On Tuesday, we shared our thoughts on the increasing pace of Crypto-related M&A on CNBC’s Crypto World.

Is crypto adoption actually further along than our industry thinks?

Yesterday, we were at The State of Crypto event by Coinbase (COIN) and the Financial Times in Manhattan where the headline was 56% of Fortune 500 executives say their companies have onchain projects, which is defined by an initiative using blockchain, crypto and/or Web3. In June 2024, even I am surprised by this statistic, which is a very important marker for the go-forward adoption of the technology.

I previously said that two-thirds of the S&P 500 will have onchain products and services by 2030 and the above stat indicates that traditional companies are adopting the technology at a quicker pace than expected. Obviously, there is a big difference between a project and a full product or service. We believe the velocity of innovation will continue to drive adoption faster than most anticipate.

For example, the Chief Investment Officer panel discussed what percentage of securities will be owned in a digital form on a blockchain in 5 years. All 4 panelists said 100% of securities will eventually be onchain, but the in-5-years responses ranged from 5% to 100%. My target has been and continues to be 75% of securities by 2030.

The report also notes the key barriers for F500 companies to engage onchain, which include a lack of trusted talent with the right skills, lack of understanding of the technology, uncertainty on how to get started, concerns about regulation eventually affecting use cases, and lack of funding or other resources. These barriers do not seem daunting to overcome.

The Bank for International Settlements (BIS) released a paper with the headline that 94% of the 86 Central Banks are exploring a Central Bank Digital Currency (CBDC). BIS offers a timeline of 6 years (2030) when they expect Central Banks to issue wholesale CBDCs. So are we estimating that almost every meaningful Central Bank in the world will have a live CBDC by 2035? Our industry actually needs this extra time because the current June 2024 version of our crypto infrastructure cannot support the entire world running digital currencies on crypto rails.

Additionally, HSBC (HSBC) announced e-CNY (digital yuan) services for their corporate clients. The e-CNY is already in everyday use in China and now a foreign bank will provide its services for China’s CBDC. The e-CNY is controversial, particularly with its “controlled anonymity” surveillance design, but it’s notable that e-CNY is in full flight and is now accepted by a global systemically important bank (G-SIB). How many others will follow? The answer is similar to the above. 100% of G-SIBs will offer CBDC and digital currency services.

If more than half of the Fortune 500 is currently moving onchain today, if 100% of securities will eventually be owned in a digital form onchain, if nearly all the Central Banks will have their own version of a CBDC, and if 100% of G-SIBs will eventually offer digital currency services, is adoption a foregone conclusion? Have we definitively transitioned from asking “if” to asking “when”?

It’s going to be a fascinating journey from here to 2030, which is my answer to the when … unless it happens sooner.

—

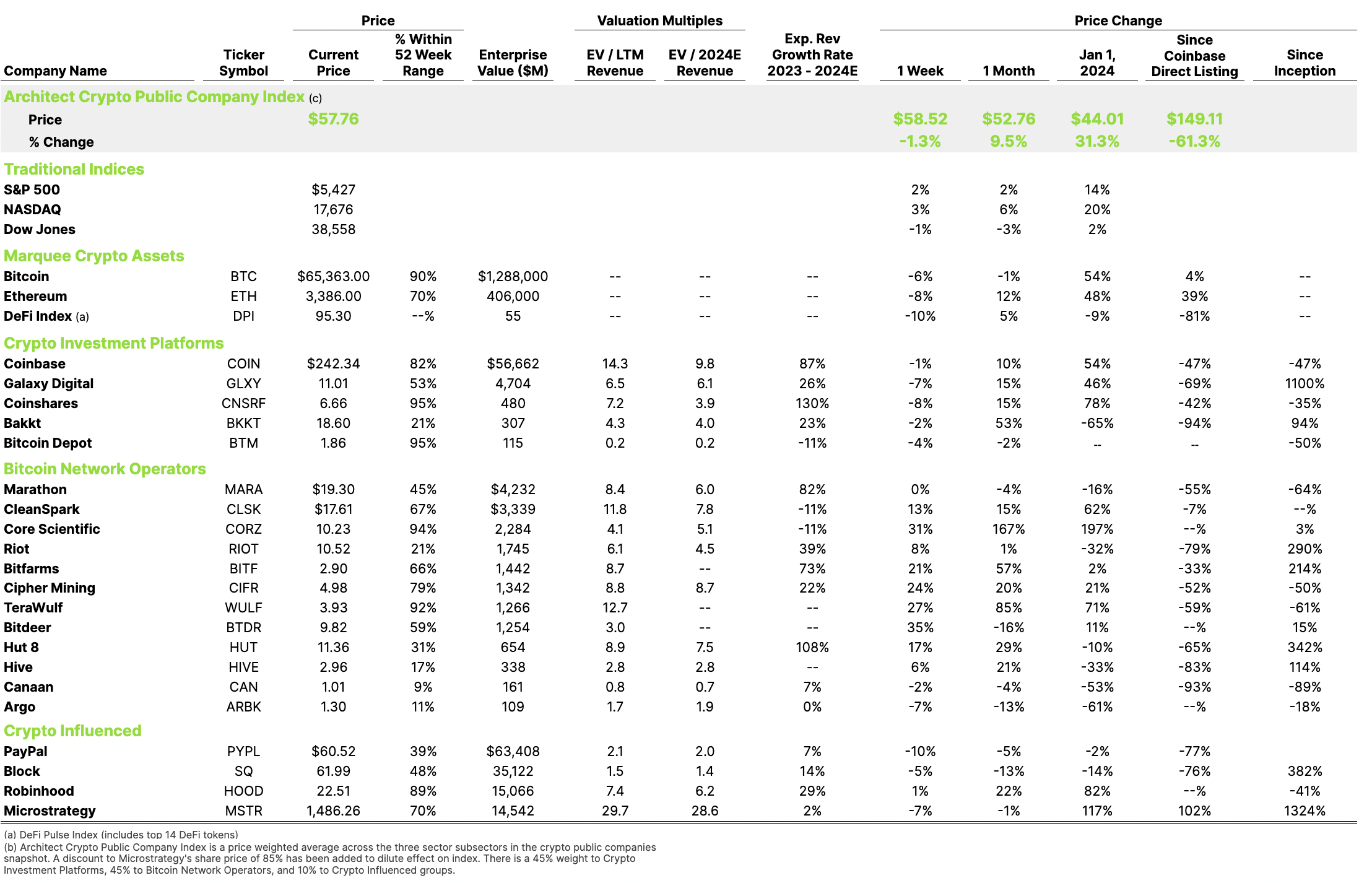

We’ve been saying that crypto will play a role in U.S. elections and, this week, Trump met with Bitcoin Miners including Marathon (MARA), Riot (RIOT), Core Scientific (CORZ), CleanSpark (SPRK), and TeraWulf (WULF) which resulted in Trump’s much covered support for the BTC mining industry.

Bitfarms executed a “poison pill” strategy in an attempt to fend off Riot’s proposed acquisition.

Gensler said in a budget hearing that Ether ETFs should be fully approved by September.

Microstrategy (MSTR) announced a private offering of $500M of convertible senior notes for the purchase of Bitcoins.