This week marks the first of the new quarter. If you haven’t already seen it, Architect Partner’s has published its Q3 Crypto M&A and Financing Report linked here.

At this point, it’s become abundantly clear that the market is not moving consistently based on Bitcoin price alone.

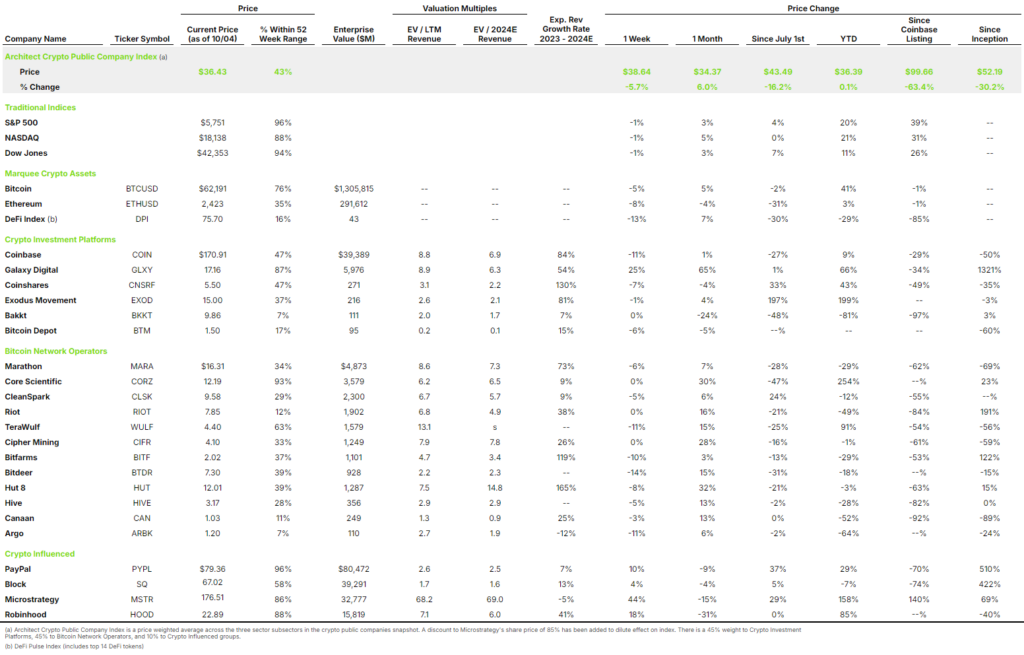

We’re seeing a massive delta between companies in the same space, particularly the mining companies whose revenue is directly tied to and impacted by the price of Bitcoin. Historically we’ve looked at the correlation to Bitcoin and our Bitcoin Network Operator group and have found a relatively strong correlation demonstrating that for about every 1% Bitcoin moves, the Bitcoin Network Operator group moved about 2%, indicating a beta (amount the stock moves with the market, in this case being Bitcoin) of 2.

So what’s happened to these stock today and why are some down by over 50% when Bitcoin price for the year is up 41%?

There are several factors at play here:

- Bitcoin offers significantly more liquidity than most public crypto companies except for some larger ones like Coinbase.

- Investors are becoming distinctly aware of the operational risk and capital expenditures required to run a crypto mining business.

- April’s Bitcoin Halving hurt Bitcoin mining rewards, resulting in lower revenue for miners.