Amber Group went public in March 2025 on the Nasdaq under the ticker “AMBR” following their reverse merger with iClick Interactive Asia Group Limited. On its first day of trading, Amber’s shares opened around $13.09, which would end up being their 52-week high as optimism about their business would fade.

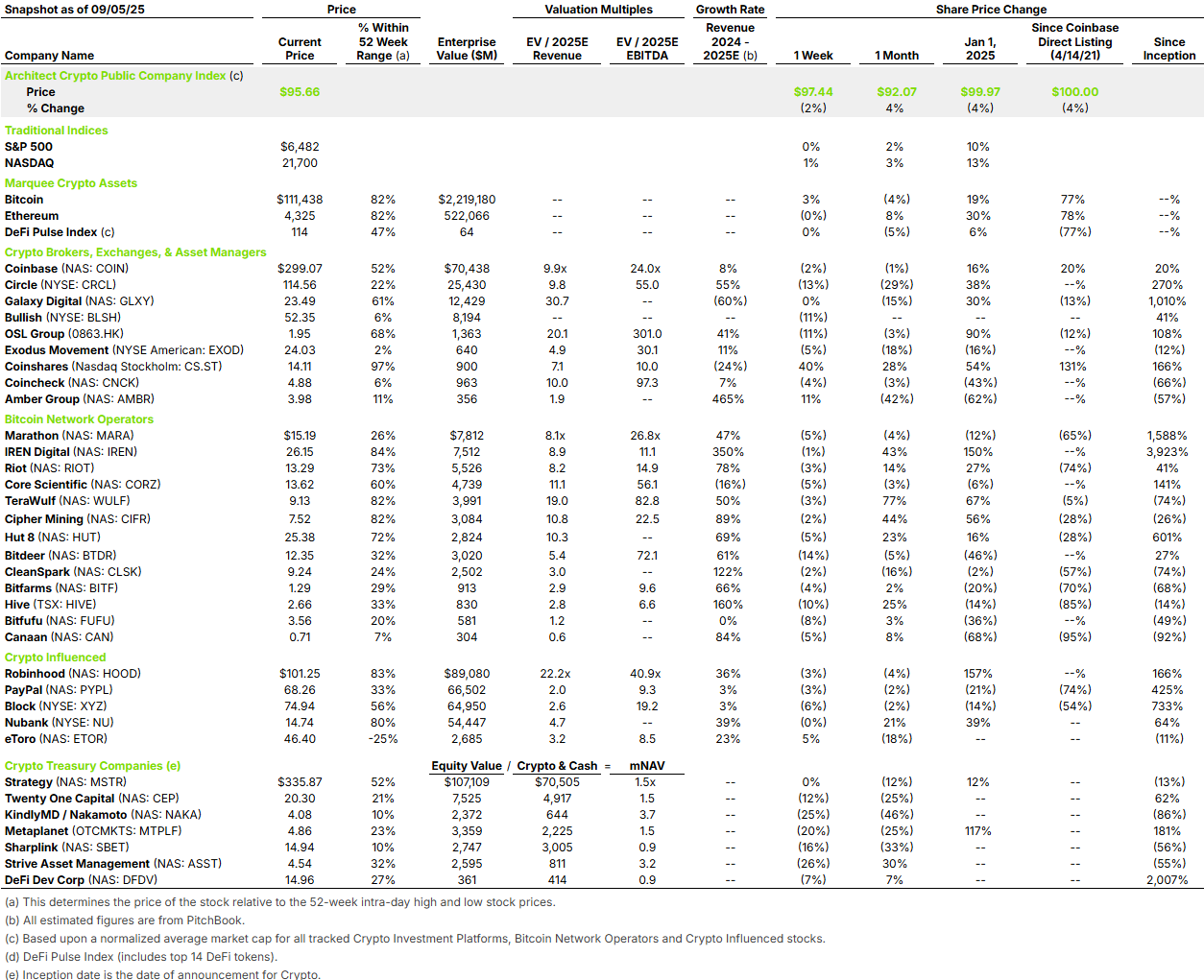

After going public, Amber experienced a surge in revenue, particularly in Q1 2025, reporting $14.9 million, up dramatically from $1 million in Q1 2024, following a strategic merger and an expansion in institutional wealth management solutions. Gross profit also leapt to $11 million, with a healthy margin of 73.7%, and turned an a modest $0.8 million operating income for the quarter. Despite this financial momentum, the share price has, fallen from a high of $13.09 to today’s price of $3.96, with its market cap shrinking by about 70% since going public. The question really is what could drive such negative returns on a seemingly growing business?

As investors look towards other successful crypto public companies like Coinbase and Circle, the narrative of these groups is very clear: leading crypto exchange and stablecoin issuer, respectively. Amber Group has an identity problem. They describe their scope of services as asset management, advisory, liquidity, investment, and research, and infrastructure. While an expert in the space may be able to piece together what all of those things mean, the typical retain investor cannot and it remains a very muddled messaging.

Storytelling in combination with financial strength is everything. To be a successful public or even private company, you need to accomplish both effectively. Amber Group from our view is a case study of what happens when the market just can’t quite follow what it is you’re doing in the crypto space.