News on Macro Economic Data

The view of the economy remains conflicted:

-

- Fed Chairman Jay Powell spoke yesterday and suggested that rates may not be tight enough, but may pause in November, based on data showing economic growth is better than expected, strong consumer demand, and inflation remaining stubbornly high at roughly 4%

-

- Powell’s remarks are balanced against The Conference Board’s data showing that the leading economic indicators declined 0.7% in September following a 0.5% decrease in August, and a 3.4% decline over the last 6 months. Lagging economic indicators are up only 0.1% over the same six-month period. While the economy has shown resilience that will likely not continue and projects a shallow recession in the first half of 2024

Long rates at 16-year highs of roughly 5% along with growing geopolitical instability have had a negative effect on risk assets in general.

A November rate hike may not be in the works as long as 10 and 30-year treasury yields remain near 5% and continue to do the Fed’s job for it, and as the Fed keeps an eye on geopolitical instability.

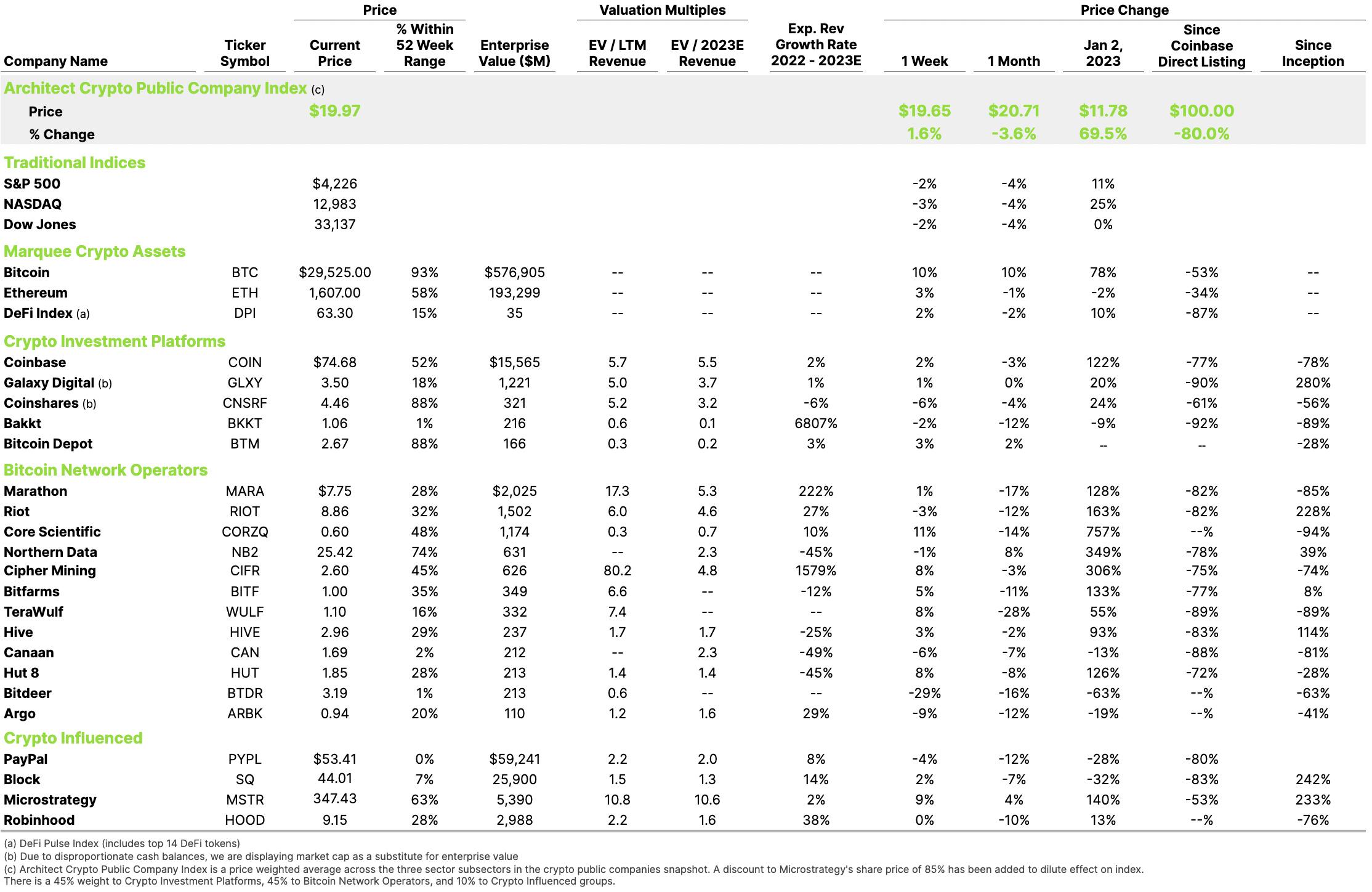

Crypto Public Company Activity

Crypto assets had positive news on Thursday as the US Securities and Exchange Commission dropped its securities violations case against Ripple (XRP up 6.5% alone on Thursday), voting to dismiss the charges with prejudice. This seems like a logical extension of the July ruling that “XRP is not, in and of itself a security”, and the recent denial of the SEC’s appeal of that ruling.

There is optimism of a spot Bitcoin ETF getting SEC approval, perhaps this year. The current optimism is beginning to drive up both the value of Bitcoin (again near or above $30,000), as well as associated equities. Coinbase Chief Legal Officer, Paul Grewal told CNBC that he is confident that the ETF will be approved soon citing the SEC’s failure to block Grayscale from converting its GBTC bitcoin fund to an ETF.

Despite having licenses in multiple EU countries, Coinbase announced its EU Hub will be located in Ireland, an area where it already has an e-money license. Coinbase is positioned well to operate once the Markets in Crypto Assets (MiCA) laws are enacted, which allows crypto exchanges to operate across the EU providing it has at least one license for an EU member country. Ireland was chosen due to its favorable approach to taxation.