Will this new cohort of crypto public companies drive the next level of crypto’s value creation in The Great Surge? Absolutely—and it’s about time.

Last week, Architect Partners published our annual update on Family Ties: The Internet and Crypto, where we compare the value created by each of these transformative technologies. The key takeaway is that in 2024, the value created by Crypto surpassed that of the Internet for the first time in their respective journeys.

I believe 2024 will be the last time we see Crypto’s created value be less than the Internet’s.

A key reason for my thesis is the impending onslaught of crypto companies achieving publicly traded status on major, traditional exchanges.

Our industry has done itself no favors with the slew of bad actors that have emerged—though I’d argue some of those actions were necessary experiments for eventual maturation. Because our “history” is being written in real time, crypto companies must now execute and operate at a higher level than our peer industries, establishing the trust and transparency that inspire confidence on Wall Street. This is the main reason we’re about to see a surge in Crypto Public Companies, aside from the usual motivations of monetization, access to capital, and prestige.

There are several ways to reach public company status—traditional IPO, De-SPAC, reverse merger, uplisting, or joint venture—each with various pros and cons for long-term price performance.

From 2022 to 2024, only two companies managed a public listing on a major traditional exchange: CoinCheck (CNCK via De-SPAC) and Exodus (EXOD via uplisting).

This week, Fold (FLD)—a personal finance app powered by Bitcoin—listed on the Nasdaq via the De-SPAC process. While they announced their De-SPAC in July 2024, Fold is the first crypto company to achieve public status on a major exchange in 2025 and will be a new addition to the Architect Crypto Public Company Index.

These three companies are at the forefront of a cohort that have announced or are rumored to have near-term public aspirations, including Kraken, eToro, Circle, Bullish, Gemini, BitGo, and Blockchain.com. There are a plethora of other high-quality crypto companies waiting to see how these processes perform while also trying to time a supportive macro environment.

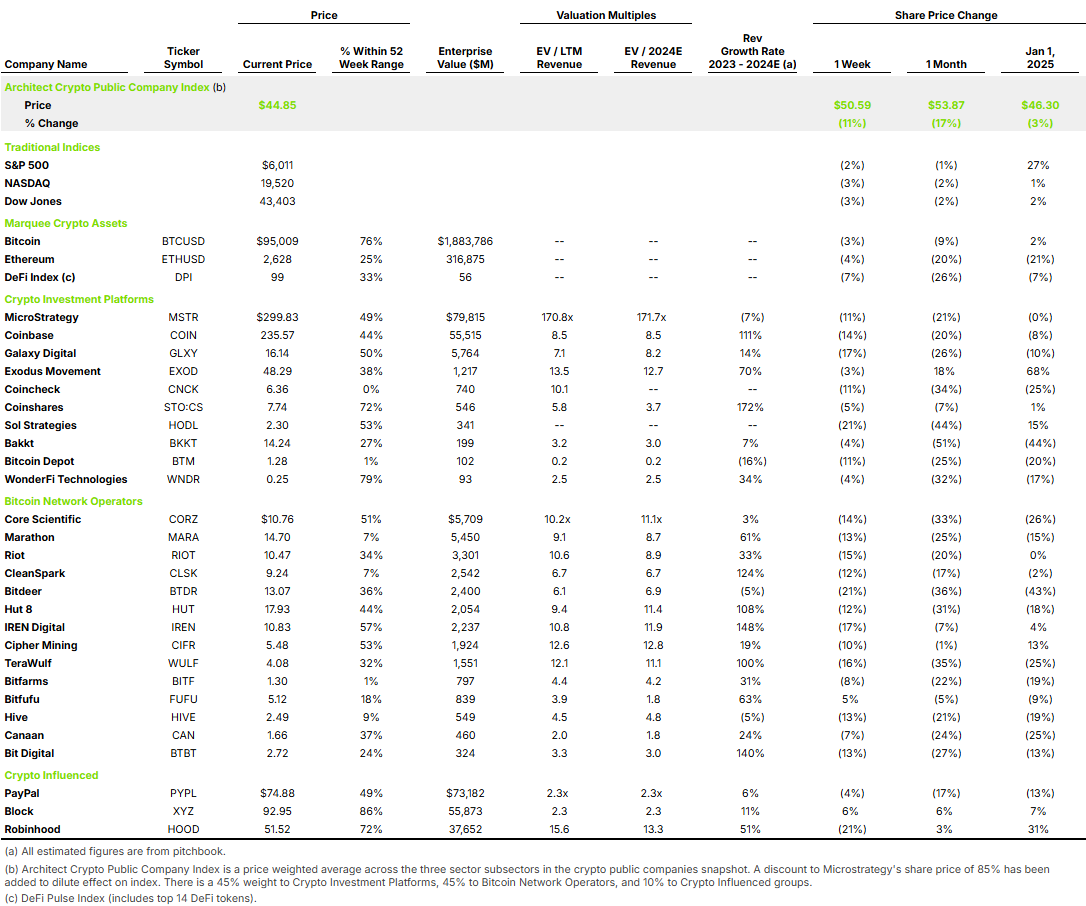

I expect that by the end of 2026, the Architect Crypto Public Company Index—which tracks publicly traded crypto companies with market caps over $100 million and currently has 27 constituents—will include at least 40 companies, marking an increase of more than 50%.

How much value will this surge of crypto public companies create? Our Family Ties report estimates that from 2002 to 2024, the Internet created over $25 trillion in value. At the end of 2024, Crypto created $3.4 trillion in value, with Crypto Public Companies accounting for about 10% of that total.

With the complete shift in the U.S. regulatory environment, public market investors are realizing they are underexposed to the Crypto industry. Part of this under-investment stems from the lack of high-quality names available for public investing—a fact that will soon change.

By 2030, I anticipate Crypto will create more than $10 trillion in total value, and I expect Crypto Public Companies will account for roughly 20% of that figure due to both the rising number of crypto public companies and their strong financial performance.

The pre-2025 timing was not right for a litany of reasons we have discussed. The post-2025 timing appears to be right. It’s about time.