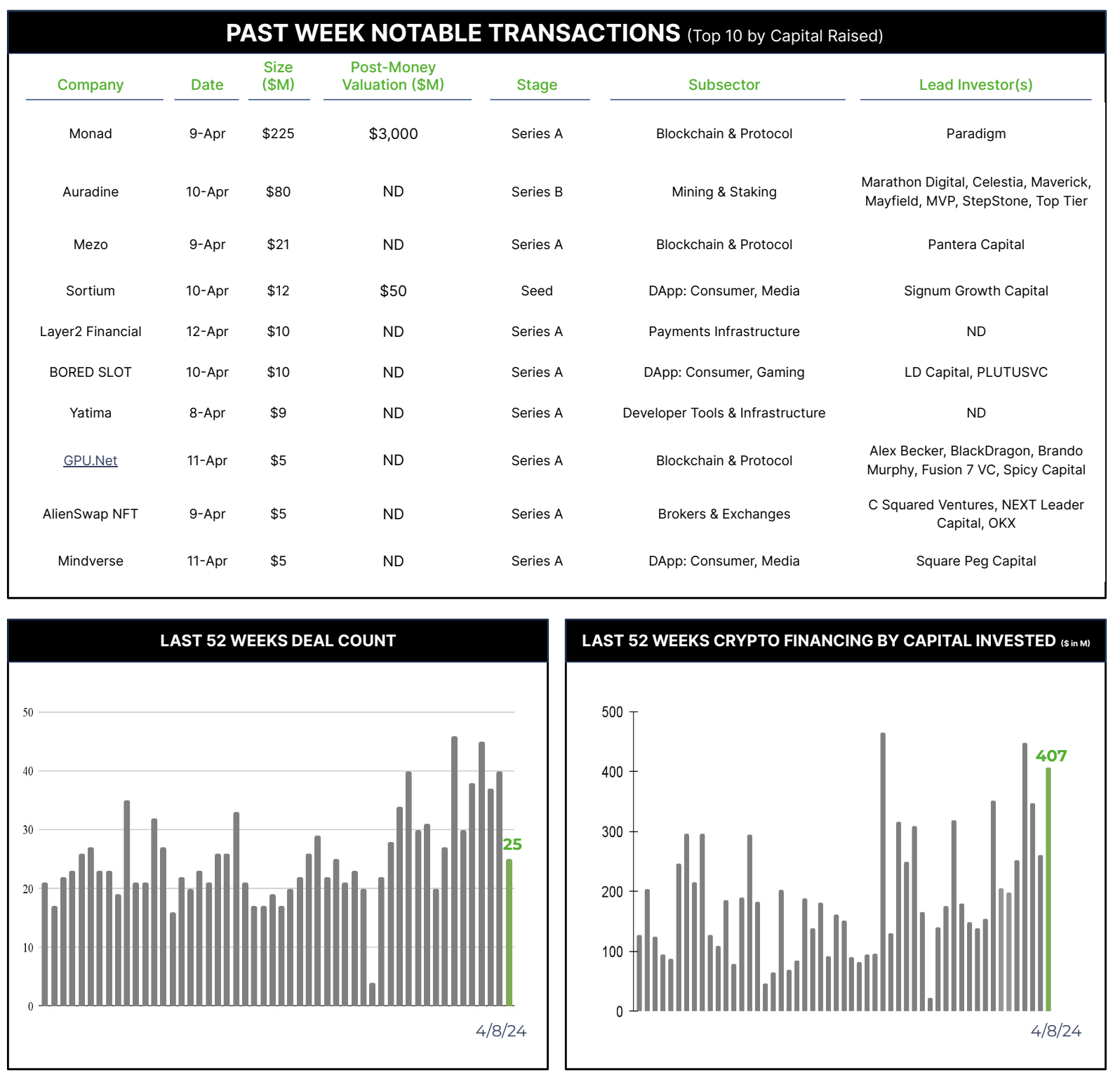

25 Crypto Private Financings Raised ~$407M

Rolling 3-Month-Average: $250M

Rolling 52-Week Average: $184M

Deal count dipped significantly last week, while 75% of funds raised came from two deals. We’ll continue to keep an eye on whether last week was just a slow week or whether broader macro issues are affecting the funding environment.

———————————————————

When the 4th Bitcoin halving occurs, miner rewards will fall from 6.25 BTC to 3.125 BTC. On a macro level, the pre-planned event is intended to increase scarcity and presumably increase the value of each BTC. One of the questions that comes about due to the halving is the question of miner profitability. With BTC prices rising, this would not necessarily be an issue for miners, but what if the price of BTC falls, as it is currently? Miners have various revenue sources aside from rewards to assist with revenue flow, but profitability remains highly dependent upon continuous improvement in operational efficiency.

Miners moved to mining specific ASICs to increase computing power, and have also continually improved their ability to manage the huge economic impact of energy resources. In November, Auradine introduced its Teraflux Mining Systems product line that assists miner operations in both of those key areas. Teraflux not only provides extreme performance in air-cooled and immersion environments, but also enables miners to dynamically adjust energy consumption and hash rate based on the demand response needs of the electrical grids.

Since its introduction, Auradine’s customer base has grown to over 30 data center scale miners, $80M in bookings, and over $200M in their order pipeline. Based on this success, Auradine announced it raised $80M in an oversubscribed Series B, which followed an $81M Series A in 2022. New investors included StepStone Group, Top Tier Capital Partners, MVP Ventures, and Maverick Capital. Existing investors, including Celesta Capital, Mayfield Fund, and Marathon Digital also participated.

The new funding is expected to enable Auradine to increase production and to accelerate R&D into additional solutions on its roadmap, which includes Blockchain and AI security.