BTC as a treasury reserve asset on the balance sheet of publicly traded companies is still an unproven strategy and a relatively new concept.

The primary theses for holding BTC as a treasury reserve asset are that BTC serves as a hedge against fiat (specifically USD) inflation and offers a tool for treasury diversification and risk management.

Naysayers of this strategy argue: if gold isn’t held as a treasury asset on the balance sheets of publicly traded companies today, then why would they hold BTC? The challenge lies in how gold is owned—either physically or via futures. While gold is a commodity, physical gold must be stored, is not easily moved, and may not be fungible with other physical bars. Gold futures are classified as securities and cannot appear on a balance sheet as a treasury reserve asset. BTC, on the other hand, is a digital commodity that is GAAP-recognized as a tangible asset with a fungible and liquid profile.

The pioneer of this strategy, MicroStrategy (MSTR), first announced BTC as its “primary treasury reserve asset” on August 20, 2020. MicroStrategy had three additional theses for implementing this tactic:

Access → MSTR provided institutional investors with exposure to BTC as an asset class, since the vast majority of asset managers could not directly own BTC.

Asymmetric Upside → MSTR CEO Michael Saylor is known, among other things, for his “Triple Bitcoin Maxi”-type language espousing BTC’s long-term price appreciation.

Branding as the Bitcoin Innovator → MSTR became the first BTC “meme stock,” riding a wave of attention and brand differentiation.

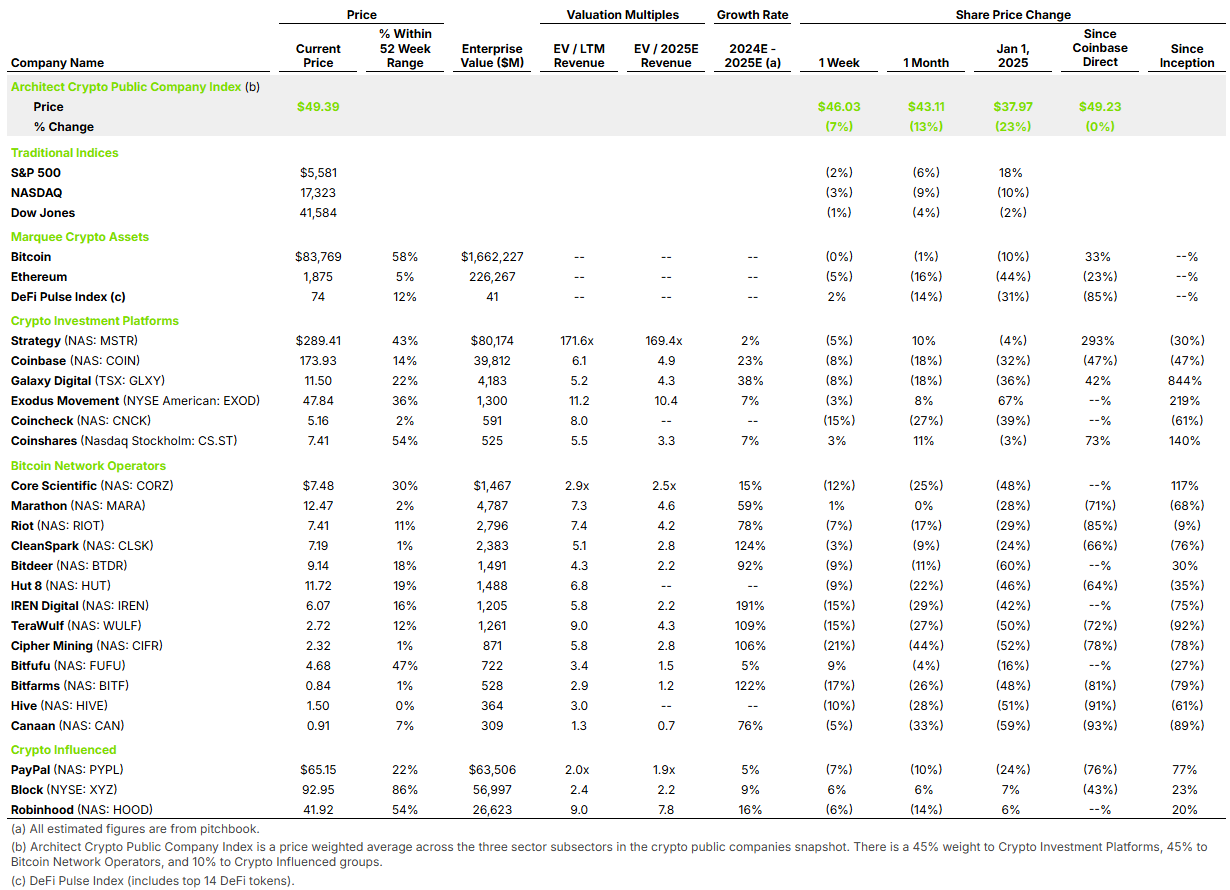

The results are hard to dispute when looking at price performance from August 20, 2020, to March 28, 2025: S&P 500: +64.81%, BTC: +781.13%, MSTR: +2,074.85%

This week, original meme stock GameStop (GME) announced a $1.3B convertible note to implement the BTC treasury reserve asset strategy. The CEO stated: “We believe GameStop has an incredible opportunity to transform its financial future by becoming the premier bitcoin treasury company in the gaming sector.” With BTC volatility proving to be a double-edged sword, GME has traded down over 20% since the announcement.

So how many publicly traded companies are executing this strategy today? According to bitcointreasuries.net, the number stands at 89. With GameStop, that makes 90. Granted, the vast majority of these are not bellwethers or household names, but I suspect 90 is far more than most would have expected.

We attended last month’s Bitcoin Investor Week in NYC, there was an entire day dedicated to educating publicly traded companies on this tactic. Last year, MSTR hosted a full conference in Las Vegas.

Like most new concepts—especially those in crypto—I ask the question: Are we going to see more or less of this activity? Until my answer is “less,” I’ll continue to pound the table on the adoption of these strategies.

That said, there’s a massive difference between truly using BTC for treasury diversification and risk management purposes versus pivoting a company’s entire operating thesis to become the “premier bitcoin treasury company” for any given sector. Companies who are implementing this strategy in hopes of replicating MSTR’s performance are positioning for disappointment. MSTR is one-of-one, similar to Tether and its stablecoin dominance. With access to BTC through ETFs, these companies cannot provide the same access, asymmetric upside or innovation branding that MSTR does.

Across all the different strategies and implementations, I anticipate that by 2030, a quarter of the S&P 500 will have BTC somewhere on their balance sheets as a long-term asset.

Why? Because those managing treasury assets won’t be able to say they didn’t at least try. If you tried it and it worked, you’re a genius. If you tried it and it didn’t work, you at least tried. Either way, you likely keep your job. But if you didn’t try it and can’t provide a good reason, your job may be at risk.

Doing nothing is no longer a defensible strategy.