Crypto public companies have an issue. Generally, investing in public equities carries two main forms of risk, idiosyncratic and systematic risk, the former is based solely on the operating risk of the company and the latter is based solely on the external market, which is generally out of the company’s control.

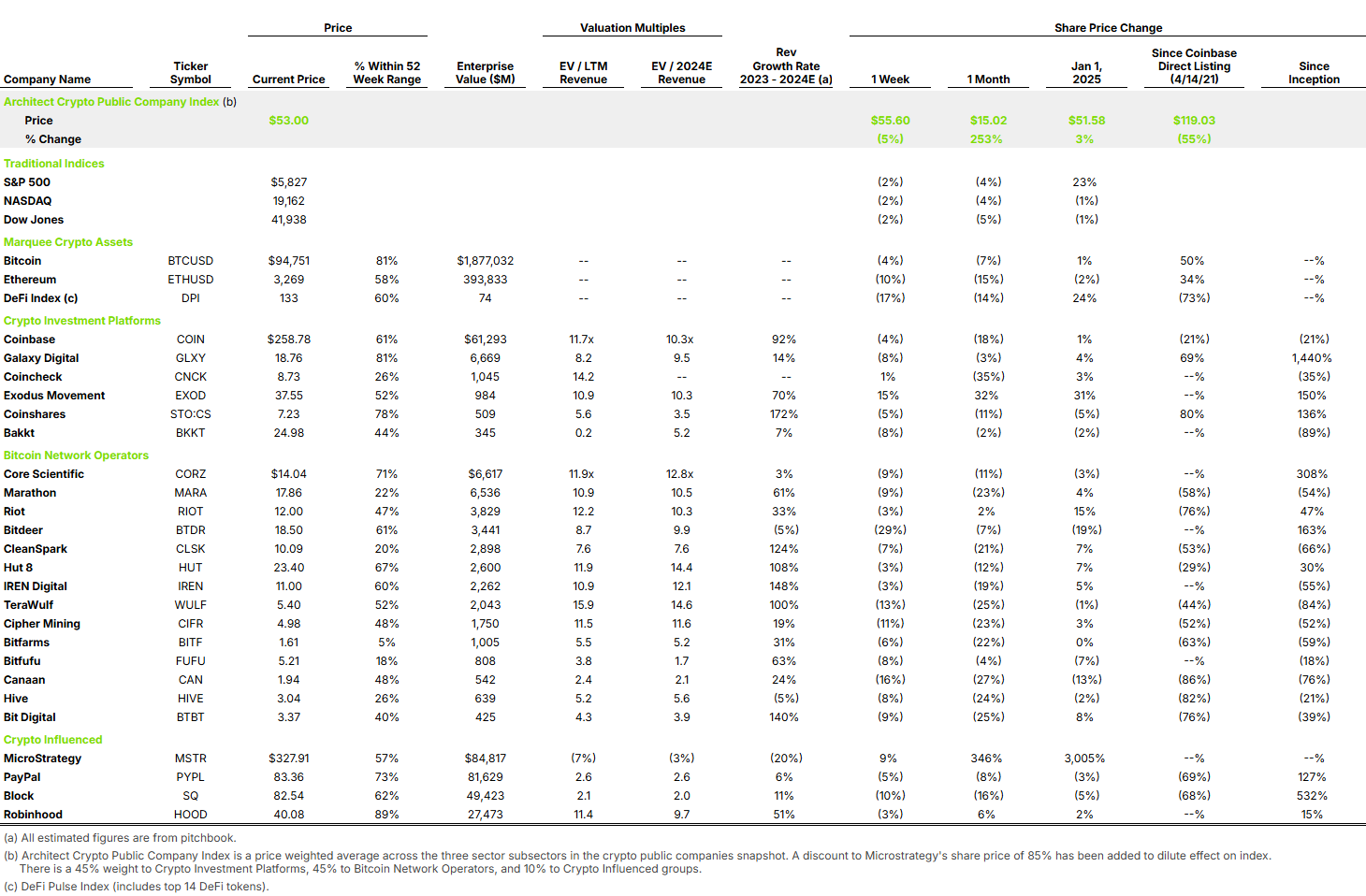

Historically the crypto public companies largely track the price of the crypto market, so the largest risk these companies have is just the systematic risk. Over time we hope these group develop more personality of their own and exceed the marker, but largely they have been either underperforming or tracking the largest Bitcoin market as illustrated below in the table on annual appreciation.

| Company | 2022 | 2023 | 2024 | 2025 |

| Coinbase | (86.6%) | 366.9% | 64.0% | 1.0% |

| Galaxy | (84.3%) | 167.2% | 131.9% | 4.0% |

| Marathon | (89.7%) | 574.4% | (24.9%) | 4.0% |

| Riot | (85.2%) | 357.3% | (32.1%) | 15.0% |

| Bitcoin | (62.0%) | 146.8% | 119.5% | 1.0% |