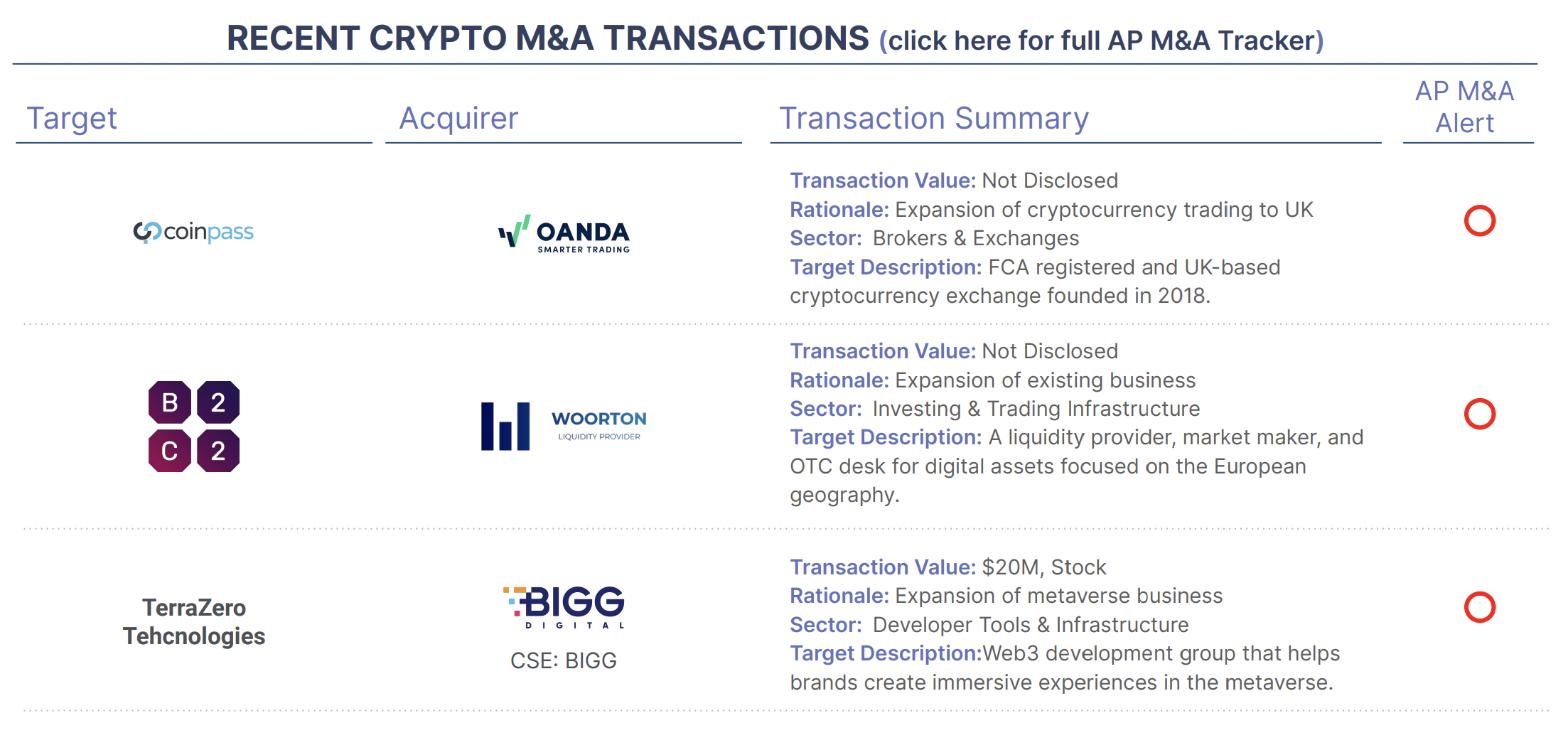

OANDA, a global foreign exchange (FX) and CFD broker, announced on August 22, 2023 that it has acquired a majority interest in Coinpass, a UK-based cryptocurrency exchange. The terms of the deal were not disclosed.

Coinpass was founded in 2018 and is registered with the UK’s Financial Conduct Authority (FCA). It offers a variety of proprietary on-ramp and trading capabilities. The exchange is reported to have over 100,000 registered users and has processed over £1 billion in trading volume. OANDA said that the acquisition of Coinpass will allow it to expand its offering in the cryptocurrency market. The company currently offers CFD trading in four cryptocurrencies: Bitcoin, Bitcoin Cash, Ether, and Litecoin. The acquisition of Coinpass is the latest in a series of moves by OANDA to expand its presence in the cryptocurrency market. In 2022, the company launched a cryptocurrency research team and a cryptocurrency trading academy. The acquisition of Coinpass is also a sign of the growing interest in cryptocurrencies by traditional financial institutions. OANDA is not the only FX broker that has made a move into the cryptocurrency market. In recent months, other FX brokers such as IG Group and Saxo Bank have also announced plans to offer cryptocurrency trading.

B2C2, a crypto liquidity provider, has acquired Woorton, a European market maker and over-the-counter (OTC) trading firm. The terms of the deal were not disclosed.

The acquisition of Woorton will allow B2C2 to expand its presence in the European market and offer its institutional clients a wider range of services. B2C2 will also benefit from Woorton’s expertise in digital asset market making and OTC trading, as well as its PSAN (prestataires de services sur actifs numériques) License, regulated by the AMF (Autorité des Marchés Financiers), which allows B2C2 to operate inside the EU. The acquisition of Woorton is a significant step for B2C2 as it continues to expand its global reach. The European market is a key target for B2C2, and the acquisition of Woorton will help the company to better serve its institutional clients in this region. The acquisition is also a sign of the growing consolidation in the cryptocurrency industry and the importance of country licenses as regulation becomes more widespread and stringent. Established companies are finding that it is faster and more certain to acquire a company with licenses than to go through the time and effort to acquire those licenses themselves. As the industry matures, we are likely to see more acquisitions of this kind as companies seek to expand their geographic reach and offerings.

BIGG Digital Assets Inc. (BIGG), a Canadian company that invests in products and companies that support crypto, has agreed to acquire TerraZero Technologies Inc. (TerraZero), a Metaverse development group and Web3 technology company.

The acquisition will allow BIGG to expand its presence in the Web3 market. TerraZero has a track record of developing Web3 projects for Fortune 500 brands that include PwC, Miller Lite and Atlantic Records. Total consideration is 62 million shares of BIGG, valued at approximately $20M. This represents a healthy revenue multiple as TerraZero has run-rate revenue of approximately $3M per year, and is showing 160% year over year growth. The transaction is expected to close in September 2023 and is subject to 66⅔% of TerraZero shareholders voting in approval of the transaction. TerraZero shareholders will own approximately 20% of the combined company when the transaction closes.