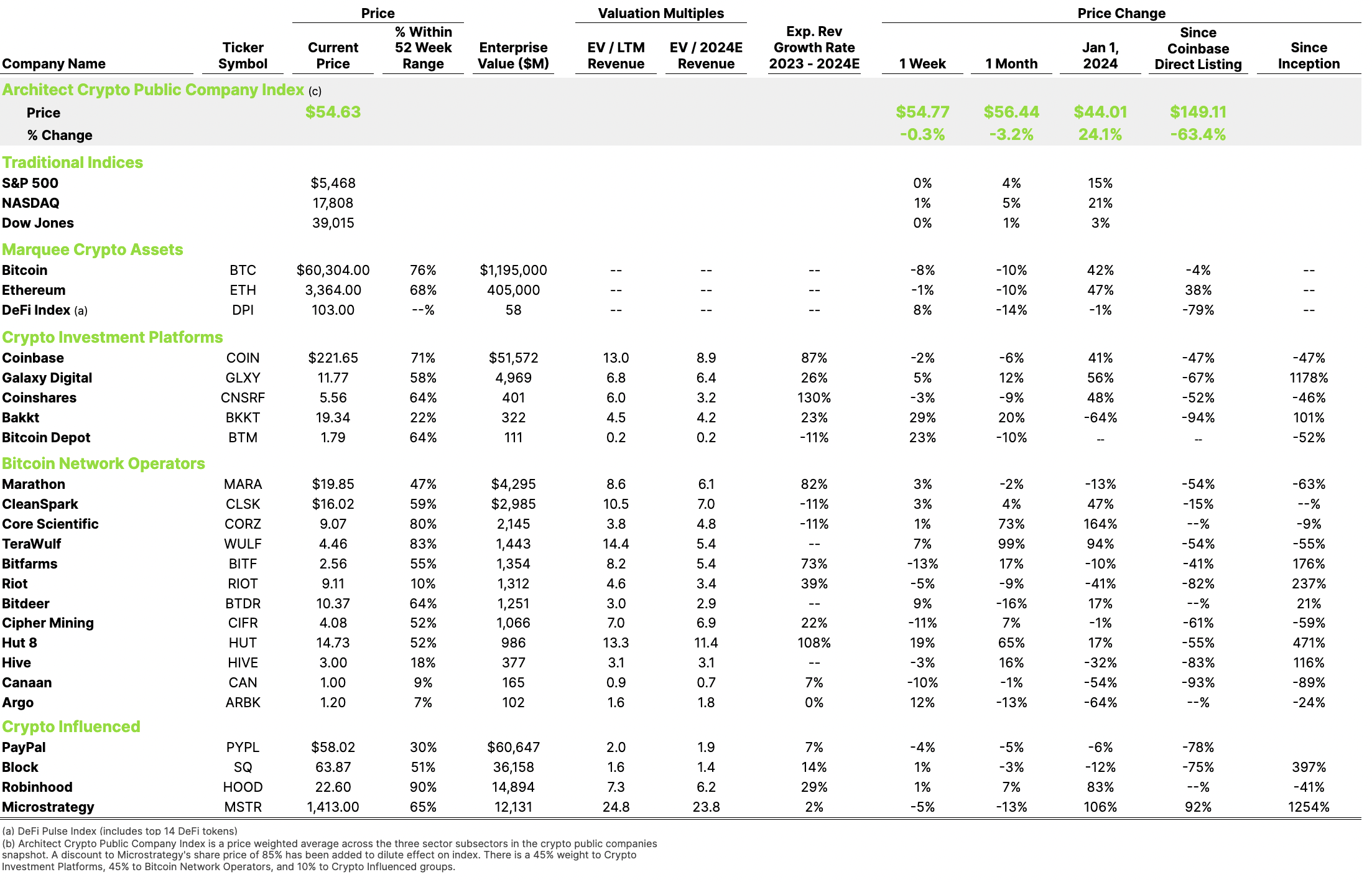

Q2 2024 delivers the most active quarter for Crypto Public Companies since Q2 2022.

11 of the 21 constituents in the Architect Crypto Public Company Index announced meaningful corporate actions in the quarter.

Capital activity in BTC Mining continues with Coatue investing $150M in Hut 8 (HUT) through a convertible note. This investment aligns with the BTC Mining and AI compute combination thesis as well as the transition of BTC network operators to energy infrastructure providers. Coatue’s participation is important as they were one of the most active crossover funds who invested in crypto during the last cycle. Having an investor of this magnitude return to crypto is a strong indicator that new capital will flow into the industry.

Acquisition activity in BTC Mining continued its rampant pace as Cleanspark (CLSK) announced two additional acquisitions. They acquired GRIID Infrastructure (GRDI) for $155M in an all-stock transaction, which they expect will add 400MW of capacity in Tennessee. GRIID was one of the few crypto companies to complete a public listing through the SPAC process, though they experienced significant delays along the way. CLSK also acquired 5 BTC mining sites in Georgia for $25.8M in all cash. With 4 acquisitions in 2024, CLSK is actively executing their BTC Miner roll-up strategy while showing their flexibility to structure all-cash and all-stock transactions. They have positioned themselves in reach for the title of largest publicly traded BTC Miner.

