Download the full report above.

Crypto Mergers & Acquisitions

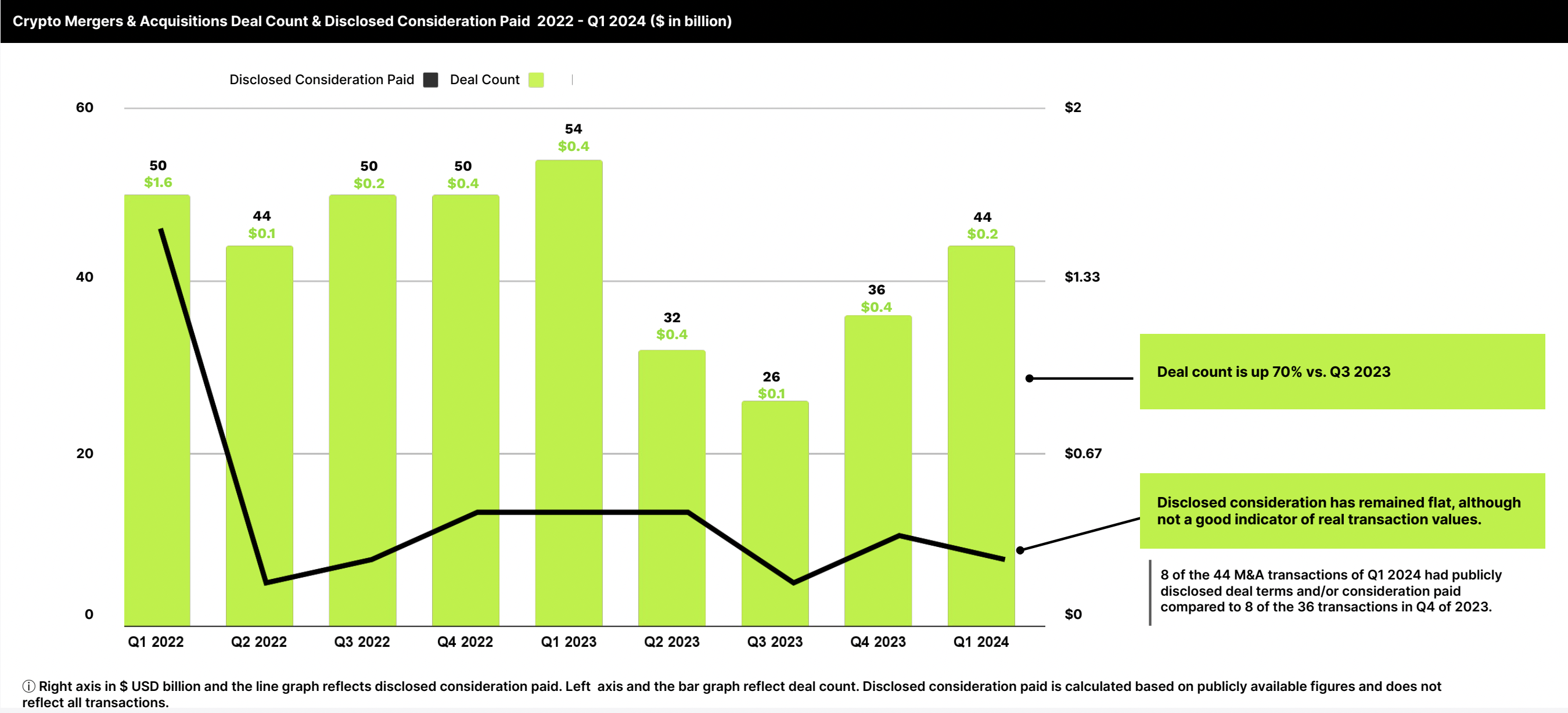

The market tone continues to improve, but M&A activity is still running below 2022 levels.

Announced M&A deal activity in Q1 2024 was up 22% from the previous quarter – good news indeed, but still below the pace of the peak year 2022. The crypto sector’s announced deal activity improved a bit more than the overall tech sector deal activity, in contrast to an observed decline in announced fintech deals last quarter. (Note that most announced crypto deals do not have an announced value, so deal value is not an accurate indicator.)

In Q4 2023, 39% of crypto deals were in the Brokers & Exchanges or Investing & Trading Infrastructure subsectors. This trend continued in Q1, with 45% of deals in the same two leading sectors.

The share of “bridge transaction” deals in which a non-crypto native firm acquired a crypto-native firm inched up to 25% last quarter, indicating increased comfort with the sector.

Valkyrie Funds | CoinShares, Brassica | BitGo, and the three-way combination of SingularityNET, fetch.ai, and Ocean Protocol into the Artificial Superintelligence Alliance (at a whopping $7.5B notional value) were the headline M&A deals in Q1.