News on Macro Economic Data

There was mixed news on the economic front this past week: GDP for Q3 came in at a robust 4.9%, however:

2.7 percentage points were associated with consumer spending. How long can this be maintained is a key question, as consumer debt is rising fast, and credit card and auto loan delinquencies are increasing

1.3 percentage points were attributed to Inventory buildup for Q4

While durable goods orders were up, business equipment was negative, and investment in IP was weaker than during the pandemic

PCE, the Fed’s favorite metric for inflation, remained stubbornly high, and rose 0.4% in Sept (3.4% annualized)

Important to note that PCE does not include key consumer needs of food and energy. Food and energy were up 6.6% YoY

Consumer spending was up 0.7% in Sept, but personal income gains only increased 0.3%

Given the mixed economic news, global instability, and 10-year T-Bills yielding 4.8 +/-%, the markets have remained volatile. Given the current environment, most economists believe the Fed will leave rates as is during their upcoming meeting.

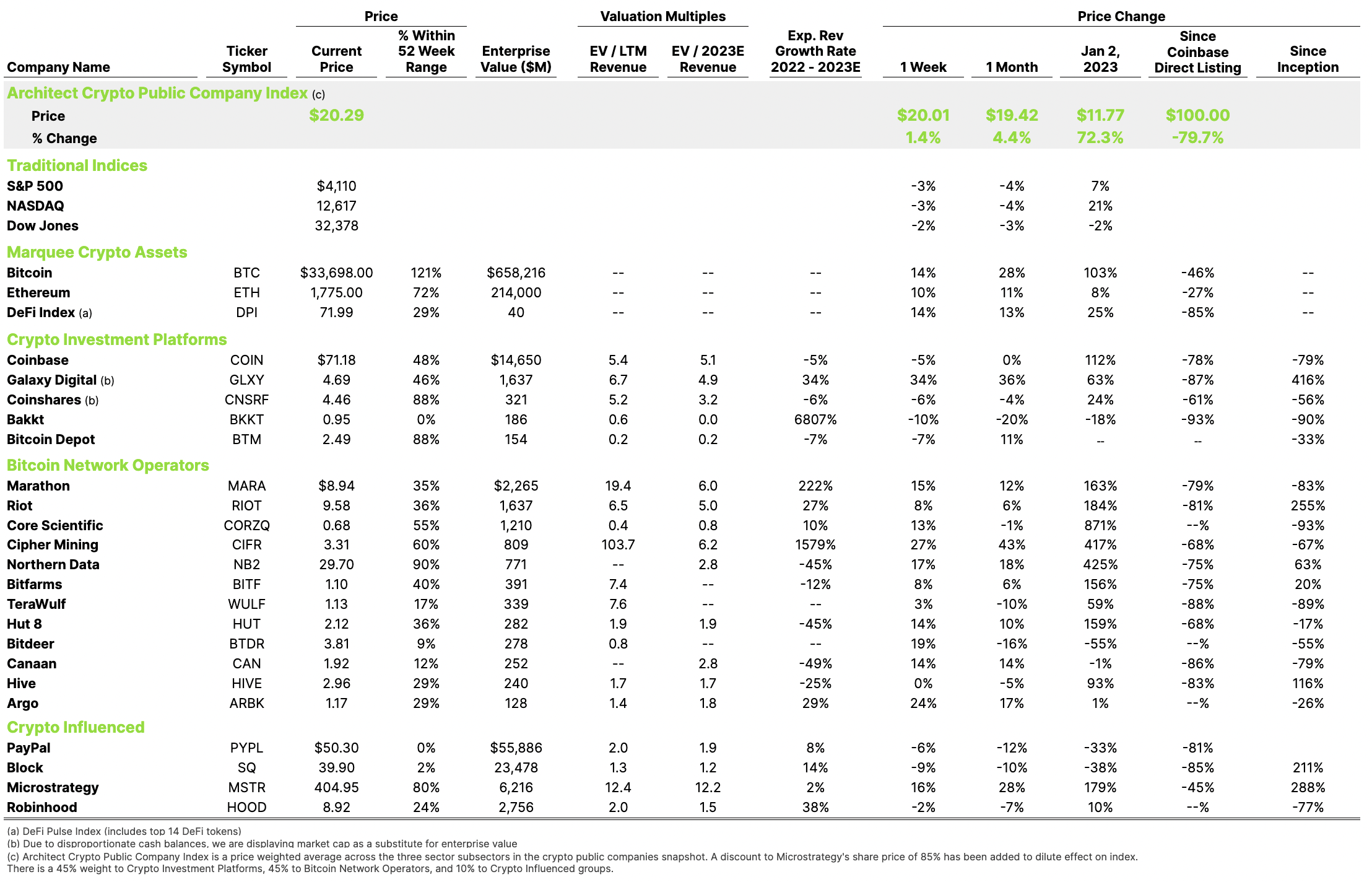

Crypto Public Company Activity

The surge in cryptocurrency values earlier in the week was fueled by growing excitement over the possibility of crypto spot ETFs available on traditional exchanges without having to deal with managing an account/wallet on crypto exchanges that collectively have a less than stellar reputation.

In a move that foreshadows an SEC approval, Blackrock’s spot bitcoin ETF appeared on the Depository Trust and Clearing Corp.’s eligibility list. DTCC is an American operating clearing house for stocks and ETFs.

Bitcoin gained 18% on Tuesday, trading above $35,000 for the first time since May 2022 at the height of the surge. Publicly traded crypto exchanges, miners, and other associated companies all had a very good day. However, these assets lost value over the course of the week, much like the broader market, as global instability and broad economic concerns drove investment decisions.

Does this major short-term move in crypto assets provide evidence that the crypto winter is thawing? It’s tough to predict given global turmoil, both geo-political and financial, as well as the ongoing regulatory environment. But, it’s a welcome reprieve.

On another positive note, the market capitalization of DeFi assets is up 15% to a three-month high of $49.4B, and for the first time since August, TVL (Total Value Locked) has surpassed $40B.