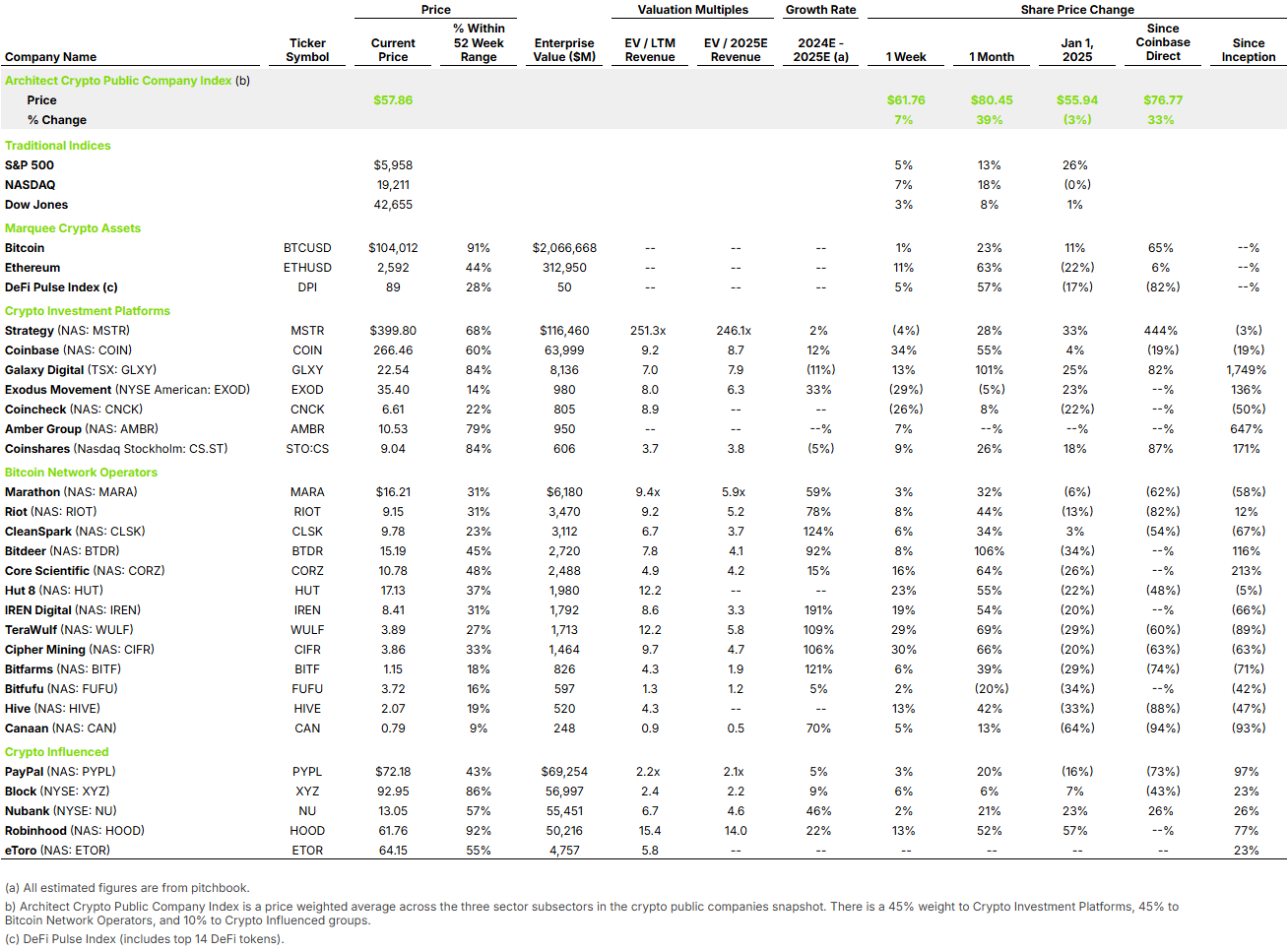

This week we welcome eToro back to our crypto public-company index. We initially added the company when it announced its SPAC in March 2021, but that deal was canceled in 2022 due to an undisclosed “impracticality” associated with the merger. At the time, eToro was valued at a $14.4 billion enterprise value (EV), implying an EV/LTM revenue multiple of 23.8x.

Today, reality has set in. eToro is going public at a $4.3 billion EV, implying an EV/LTM revenue multiple of 5.8x. The stock rose 28.8% from its initial price of $52 per share on the first trading day and finished up 23% after two days.

eToro is positioned similarly to Robinhood and first gained popularity through its trade-copying feature, which lets users mirror the trades of professional investors. Although the company’s LTM revenue is roughly 75% smaller than Robinhood’s, the two share a decidedly similar DNA.

Crypto accounts for about 38% of eToro’s trading commissions—comparable to Robinhood’s 43% share of crypto revenue. Overall, we’re pleased to see new public companies join our list and expect this trend to expand significantly over the next 24 months as crypto becomes more favorably viewed by the SEC and other regulators.