In Feb, Architect Partners said we expect “meaningful” mining-related M&A in the second half of 2024, and into next year. With 8 M&A transactions in 2024, the activity came faster than even we thought.

Our industry needs legitimacy in order to attract new high quality market participants. One of the best ways of legitimizing crypto is having traditional financial services organizations provide crypto services. In the last two weeks, Itau (ITUB, $54B Mkt Cap), Standard Chartered (STAN.L, $18B Mkt Cap), and Santander (SAN, $72B Mkt Cap) all announced crypto trading services.

From a product perspective, Nubank (NU, $61B Mkt Cap) announced a partnership with Lightspark to bring the Bitcoin Lightning Network to Nubank’s users. State Street (STT, $22B Mkt Cap) and Galaxy Digital (GLXY) announced digital asset investment products that focus on all the other investable assets that are happening in our $2.3T digital asset ecosystem, outside of BTC and ETH. Both of these are important announcements as they improve our industry’s distribution and eventual adoption of the asset class.

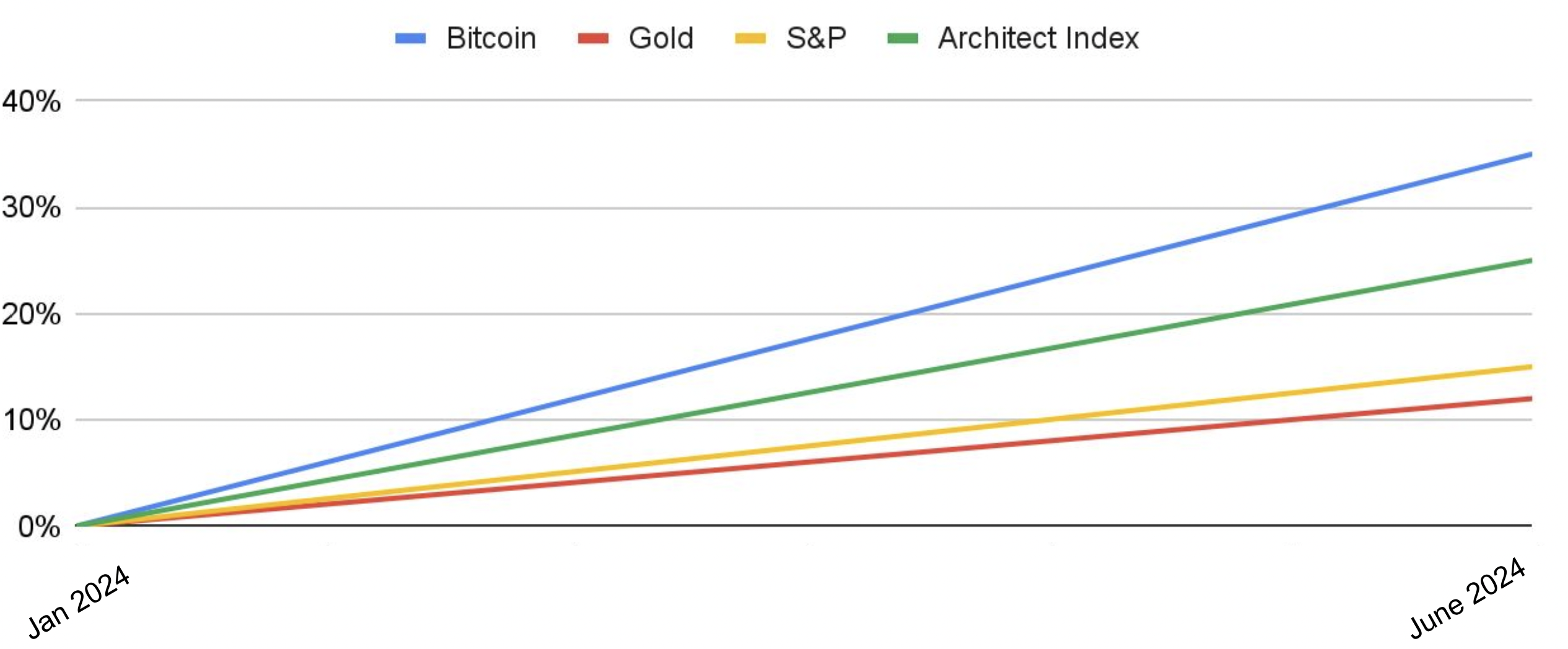

All this real capital, M&A, products and services activity to start 2024 signals an accelerating and robust go-forward market environment for our industry. We are just getting started.

Architect Partners will release our Q2 Crypto M&A and Financings report next week.