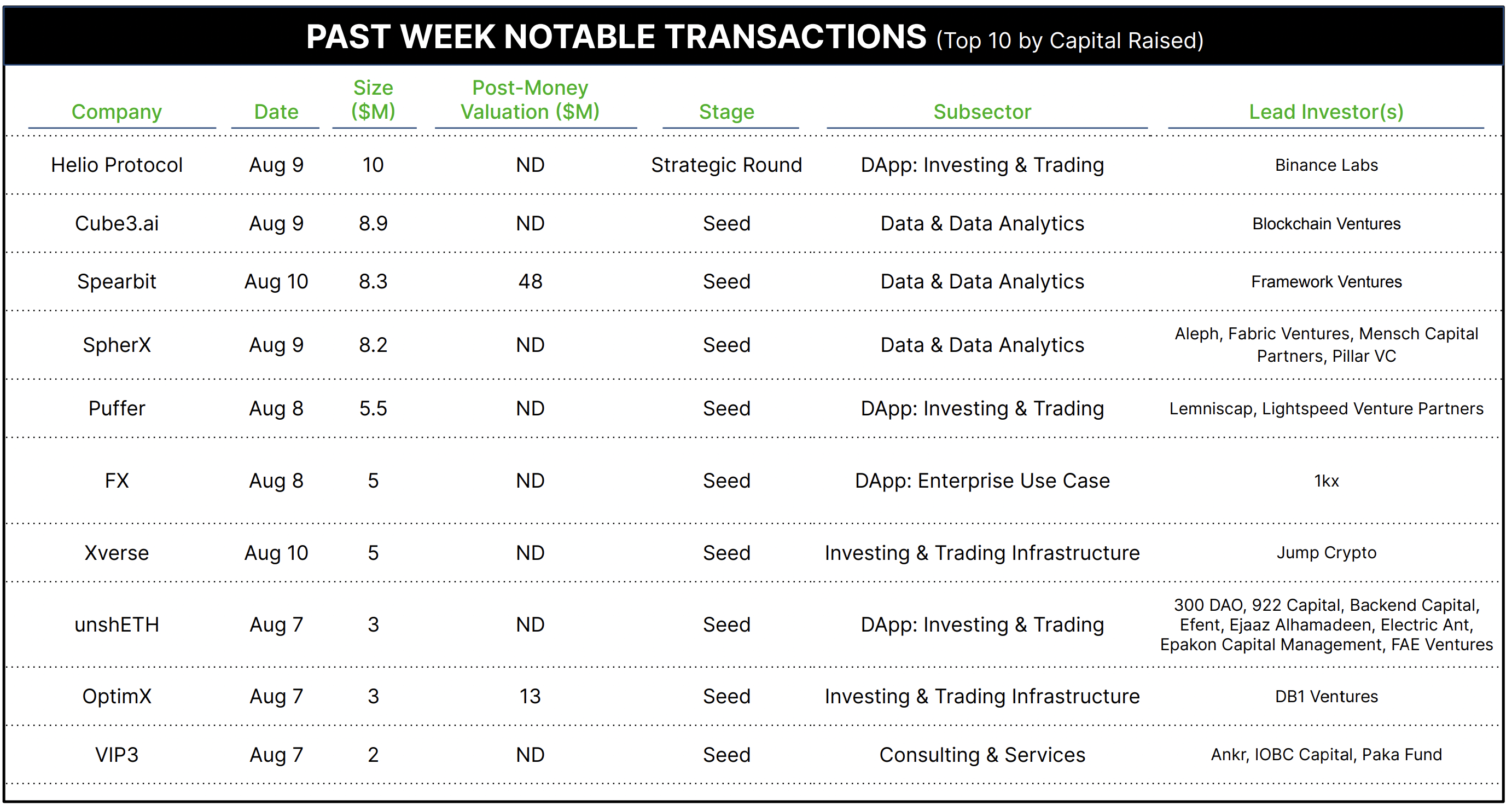

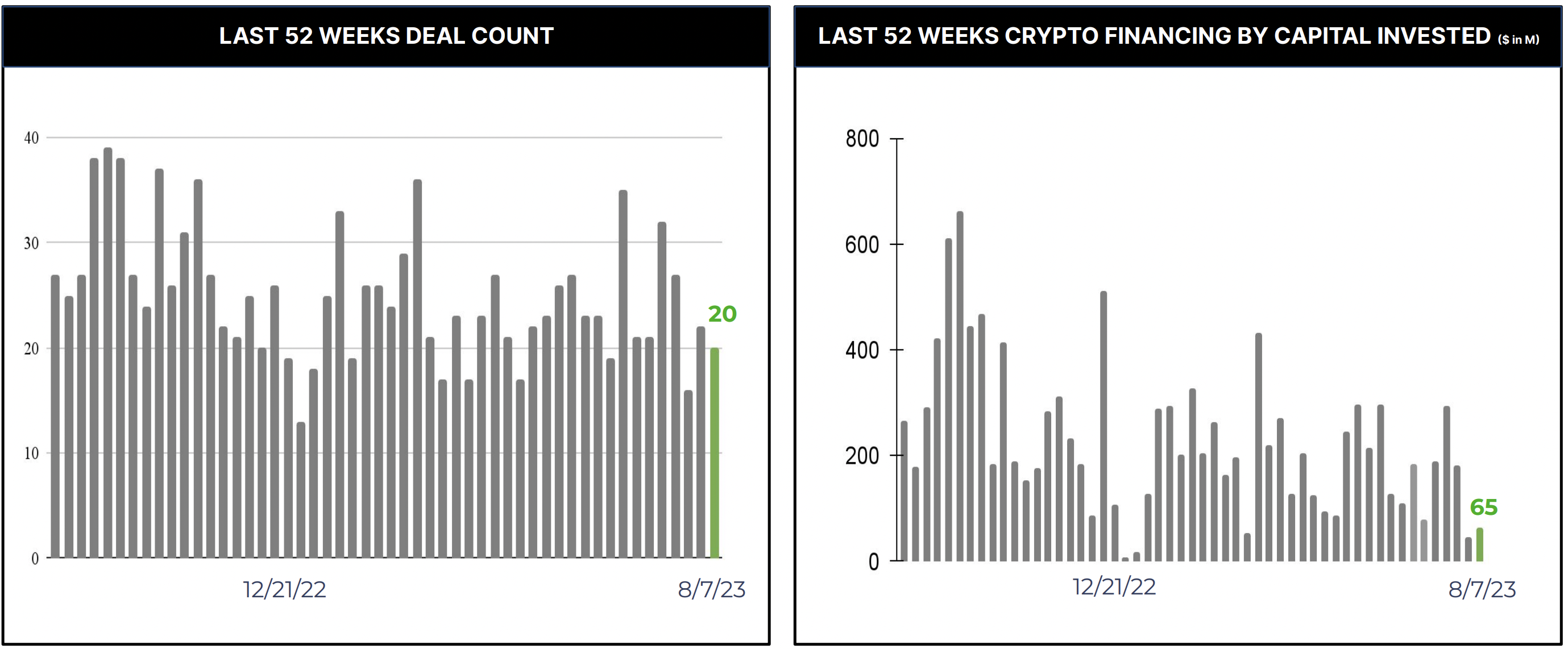

20 Crypto Private Financings Raised ~$65M

Rolling 3-Month-Average: $174M

Rolling 52-Month Average: $231M

Segment Overview

August – like July just hotter & more humid (for us in the northern hemisphere). August so far is as slow as expected with capital flows below average and smaller deal sizes.

Selected Highlights

Moneygram took an investment from Stellar, hitting the tape just yesterday. Following a commercial working relationship, Stellar’s Foundation head will join Moneygram’s board to help further the digital strategy. Moneygram is the well known money transfer firm with online and physical locations. Moneygram was taken private by Madison Dearborn Partners, the large PE firm, in June. Terms of Stellar’s investment were not disclosed.

Why Notable? Very rare to see a crypto native invest in a notable traditional firm. The Stellar foundation has sizable assets and using them to cement partnerships is something, as an investment banking firm, we encourage. We may add additional commentary in next week’s snapshot.

Helio Protocol raised $10M from Binance Labs. Helio combines its overcollateralized, decentralized stablecoin (HAY) borrowing and lending on Binance’s BNB chain, with multichain Storage-as-a-Service (STaaS) and Liquid Staking Derivatives Finance (LSDfi). Quite a mouthful of lingo! The protocol lives in the DeFi space and has nearly $300M in total value locked. Last month, Helio Protocol also acquired Synclub to boost its staking infrastructure.

Why Notable? Binance Labs has been on a bit of an investing tear, investing in firms that can propagate its own assets such as the BNB chain. For DeFi, we’re seeing CeFi and TradeFi infrastructure migrate into the DeFi world with its own unique spin. Managing risk in DeFi continues to be an area with significant room for growth.

Cube3 and Spearbit each raised for their seed round. Cube3 is a Web3 security platform protecting smart contracts from malicious transactions and raised $8.9M with Blockchain Ventures leading. Spearbit is a marketplace for security experts to advise on Web3 projects and raised $8.3MM with Framework Ventures leading.

Why Notable? Both are security for Web3, the often hyped concept. Security for this evolving technology is critical for it to mature and be given serious consideration for adoption. Raising seed rounds of a decent size shows the continued interest in the segment.

Patterns Web3 was a popular sector this week, with a fair number of firms focused on infrastructure stability, from security to data analytics. These functions are signs of the maturation phase in the typical technology cycle.