August 18 – August 24 (Published August 28th)

PERSPECTIVES by Todd White

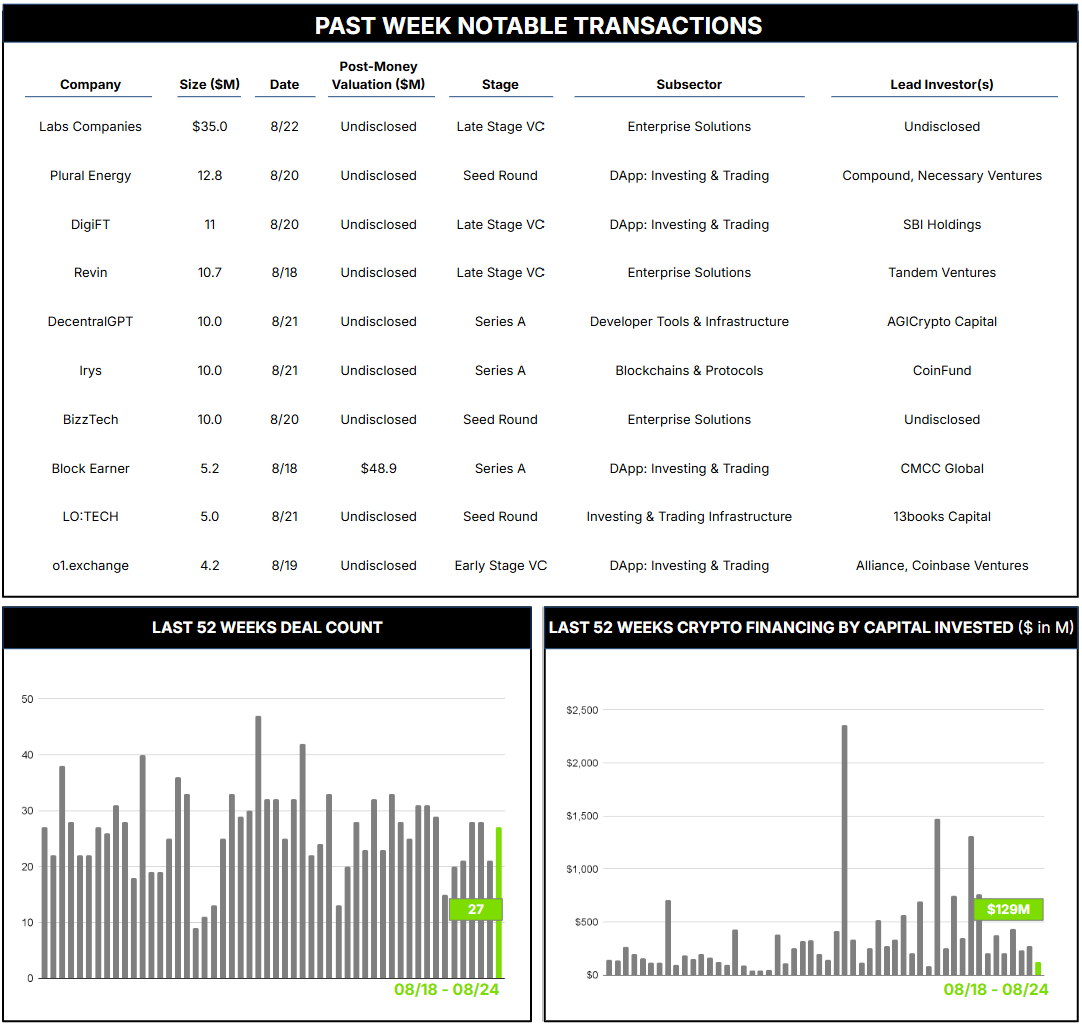

21 Crypto Private Financings Raised: $129.4M

Rolling 3-Month-Average: $439.7M

Rolling 52-Week Average: $348.2M

There is a growing cadre of blockchain-enabled climate initiatives. Many leverage blockchain technology to enhance transparency, efficiency, and trust in climate-action domains—particularly carbon markets and climate finance—and are beginning to advance beyond pilot stages. Some examples include: KlimaDAO’s use of smart contracts and tokenization to make carbon-credit offsetting more accessible and efficient through fractionalization; Power Ledger’s focus on peer-to-peer energy trading and decentralized solar-energy sales; Net Zero Company’s issuance of tokenized carbon credits backed by transparent and verified carbon capture; and Triangle Digital’s digital-finance platform to fund and manage climate and infrastructure assets with real-time data, liquidity creation, and regulatory compliance.

Plural Energy has also emerged as an innovative player in the sector. Founded in early 2023 as an on-chain investing platform, the San Francisco-based team focuses on enabling broader access to investment opportunities traditionally limited to large infrastructure funds. They offer tokenized investment opportunities in renewable-energy projects and a platform that enables direct investment in solar and other renewables while maintaining regulatory compliance through partnerships with SEC-registered broker-dealers and KYC/AML technology.

The team raised $12.8M in a seed round on August 20, 2025, led by Compound and Necessary Ventures. This follows a $2.3M pre-seed financing in May 2024. The funding will support enhanced investment analytics, multi-currency distribution options, investor-voting features, and the integration of debt markets.

Blockchain’s potential to reshape climate finance, through immutable carbon registries, tokenized instruments, and new financing models, shows promise but remains nascent. There is substantial room for development, and current trends center on ecosystem interoperability, AI integration, global standards for carbon credits, and novel financial instruments. We are encouraged by investor support for teams such as Plural’s and are actively monitoring developments as the subsector evolves.