Should I buy BTC or should I invest in a BTC Network Operator (Miner)?

This continues to be a key question on how BTC investors position their portfolios, as the thesis with investing in a BTC Miner is the Miner can earn BTC rewards at a cost basis that is lower than the current BTC price. So investors decide if the risk associated with a Miner’s ability to generate rewards is worth the difference in cost basis of the BTC rewarded versus the current price of BTC.

Today the Fourth Halving is upon us and the BTC rewards are cut from 6.25 to 3.125 BTC rewarded per block, which has a significant impact on every Miners’ ability to generate BTC.

So how did the Third Halving (12.5 BTC down to 6.25 BTC) affect BTC Miners?

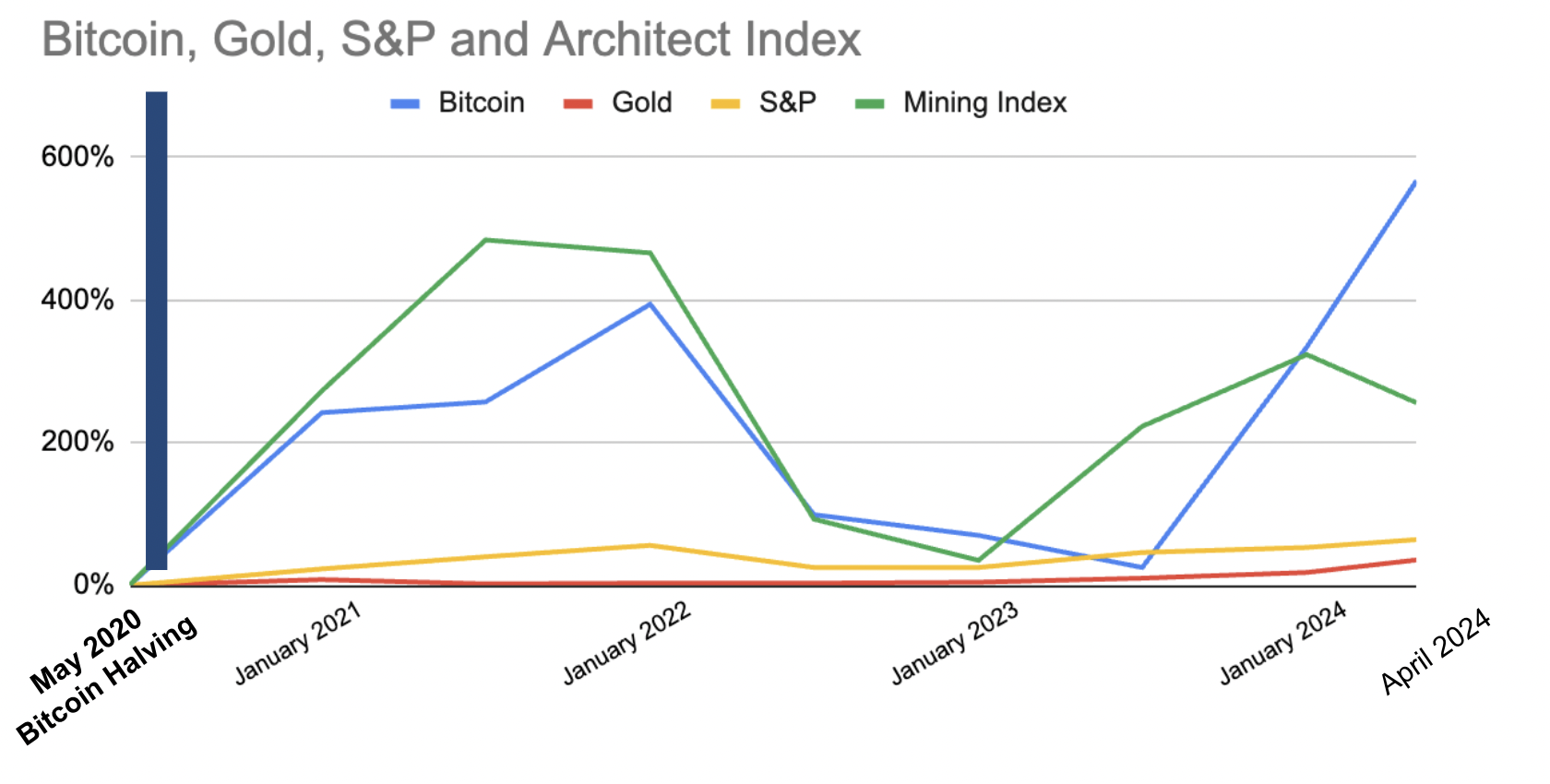

The Third Halving was on May 11, 2020 and in the following weeks, the first set of publicly traded companies started announcing their transition into BTC Mining companies, so while the data set is not perfect, we present the bottom chart on the left, which compares the performance of our BTC Network Operator Subsector to the price of BTC, Gold, and S&P 500. (Note we measured performance in percentages and not absolute return.)

After the Third Halving, BTC Miners outperformed BTC until Jan 2022, which was when Miners experienced the death scenario of extremely expensive cost of capital, high energy prices, high miner machine prices, and low BTC prices. In 2023, the Subsector rebounded by capitulating on unrecoverable situations, re-negotiating more sustainable operating and financing terms, and recalibrating their operating discipline.

In YTD 2024, BTC is up 45%, the Architect Crypto Public Market Index is up 26% (driven primarily by Coinbase & Microstrategy), while the Network Operator Subsector is down 31%.

Where do we go after today’s Fourth Halving?

As BTC adoption continues, the value of BTC will go higher.

Publicly traded BTC Miners who have successfully navigated since the Third Halving will be rewarded with real opportunities to acquire BTC mining assets (full operating sites, data centers, ASIC miners, shovel-ready development sites) in the next 18 – 24 months. We expect we will see an active M&A environment as the proven BTC Miners jockey for a new batch of sellers who struggle with go-forward 3.125 BTC rewards.

We also expect BTC Miners to diversify their revenue profiles, including providing computing power to satiate the AI industry’s appetite, delivering innovative on-chain solutions such as Marathon’s Slipstream service, providing BTC mining operating software, and running their own BTC mining pools.

Finally, we expect corporate action activity between BTC Miners and manufacturers of ASIC-mining equipment, given their shared BTC vision and close business alignment.

The Fourth Halving version of BTC Miners is experienced and battle-tested with proven leadership teams who are even bigger believers that BTC will be the global asset of the future.

As BTC adoption continues, the value of BTC Miners will go higher.

Take the long-term view and know we will see additional cycles (downs & ups) as we achieve sustainability higher levels.