Is the crypto treasury strategy for public companies a short-term memecoin phase or a permanent shift in how treasuries will be managed in the long term?

(Circle completed a successful IPO this week, which we alluded to in our Financings Alert, and we will cover the impact of CRCL in next week’s Perspectives.)

While this topic is fiercely debated at Architect Partners, I believe this moment represents a shift in how the treasuries of public companies will be managed going forward. As with all things related to crypto, quality execution is critical. Only the best implementers of this strategy will deliver the promised benefits to their shareholders.

Will public-company shareholders see sustainable value created from adding crypto to their balance sheets that results in long-term stock price appreciation? This is the key question that must be answered.

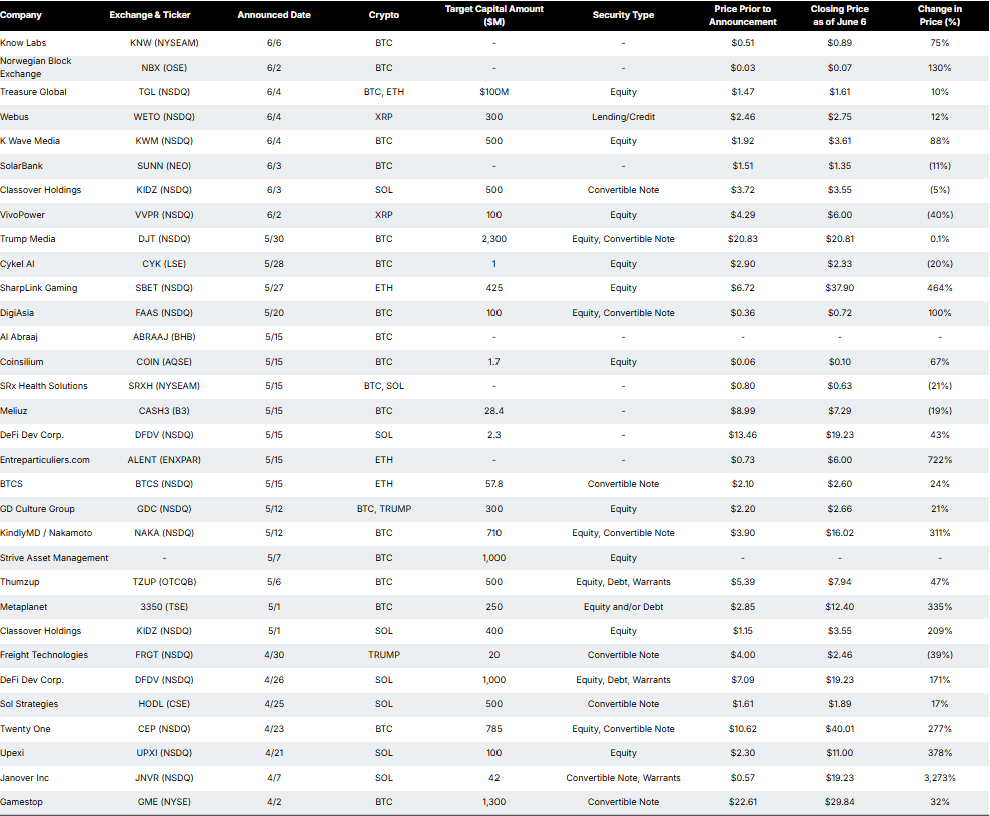

Since April 2, thirty-two public companies have announced a crypto treasury strategy with intentions to raise over $11.3 billion in capital. Twenty-six of those companies are trading higher since their respective announcements (many are trading lower than their initial price increase).

To understand whether this is a phase or a permanent shift, we ask the following questions:

What is the role of treasury management?

The crypto industry does not do a good job of using TradFi vernacular, so it is important to define what treasury management is. Responsibilities include collecting revenues, paying expenses, ensuring working capital for operations, and managing financial assets. Management of financial assets encompasses preserving value, mitigating risks (FX volatility, interest rates), and maximizing returns within risk tolerance, which is typically very low.

Implementing the crypto treasury strategy typically falls here, which brings us to the first issue: Is the crypto treasury strategy a preservation-of-value and risk-mitigant activity, or is it an investment activity? We will find out soon.

Is this shorter-term financial engineering or a truly longer-term shift in how corporate treasuries will be managed?

Objective observers see this strategy as raising public capital to buy an asset that is already publicly available. Why should that result in a higher stock price? Additionally, what happens when the crypto assets held in the treasury move 25 percent lower, which will most assuredly happen?

From a longer-term perspective, we are seeing the development of four types of crypto treasury strategies:

Accumulate and Hold

- The objective is to buy the crypto asset and simply hold it long term on the balance sheet.

- MicroStrategy (MSTR) is the best example.

Accumulate and Generate Yield on the Treasury Assets

- The objective is to buy the crypto asset and use that asset to generate yield.

- Companies such as SOL Strategies and SharpLink, which buy proof-of-stake assets (SOL, ETH), are examples.

Accumulate and Build Products and Services that Produce the Treasury Asset

- The objective is to buy the crypto asset and build a business that generates revenue in that crypto asset.

- Bitcoin miners are an example.

- Twenty One Capital appears to aspire to this model as well: “Twenty One intends to develop a corporate architecture capable of supporting financial products built with and on Bitcoin. This includes native lending models, capital market instruments, and future innovations that will replace legacy financial tools with Bitcoin-aligned alternatives.”

Accept the Treasury Assets as Payment for Existing Goods and Services and Hold

- The objective is to use the crypto asset as a payment rail and, once received as payment, keep the crypto asset and not convert it to fiat.

- Block and Tesla are examples.

Who is executing the strategy, what is their background, and how crypto-native are they?

In crypto, it is vital to recognize that there is a massive difference between an announcement and execution. Interacting with crypto assets in an institutionally secure and responsible way is much more important than managing fiat. The operational fortitude and acceptance of the volatility inherent in crypto assets require a crypto-native way of thinking and executing. The “who” behind the crypto treasury strategy will be the most important factor for long-term sustainability.

Much has been written, and much more will be written, about the controversial crypto treasury strategy.

I believe that while the majority of today’s announcements will not succeed in the long term, we will still be actively speaking about this strategy in 2030 and looking back at how the best-performing publicly traded companies have crypto assets on their balance sheets.