in a much lower EV / revenue multiple as seen in our table, which may paint a confusing picture. This compares to groups in the traditional space like Block who process billions in transaction volume, and recognize the full volume as revenue, but are only capturing a small portion of that volume as profit. When speaking in the context of investors, Block essentially ignores revenue and points investors to gross profit which they view as a far better measure of the company’s performance.

Potential economic distortions required by GAAP are certainly not unique to the digital asset space, and lead many companies to report on a non-GAAP basis to provide investors a more meaningful view of their financial picture. But the perils of Crypto accounting can challenge companies and investors alike, particularly when uncertain accounting rules combine with other difficulties such as tracking opaque transaction volumes and the notoriously uncertain legal environment.