December 2nd – December 8th

PERSPECTIVES by Eric F. Risley

Let’s celebrate even the small wins.

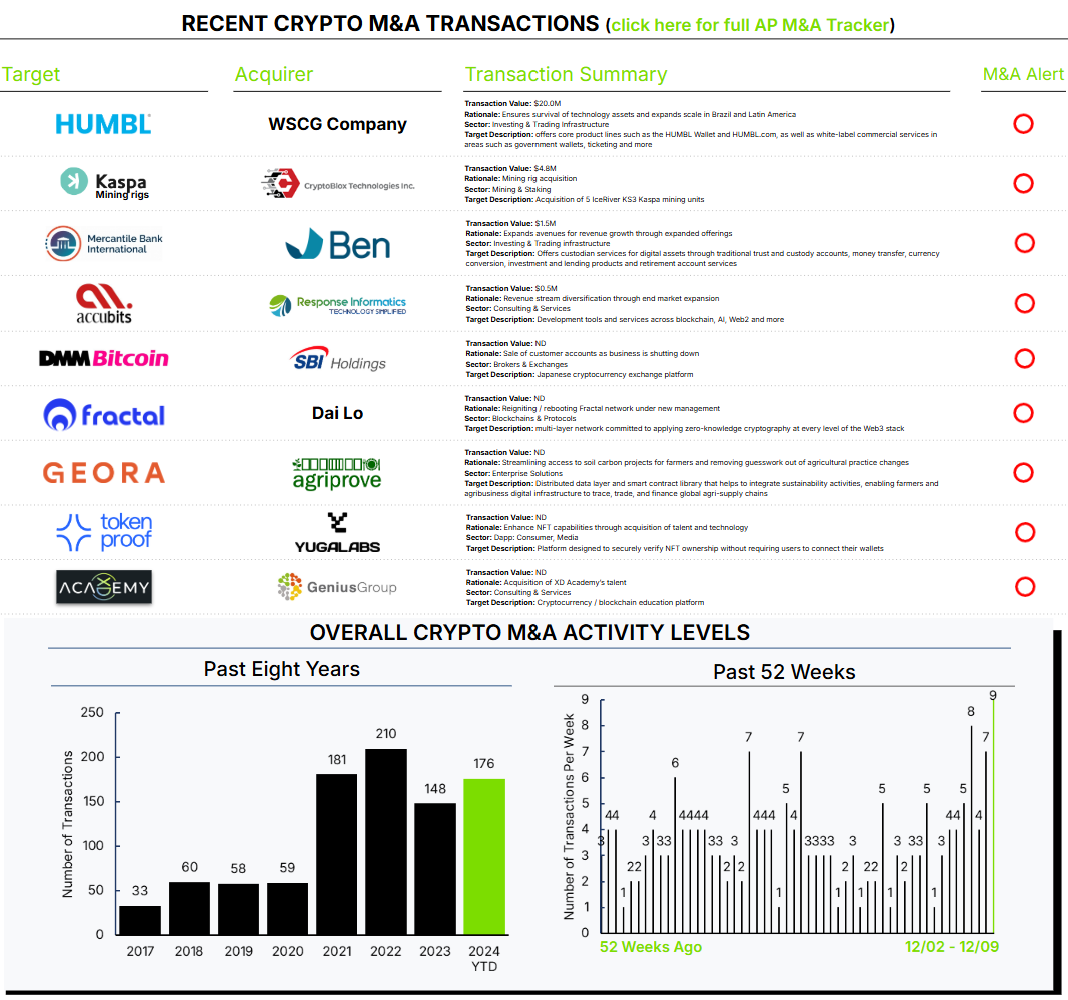

This week was the most active week for announced crypto M&A transactions in history, and we’ve built what we believe is the most complete database covering every transaction since the inception of the crypto industry over the past 10 years.

Now, let’s be honest—numbers aren’t really what matters. We focus on “premium-value” transactions, which represent important strategic initiatives in action. None of this week’s activity falls into that category. However, anything involving headline names like SBI Holdings and Yuga Labs deserves some level of attention. Both executed small transactions this week: SBI acquired customer accounts from a Japanese exchange, and Yuga Labs completed a team and technology acquisition. Neither falls into the “important” category.

From a broader strategic trend perspective, our team is focusing current attention on a number of important themes. You will see more from us on these topics in the coming weeks, but a “sneak” preview includes:

Mergers & Acquisitions

- It’s Time For Urgency

- Brokers & Exchanges M&A Is Stuck in a Valuation Tug of War

Value Creation

- Crypto Has Delivered Exceptional Investor Returns Overall

- Crypto Continues to Outpace Internet Value Creation Pace

Capital Markets

- Early Stage Crypto Venture Funding Is Thriving

- Growth Stage Crypto Funding Continues to Struggle

- Crypto IPOs Are Coming

- Leverage Is Quickly Returning

Beyond Speculation

- Stablecoins Have Proven Real-World Use