News on Macro Economic Data

CPI came in slightly higher than expected for December ending 2023 up 3.4% year over year. However, December’s PPI unexpectedly dipped 0.1% in December, representing three straight months of decline, and a 1% increase year over year. Overall, the two numbers represent a cautiously optimistic view of the economy going forward.

The Fed’s interest rate hiking cycle along with quantitative tightening has done its job of reducing inflation from its highs, although getting down to the targeted 2% may take much longer and may be harder to achieve due to persistent economic pressures. Lingering inflation also remains an issue, with overall prices up 17.6% since January 2021 (food up 33.7%, shelter up 18.7%, energy up 32.8%, and electricity up 27.1%), with many of these price increases being permanent.

For now, despite ongoing major geopolitical events, rising oil prices, the ever-rising US debt, and other issues, the economy remains resilient and appears to be headed only for a slight contraction in 2024. Earning season just kicked off and 2024 guidance will be important.

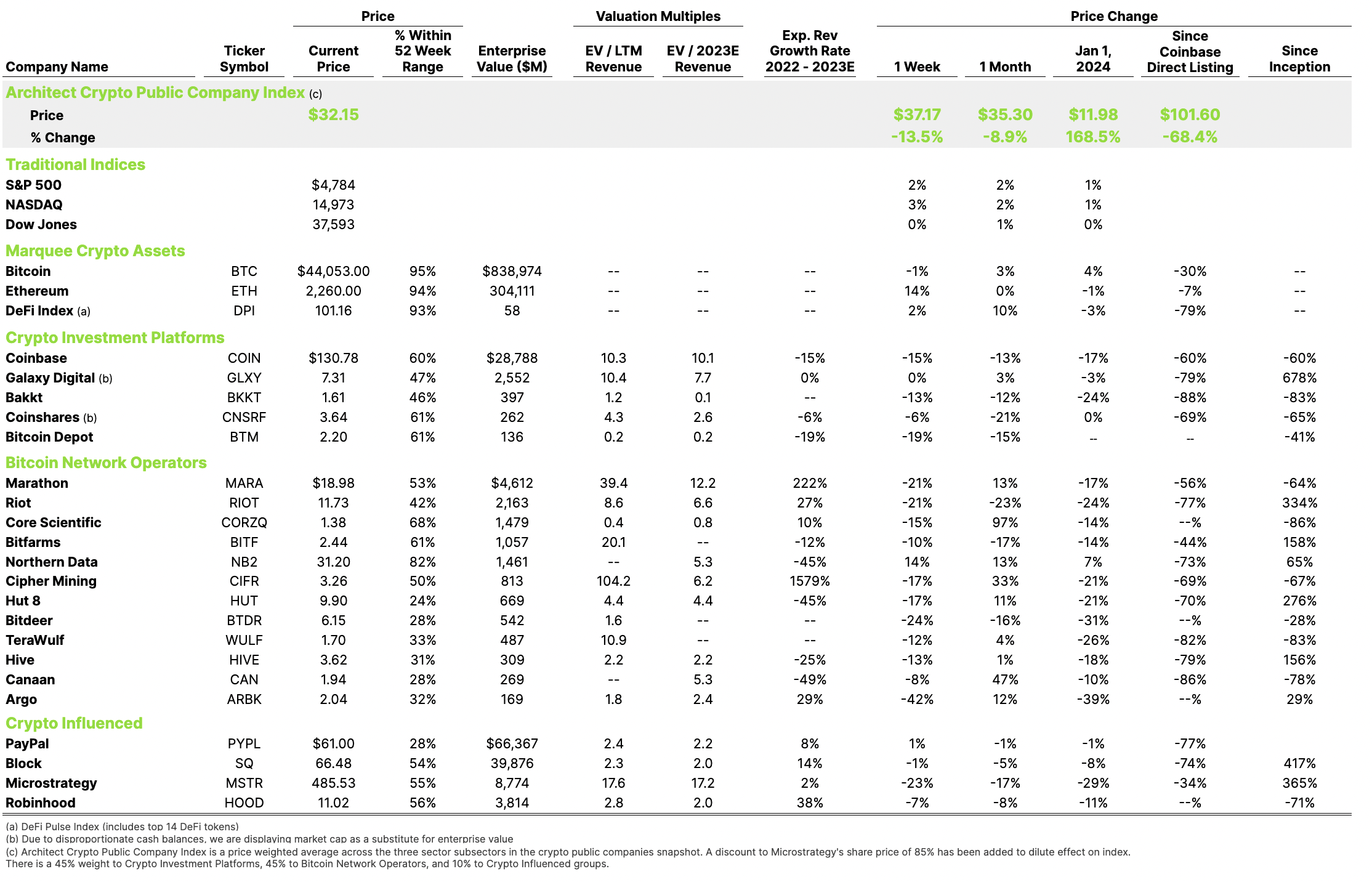

Crypto Public Company Activity

One more week of Bitcoin ETFs

The SEC approved eleven spot bitcoin ETFs this week which saw a total of $4.6B in volume on the first day of trading with Grayscale Bitcoin Trust leading the way with $2.32B.

The general investor will get all the usual benefits of ETFs – liquidity, easy access, and security. Portfolio management also becomes much easier for the general investor who wishes to allocate a portion of assets into more speculative investments.

The fees charged by the ETFs are significantly lower than existing bitcoin funds. However, an interesting aspect of the SEC’s rules for these ETFs is that bitcoin transaction fees are operating expenses and are not deducted from each customer transaction. This will reduce the overall performance of the ETF – to what extent will only be known over time.

One of the true winners is Coinbase which is providing much of the “plumbing”. For most of the ETFs Coinbase will be the crypto custodian as well as the likely exchange for ETF bitcoin trading. Coinbase is also responsible for SEC-mandated surveillance-sharing agreements with the listing exchanges providing details of crypto trading that could affect ETF prices.