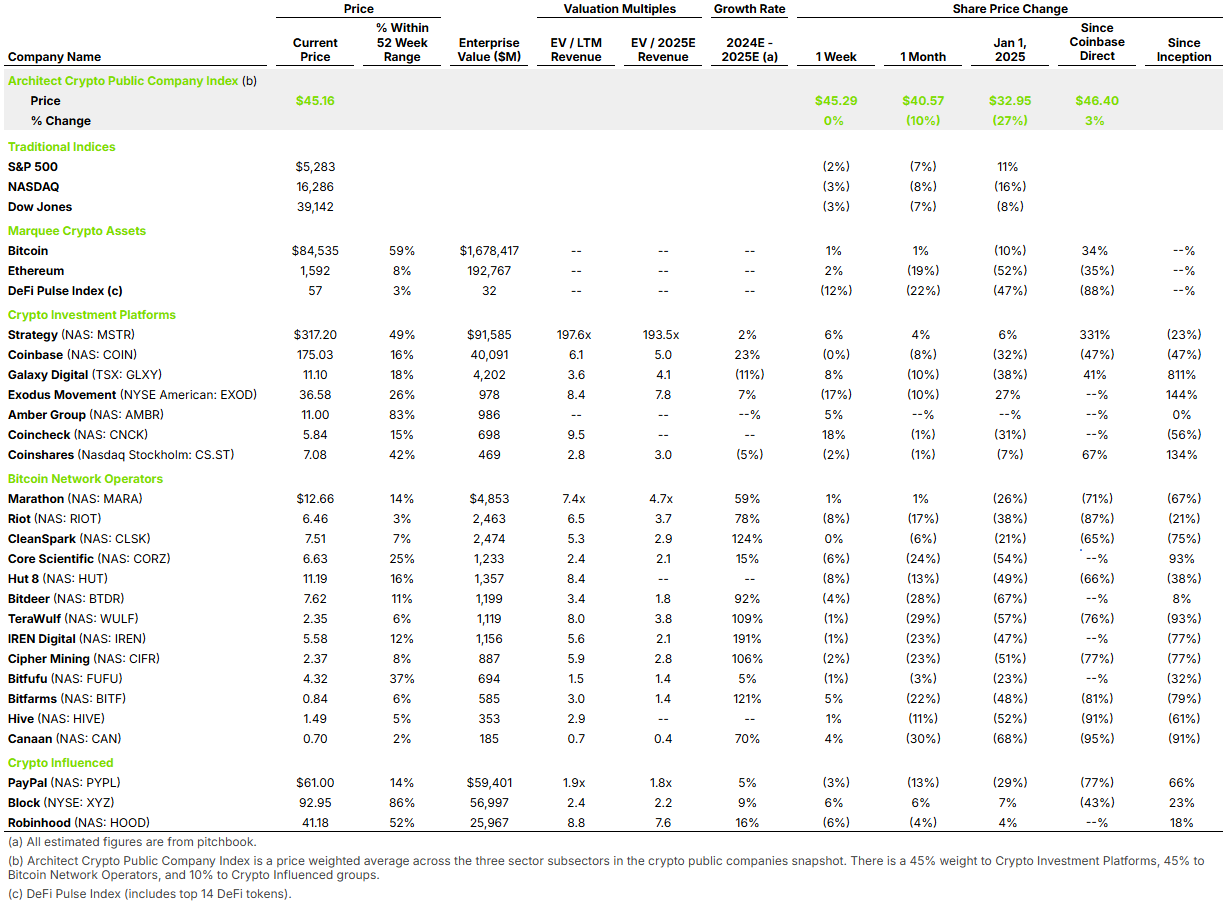

Let’s take a closer look at how tariffs and market volatility have affected our group. Since tariffs were first announced on “Liberation Day”, the index overall has fallen by 10% with Crypto Investment Platforms falling by 9%, Bitcoin Network Operators falling by 13%, and Crypto Influenced falling by 2%. Bitcoin Network Operators are of course directly affected by tariffs, as the mining rigs used in their business operations and now heavily tariffed, creating much uncertainty around their future capex requirements, which were already very high. This has led to the almost 2x decline relative to the S&P 500, which declined 7% since April 2nd. The investment platforms fell largely in line with the market and the influenced groups remained rather unaffected, likely given that they’re not dealing in goods.

In our Q1 2025 research report, we said that Kraken, eToro, Circle, Gemini, Blockchain.com, Bullish and BitGo had all announced IPO intentions. At this point, following the tariffs, Kraken and Circle, amongst others have already announced that they are slowing their expectations around timing to likely 2026, depending on market conditions. Unfortunately this is going to be the new normal, as there is absolutely no reason for a company to go public in uncertain conditions. In every case, after going public we would like to see a nice uptick in valuation from new investor excitement. After seeing the flat CoreWeave IPO, many have seen enough proof that markets aren’t particularly excited about new public equities coming to market.