April 28 – May 4 (Published May 6th)

PERSPECTIVES by Todd White

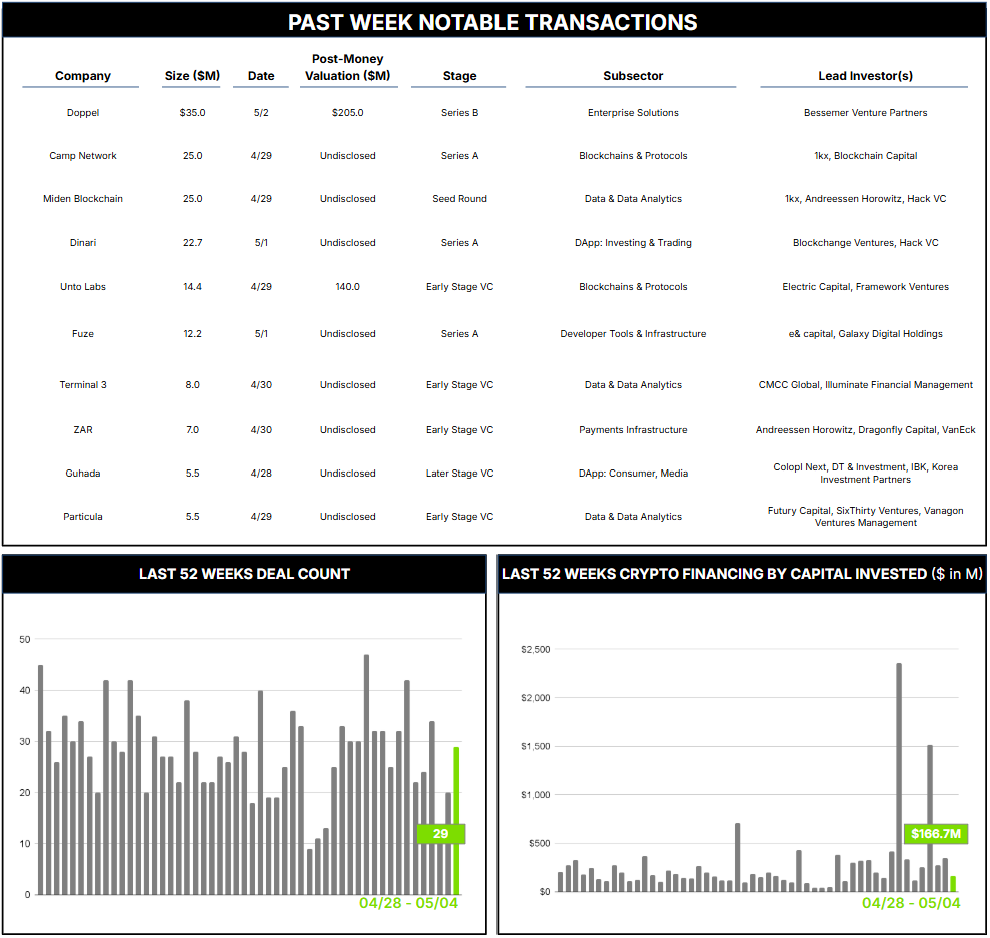

29 Crypto Private Financings Raised: $166.7M

Rolling 3-Month-Average: $536.2M

Rolling 52-Week Average: $273.8M

Innovative technologies have repeatedly disrupted and reshaped the protection and enforcement of individual and economic rights across industries, from basic privacy to copyright and other intellectual-property interests. Since Gutenberg’s printing press, inventions such as player pianos, radio, photocopying, VCRs, and the digital downloading and streaming of music and video have challenged existing frameworks, bringing both threats and safeguards time and again.

For example, the music industry was profoundly disrupted by peer-to-peer (P2P) file-sharing platforms like Napster and LimeWire in the late 1990s and early 2000s. Early digital devices such as MP3 players and P2P networks enabled unauthorized distribution, much as photocopiers once threatened print media. Bypassing traditional sales channels, P2P file sharing severely cut into artists’ and labels’ revenues, sparking major legal battles; Metallica’s lawsuit against Napster culminated in Napster’s 2001 shutdown for copyright infringement.

The technology threatened musicians’ livelihoods by enabling widespread piracy, but it also sparked a tech-enabled solution. Digital Rights Management (DRM) began with basic encryption and access controls to prevent unauthorized copying and sharing of digital content, then evolved with stronger encryption, rights management, and authentication that ultimately helped digital media consumption grow across platforms while protecting creators. DRM continues to expand, with new technologies such as blockchain and AI giving artists even more granular control over, and remuneration from, their work.

Similar stories are playing out today and are attracting investor interest. Modern AI development consumes massive amounts of data, including copyrighted material, to train models and image generators. As with P2P file sharing, this has spawned numerous lawsuits alleging unauthorized use of articles, books, movies, photos, and more. Camp Network, which recently closed a 25 million-dollar Series A led by 1kx and Blockchain Capital, with support from OKX Ventures, Lattice Ventures, and Paper Ventures, has developed a purpose-built Layer-1 blockchain for creators to register, license, and monetize intellectual property (IP) with provenance baked into the protocol. It targets creators in the crypto ecosystem, offering gas-less IP registration and smart-contract-enabled royalty distribution to support AI training with incentives aligned between creators and AI developers.

As has happened time and again, technological advancements that create formidable threats ultimately catalyze technological solutions that lead to greater control and creative freedom, generating both investment and revenue opportunities. We hope, and fully expect, this point-and-counterpoint dynamic to continue, with groups like Camp Network and the investors who back them playing a critical role.

Architect Partners will be at Consensus Toronto; if desired, please contact ryan@architectpartners.com to schedule a meeting.