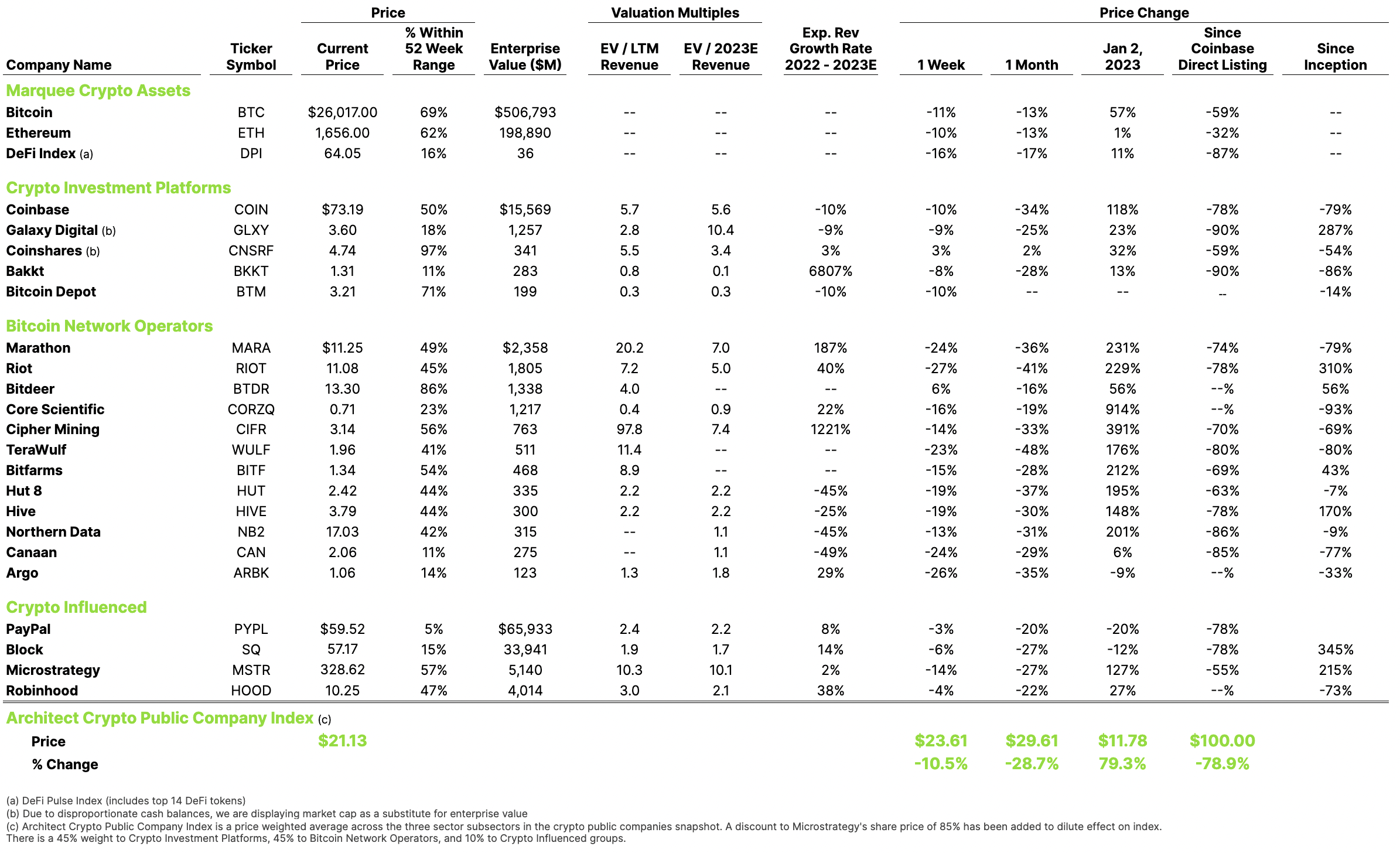

Our public index is down 10.5% this week, driven largely by the pullback of BTC, ETH, and across the crypto asset spectrum. Some cite the news of SpaceX’s offloading triggering the pullback, while others attribute the moves to large-scale liquidations on leading derivatives exchanges following heavily-leveraged open positions that were ripe for a feedback loop. As usual, it’s likely a combination of myriad factors that can be hard to predict, analyze or correlate to specific movements. The Network Operators were the hardest hit sub-segment on our index, hardly surprising given their position as leveraged Bitcoin plays.

Also notable is PayPal’s August 7 launch of PYUSD, its US$-backed regulated stablecoin issued by Paxos, available immediately for use in payments through PayPal’s digital wallet. Although PayPal has been muted of late on their crypto and blockchain initiatives, their digital wallet and commerce segment – which includes P2P, remittances and crypto – is one of three strategic pillars (along with network/credit and payment service provider initiatives). On the heels of the PYUSD launch, PayPal also announced its integration of Ledger Live on August 16th to provide secure crypto purchases using the Ledger Live app directly from a PayPal account.

The opportunities that the PYUSD present are potentially transformative. José Fernández da Ponte, PayPal’s crypto SVP, was understated and cautious in a recent interview, and he highlighted their long-term and patient view towards blockchain-based payments. But one need only ponder how the embedded yield on the assets backing their new stablecoin might be used to mitigate both merchant and consumer payment costs to begin to grasp the potential.

We will watch enthusiastically as PayPal’s strategy takes shape and plays out, and believe their renewed focus merits re-inclusion in our Public Crypto coverage and has brought them back as a leading “crypto-influenced” player in our coverage index, incepting this week.