Over the last few weeks, we have taken a close look at specific companies that are going public, including both treasury and operating crypto companies, which has been great to see. But this week, let’s step back and look at the market overall, which has not been doing too well.

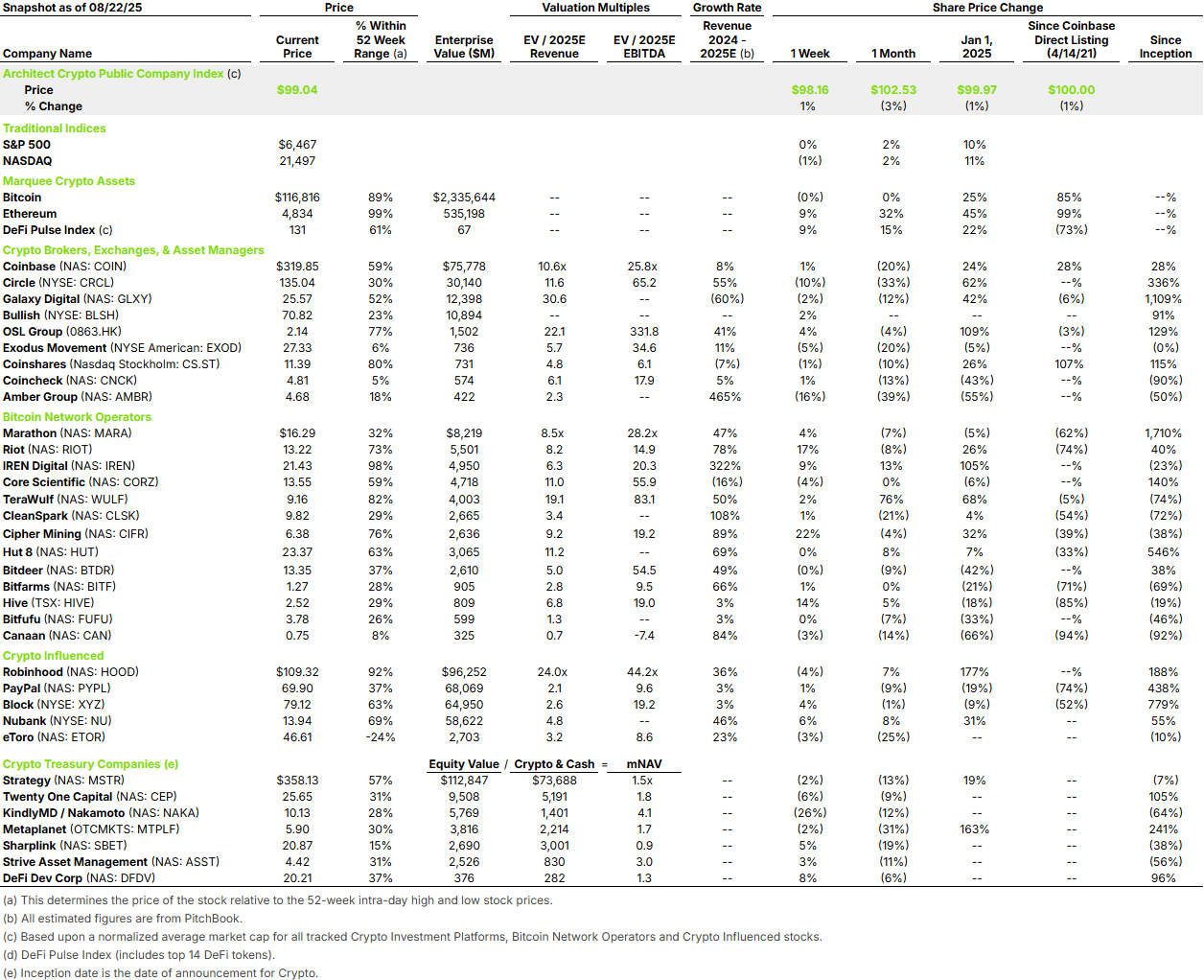

Our crypto brokerage group of stocks fell by a median of 16% for the month, even as Bitcoin and Ethereum, the underlying assets that these companies typically correlate with, are at all-time highs. Coinbase, Circle, and Amber Group are down 30%, 33%, and 36% for the month.

Bitcoin miners and treasury companies are also down, albeit more modestly, with miners down a median of 4% and treasury companies down a median of 12% for the month.

After an IPO-packed summer in which debuts like Circle (up 168% intraday) and Bullish (up 83% at the open) epitomized investor euphoria, the pullback over the last month has pushed crypto trading companies back down to earth, at a median of 8.4x 2025E revenue. That is roughly in line with healthier fintech peers and far below the 30x-plus peaks recorded last month. This orderly reset removes excess froth, re-anchors valuations to fundamentals, and ultimately leaves the group on a sturdier footing for the next leg of growth. Sometimes a decline in price is not such a bad thing.