Our industry desperately wants and needs a regulatory framework to operate within. We all agree that regulation is needed to call out the bad actors and to protect investors from those bad actors. The current regulatory environment is characterized by attacking any crypto business that can pay a substantial fine, regardless of that company’s intent on being a good actor.

If you are in crypto, you care because if you make enough money and operate in the U.S., it is guaranteed that the current SEC will come for your business, no matter what actions you took to properly and transparently operate in this no-framework environment.

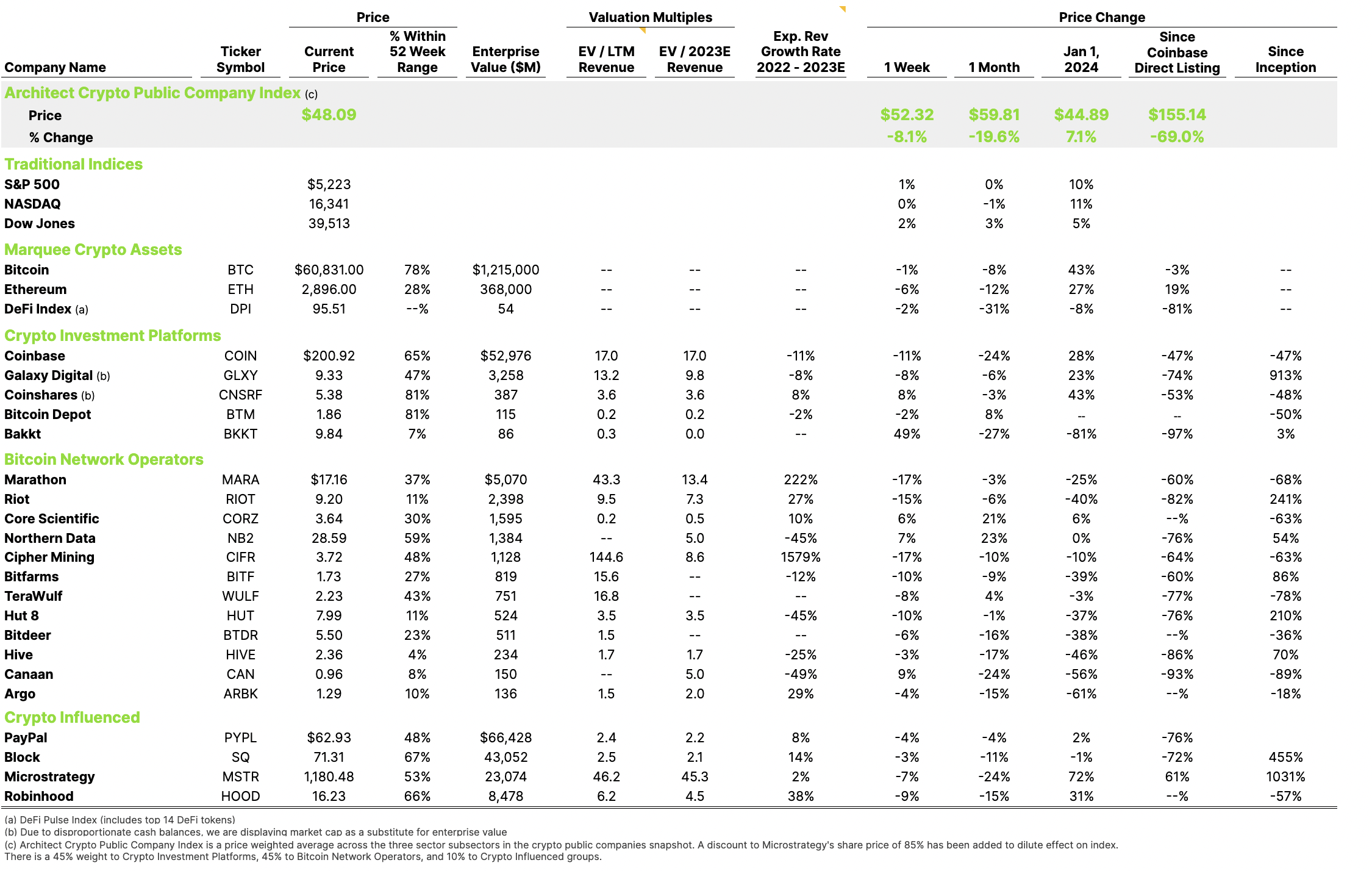

If you are not in crypto, you care because this behavior is forcing innovation out of the U.S. as almost every U.S.-based crypto company is opening a business entity in a jurisdiction that has some regulatory framework. This matters if you care about the U.S. maintaining its global dominance in capital markets. The Technology sector accounts for ~30% of the S&P 500 from a weighting and a 2023 return perspective. I can argue “tech” is now a critical part of almost every company in the index. Additionally, I can argue that almost every S&P 500 company will be leveraging blockchain within the next 10 years.

This week, Robinhood received a SEC Wells Notice for their crypto business and Exodus – a leading wallet provider – was forced to delay their ringing of the NYSE bell ceremony and listing on the NYSE American exchange because the SEC suddenly required further review of Exodus’ registration statement.

CoinRoutes’ Co-Founder & Chairman Dave Weisberger offers excellent thoughts on the SEC’s positioning on CNBC’s Crypto World.

Looking at the scoreboard, Coinbase, Kraken, Consensys, and Uniswap are involved in SEC enforcement actions and what many may not know is that Coinbase and Consensys are fighting back and have taken action against the SEC to defend their positions.

Notable for the companies in their growth phase and without the resources of the top crypto companies is Exodus’ journey. Exodus has been doing it right from the start as they are the only company to raise capital via a Security Token, transition onto OTC Markets, and then earn the status to uplist to the NYSE American. They explicitly made these decisions knowing how difficult it would be to trailblaze the process, be transparent with regulators from the start and not take any shortcuts.

On the eve of their opening bell ringing ceremony with 100+ of their key supporters in New York, they were forced to cancel their event because of the SEC’s no-framework and attack every crypto company enforcement strategy. Absolutely brutal.

Our industry has resolve and we know we are on the right side of history. We just need ANY regulatory framework to operate within.

—

Block released Bitcoin Blueprint for Corporate Balance Sheets and, combined with Microstrategy’s recent conference, this concept will be increasingly important for all publicly traded companies to not just pay attention to, but to actually implement.

Visa announced a new crypto analytics dashboard and shared their perspectives on how to interpret the data. This is one of the reasons why the future of payments will be in a digital form on a blockchain.

PayPal announced a partnership with MoonPay, one of the leading Web3 infrastructure and crypto payment companies, to improve the usability of crypto’s medium of exchange use case.

Marathon Digital announced earnings, producing less BTC than expected and this is the last earnings before the Fourth Halving.

We will cover these topics in subsequent Perspectives.

Architect Partners will be speaking at Digital Asset Week SF May 21-22 and will be at Consensus in Austin May 27 – Jun 1. Please reach out if you’d like to connect at either event.