August 18th – August 24th

PERSPECTIVES by Eric F. Risley

M&A requires complex, nuanced financial and legal advice and must satisfy myriad legal and regulatory requirements. DAO M&A appears to ignore these fundamentals.

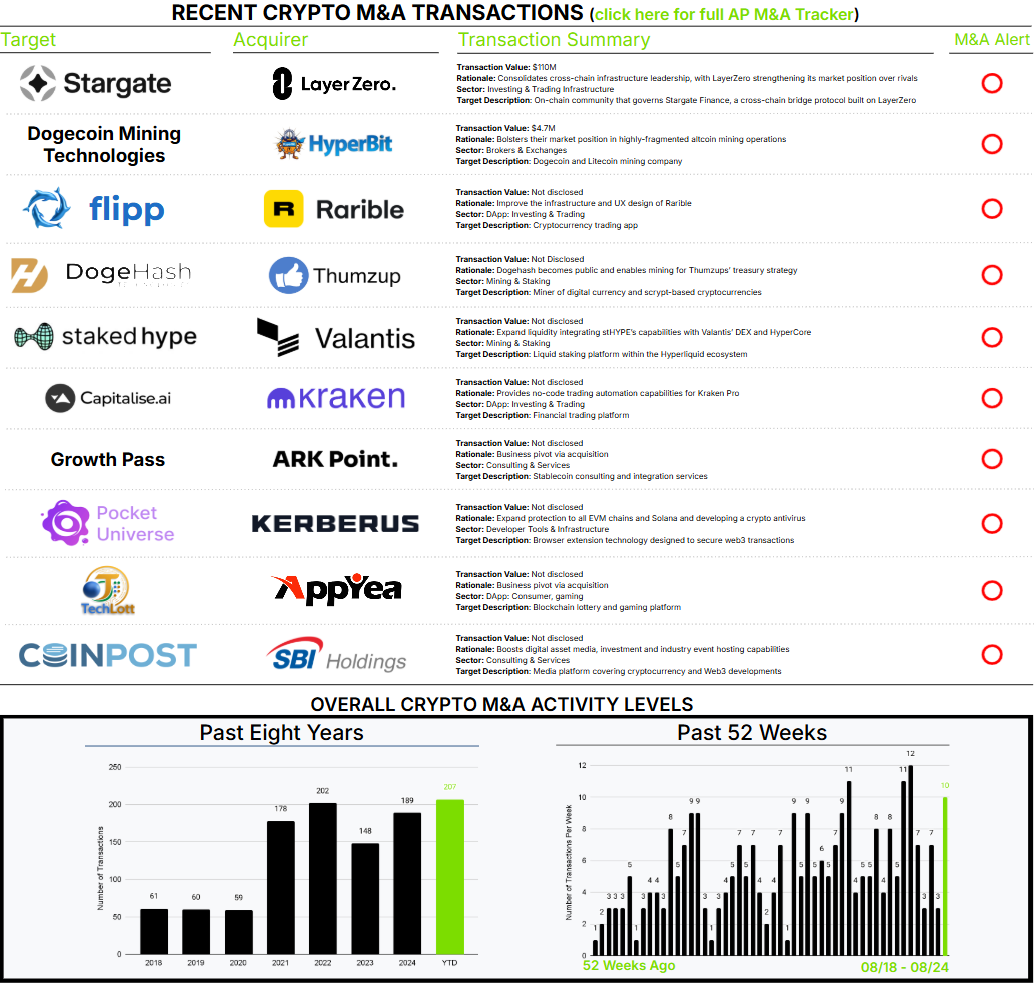

This week, we’ve watched the Stargate saga unfold, with LayerZero and Wormhole as interested acquirers. As a lifelong M&A practitioner, many essential questions come to mind.

First and foremost, a commonly stated premise is that many tokens are not securities. That has profound implications, relieving token issuers—in this case, decentralized autonomous organizations (DAOs)—from a vast corpus of securities-related regulations and requirements.

In this instance, we are seeing all the core elements of traditional corporate M&A:

- An economic entity that generates both revenue and profits.

- Dedicated people who have created and operate that entity.

- Holders of tokens who have received economic benefits from those efforts.

- Token holders with governance rights to vote on important matters to defend their interests.

- Clear economic value being offered and negotiated.

- Disclosure of material information from all parties, sufficient for token holders to make an informed decision, appears to be lacking.

I’ll refrain from making a judgment as to how this set of facts, activities, and rights can fall outside the legal requirements and securities laws that govern corporate M&A. However, from an M&A professional’s perspective, this process is a concerning case study in execution. I am certain our industry can do better.