Is BTC Mining good for the environment?

Today, this is a loaded question with fierce arguments on both sides.

On the not-good side, naysayers point to the total amount of energy used and the use of carbon-based sources of power.

On the good side, proponents focus on the BTC Mining industry’s ability to adapt and react to real-time energy usage and its use of non-carbon energy sources.

Not surprisingly, I am 100% on the BTC Mining is long term good for the environment side, but we are early in our journey and there will almost always be new ways that the industry can improve.

PayPal agrees as they announced that they will be further incentivizing BTC Miners who use low-carbon energy sources. PayPal partner EnergyWeb will implement a clean energy validation platform that confirms a Miner’s low-carbon operations. These “Green Miners” will be associated with a public key and certain on-chain transactions will be preferentially routed to these green miners, one can earn additional BTC rewards.

The key takeaway is that incentives drive behavior and PayPal is helping the BTC Mining industry by improving its good-for-the-environment narrative by offering additional BTC rewards within the operating framework of the BTC protocol.

Block announced their own new BTC mining system this week, which includes a three-nanometer BTC mining chip, a full tapeout design with a leading semiconductor foundry, and the development of a full bitcoin mining system. There is a lot behind these statements, especially as Block is solving for both the hardware and the software components that make up this industry, and there will be long term environmental benefits as a result. Surely Block’s comprehensive mining system is an aggressive endeavor that has yet to be achieved by any single market participant, but if there is a company with the BTC passion, resources, talent, and resolve to make their own mining system a reality, it’s the team at Block.

The fact that BTC Mining continues to work in a decentralized environment after 15 years, four Havlings and zero downtime, errors, or hacks is a modern-day miracle on its own. PayPal, Block and many others in the industry are constantly striving to improve the most sophisticated computer network and its innovative incentivization network. These types of market participants are the reason that almost everyone will eventually believe that BTC Mining is good for the environment.

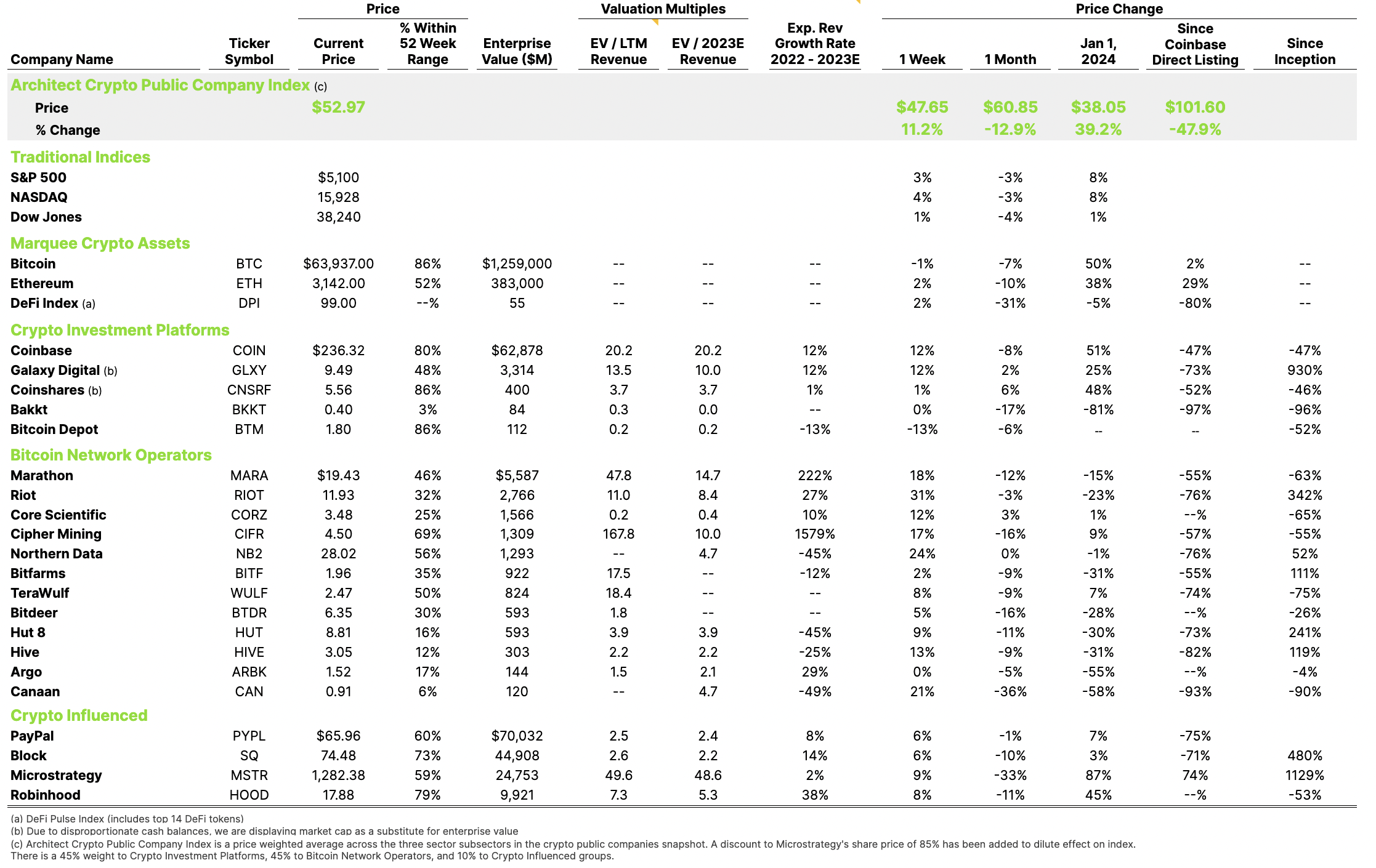

Finally, Bakkt announced a 1-for-25 Reverse Stock Split, in order to regain compliance with the price criteria of NYSE’s Listing Rule.