December 30th – January 5th

PERSPECTIVES by Eric F. Risley

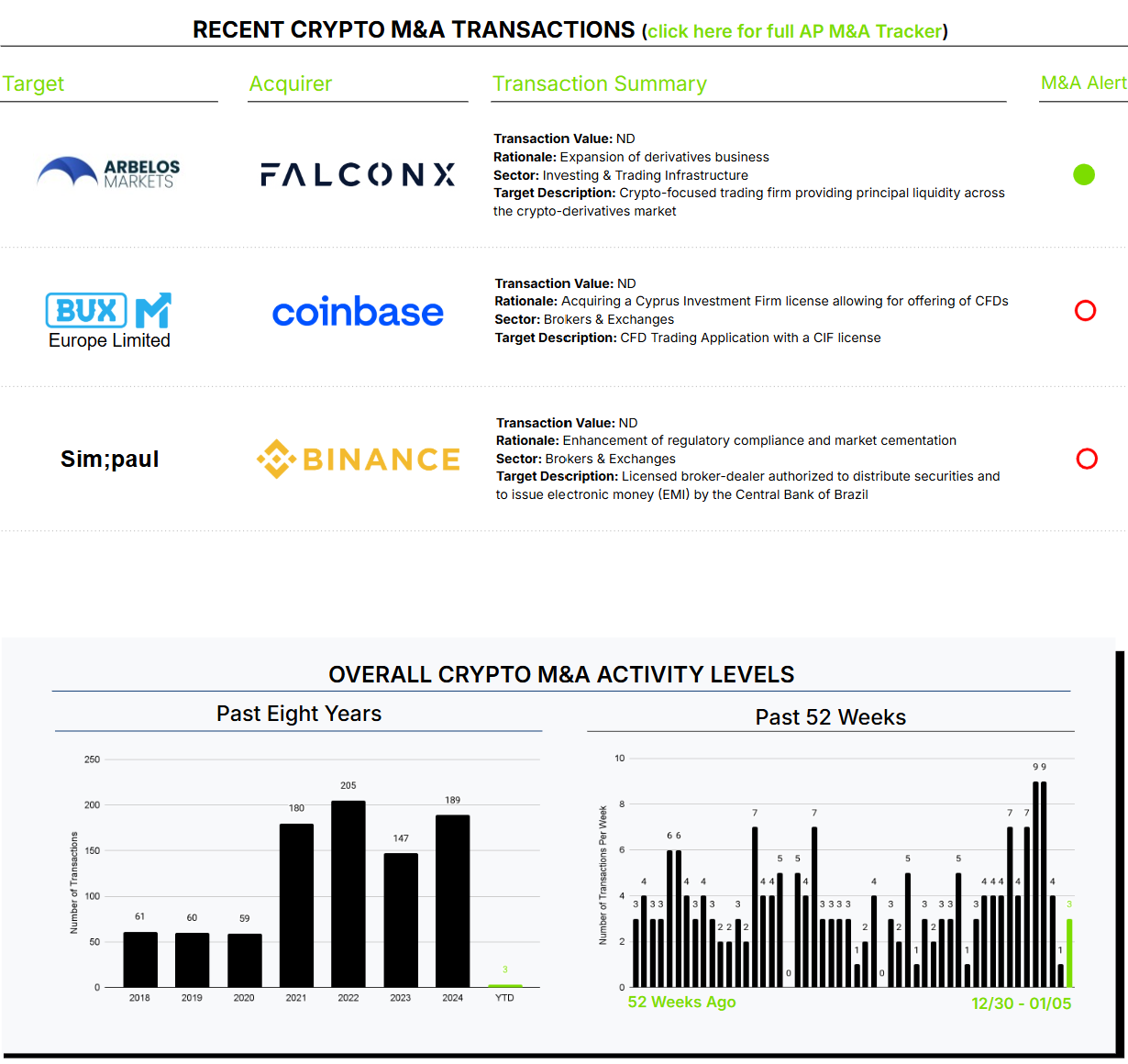

The return of the leaders to the M&A market.

It has been a satisfying week, especially when considering the overall sentiment in the market. From an M&A perspective, announcements from Coinbase, Binance, and FalconX signal the return of a critically important acquirer group: the crypto leaders. While the Coinbase and Binance transactions were modest-sized, tactical license and product acquisitions—and quite predictable—they align with a growing consensus we’re hearing in conversations with leading crypto firms: M&A is back on the table. In some cases, these firms are even aspiring to more strategic, “move the needle,” high-profile objectives.

FalconX’s acquisition of Arbelos Markets is unquestionably the most strategic deal this week. FalconX is arguably the leading institutional-only crypto prime broker, boasting impressive institutional trading volumes and a strong financial position. Arbelos Markets, co-founded fairly recently by Joshua Lim and Shiliang Tang, raised $56 million in seed funding in May 2024, led by Dragonfly, with FalconX also participating.

This acquisition bolsters FalconX’s position in derivatives by bringing a block-trading and OTC derivatives market liquidity provider in-house. This move not only enables FalconX to capture a larger share of trade revenues but also ensures client needs are consistently met. Derivative volumes significantly outpace spot trading volumes and are, arguably, more profitable. As aptly noted by our partner, Mike Klena, in our M&A Alert on this transaction, a similar trend occurred in U.S. equity trading once it became commoditized in the early 2000s. Firms responded by expanding their higher-margin derivatives offerings, often through acquisitions.

There are already notable M&A precedents in this space. Coinbase acquired FairX in 2022 (an Architect Partners client and now Coinbase Derivatives), and CBOE purchased ErisX in 2021—though, in hindsight, that deal may have been premature given the market’s development at the time. Several new players, including OneTrading and D2X, have also emerged recently.

Finally, for a complete assessment of the M&A and financing markets, keep an eye out for our Year-End 2024 Crypto M&A and Financing Report, which will be published this coming week. Preview summary statement: “Cautious optimism.”