Circle has had a bumpy start to public-market life. Since its IPO earlier this month, the stock has moved through an early wave of excitement, a period of pullback, and now appears to be settling into a valuation that more accurately reflects its fundamentals.

The highs

In its first few weeks of trading, CRCL jumped 675 percent above its IPO price of $31.00, to $240.28. Investors were able to invest in the future of stablecoins for the first time ever, and the price reflected that. At its peak, the company traded at around 15.9x 2025E revenue.

The lows

That early momentum faded in spite of seemingly positive stablecoin news, with the GENIUS Act helping drive some regulatory clarity for stablecoins. Perhaps investors fear Circle may be challenged to get an OCC bank charter that is likely required for it to operate its business. Circle’s stock gave up much of its early gain, declining 25 percent from the highs as sentiment normalized.

Where it stands today

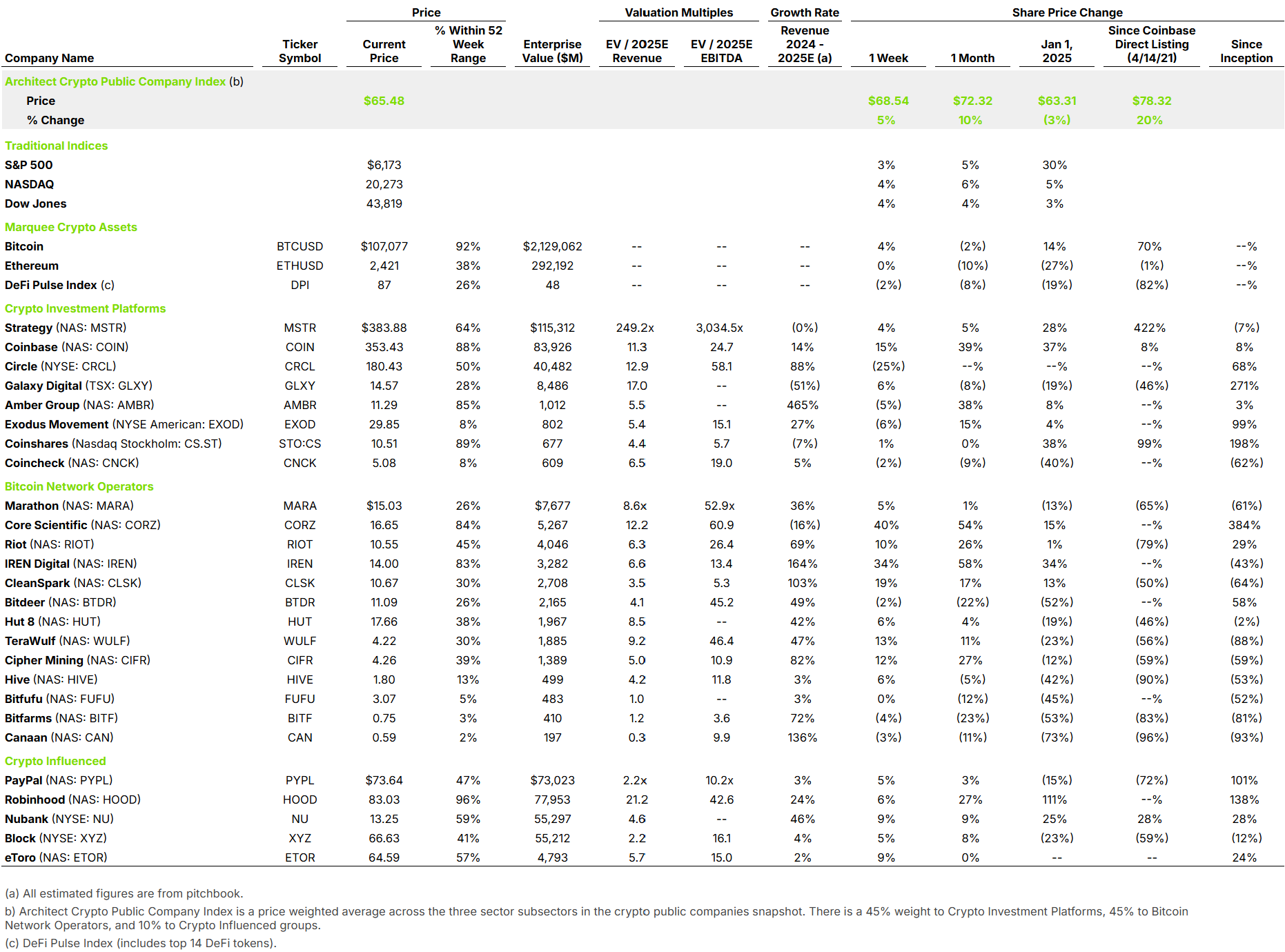

Circle now trades at 10.4x 2025E revenue, placing it more in line with public crypto peers on our comp sheet such as Amber, Galaxy, and Coinbase. The current valuation reflects a more grounded view of Circle’s outlook, balancing its strong market positioning with the practical challenges and risks of scaling its highly regulated and competitive stablecoin-issuance business.

Our take

Circle’s current valuation approaches being reasonable, while still in excess of typical fintech valuations on a revenue-multiple basis. The early hype has faded, and what remains is a business with clear utility, real revenue, and a valuation that sits within the peer set.