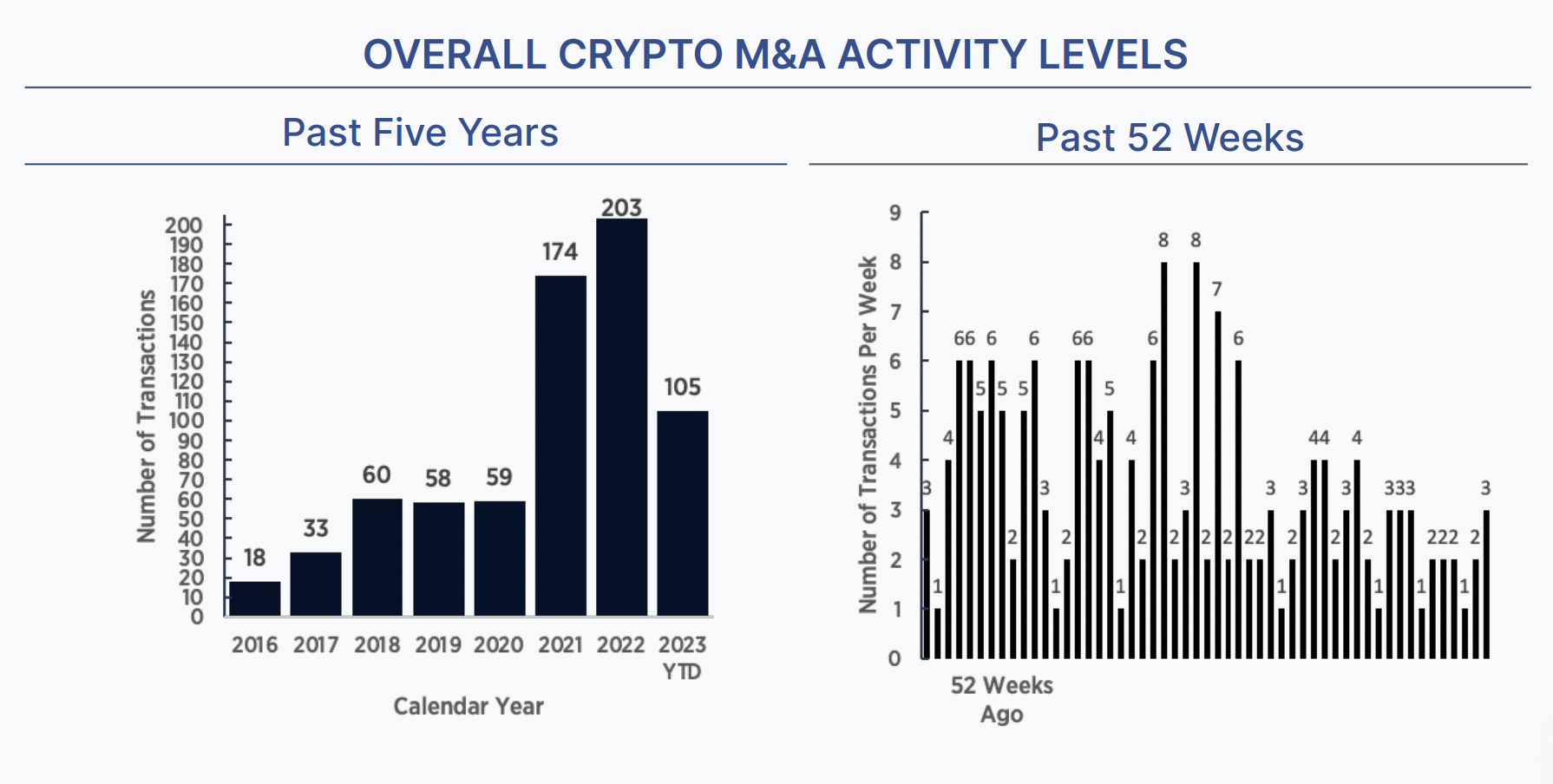

Crypto M&A activity in Q3 2023: A slowdown, but with some notable deals

Summary

The crypto M&A market has slowed down in the first two months of Q3 2023, with only 17 acquisitions announced, compared to 68 in Q3 2022 and 33 in Q2 2023. However, there were still some notable deals, including:

- OANDA acquired CoinPass, an FCA-registered cryptocurrency exchange.

- Securitize acquired OnRamp Invest, a digital asset management platform focused on RIAs.

- Deutsche Börse acquired FundsDLT, a blockchain-based platform for fund distribution.

- WonderFi acquired both Coinsquare and CoinSmart, two Canadian crypto exchanges with 1.6M users.

- Laser Digital acquired Elysium Technologies, a post-trade solutions provider for FX and digital assets.

Reasons for the slowdown

The slowdown in the crypto M&A market can be attributed to a number of factors, including:

- The ongoing war in Ukraine, the fear of inflation and the Federal Reserve’s interest rate hikes have created a risk-off environment, which has made investors less willing to invest in risky assets, including crypto companies

- The high-profile failures of crypto companies like FTX, Celsius, and 3 Arrows Capital have shaken investor confidence in the industry.

- The regulatory status of cryptocurrencies in the USA is unclear, which is creating uncertainty for businesses and investors. The industry needs clear regulations so that businesses can operate and investors can make informed decisions.

Positive developments

Despite the slowdown, there are a number of positive developments that could drive the crypto M&A market in the coming months. These include:

- Grayscale’s Supreme Court win against the SEC, which could pave the way for more spot Bitcoin ETFs to be approved.

- The launch of PayPal’s stablecoin for payments, which is a major milestone to enable the adoption of crypto by mainstream consumers.

- X, formerly Twitter, has obtained money transmitter licenses in seven U.S. states, signaling Elon Musk’s grand plan to enable blockchain-based payments to their 400 million global users.

Overall outlook

Overall, the crypto M&A market is likely to remain active in the coming months, albeit at a slower pace than in previous years. The key drivers of the market will be the continued growth of the crypto industry and the establishment of additional real-world use cases for crypto and blockchain.