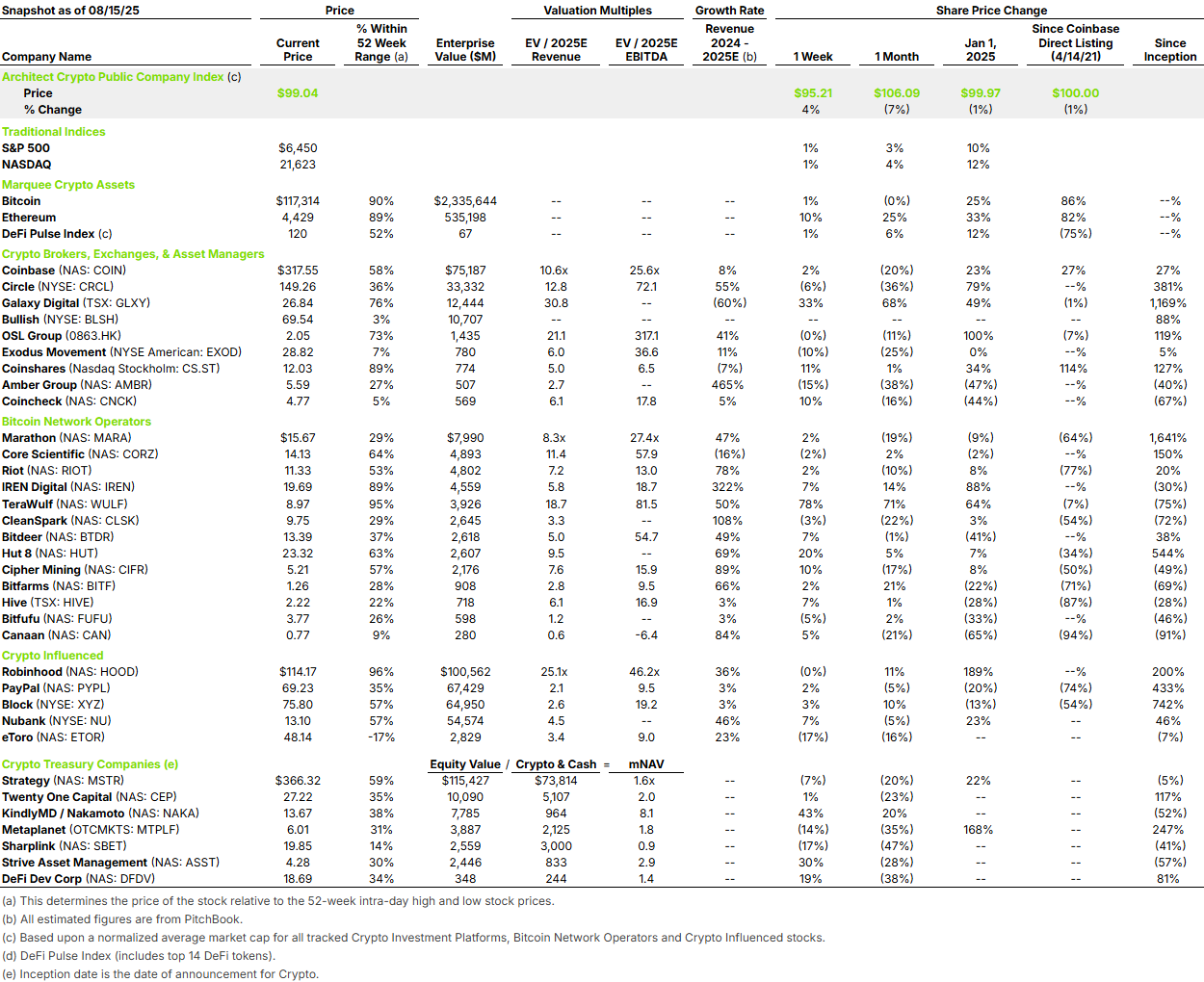

This week, Bullish went public in an upsized IPO, selling 30 million shares at $37 per share, raising $1.1 billion and implying a $5.4 billion market cap. On day one, the shares opened at $90 and closed at $75, about 2x the IPO price, similar to Circle’s first day of trading. After the first week, Bullish’s market cap is about $10.2 billion.

While Bullish is an exchange, broadly comparable to peers such as OSL Group and Coinbase, it is also more than that. As many of you know, it was founded and capitalized by Block.one, which provided nearly $10 billion in assets: $100 million in cash, 164,000 BTC, and 20 million EOS tokens. The company now has roughly $3.3 billion in cash after raising about $1.0 billion in its IPO, alongside a growing operating business.

Bullish is one of the few companies combining trading and news. It acquired CoinDesk in November 2023 for $72.5 million, and the platform has become central to its story. Over the last twelve months (LTM), the exchange handled $647.4 billion of volume and generated $150 million in net spread revenue; the media business produced $72 million, or about 32% of total revenue. After its first week of trading, Bullish trades at an enterprise-value-to-LTM-revenue multiple of 48.0x, higher than peers. That premium is consistent with recent IPO dynamics, similar to Figma, which traded up to a 68.6x revenue multiple.

Bullish now needs to earn that valuation. While it has a real business today, it remains subscale relative to its market value. The exchange space is highly competitive, but with a large balance sheet for M&A and a differentiated media position, Bullish could become a unique asset. It continues to use cash, about $30 million net cash used in operating activities in 2024, so there is work ahead for CEO Tom Farley. Still, it’s encouraging to see another marquee crypto company enter the public markets in a disciplined way.