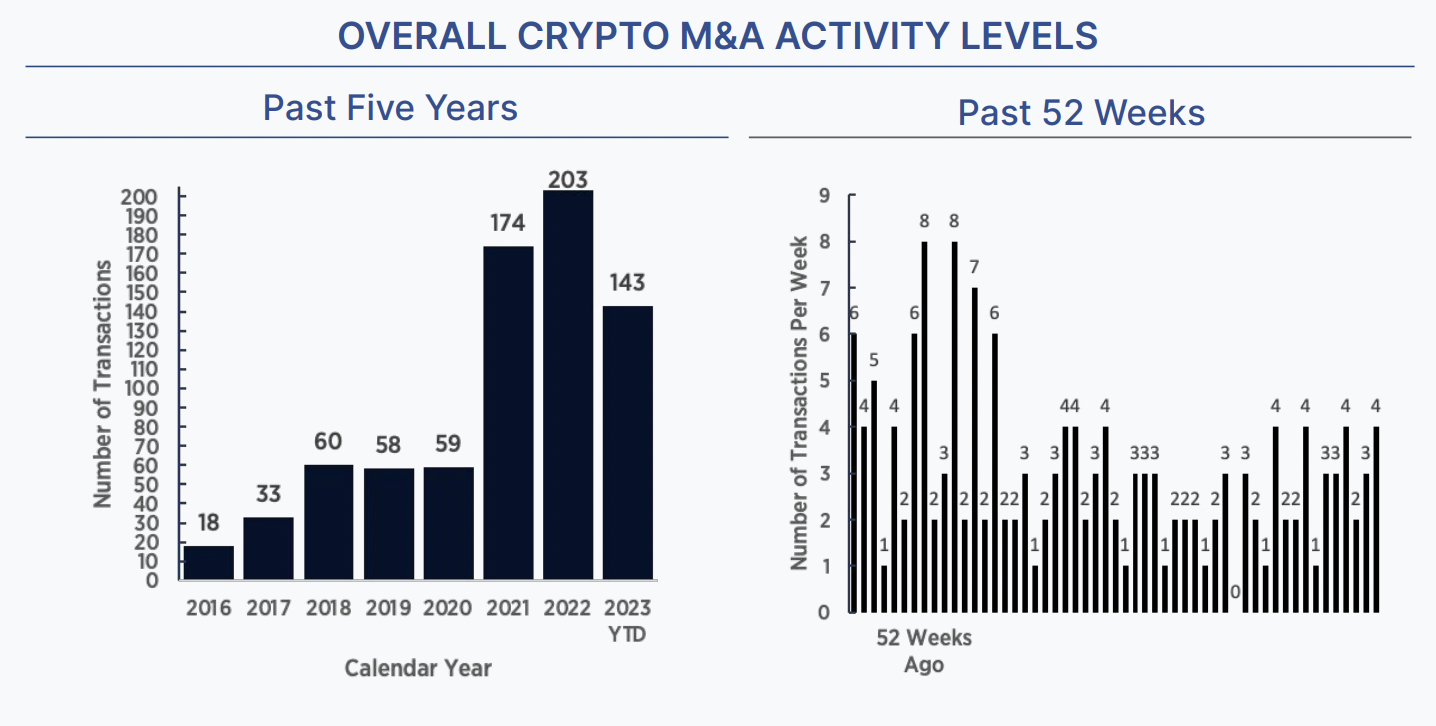

Protocol M&A is rapidly maturing.

A protocol’s success is measured by attracting, scaling and retaining users, no different than a traditional company and its products and services. While perhaps a bit more “organic” in design (sometimes), the leadership of a protocol thinks and acts much like traditional founders and management.

Why acquire? We see M&A as a manifestation of corporate (and now protocol) strategy. For early and mid-stage businesses and protocols, the most frequent drivers are in increasing order of value:

- Attract talent

- Acquire technology

- Access to capital

- Combine efforts with a competitor

- Acquire complementary products or capabilities

- Acquire active users

Increasingly we see protocol mergers and acquisitions as part of the strategy tool set. A perfect existence proof is the open-source software movement. Over the past two decades, a similar dynamic emerged in the open-source software market. In fact, this also signals what will eventually become another form of transaction, a corporate entity acquiring a protocol. It will take time, but think MySQL being acquired by Sun or GitHub being acquired by Microsoft.

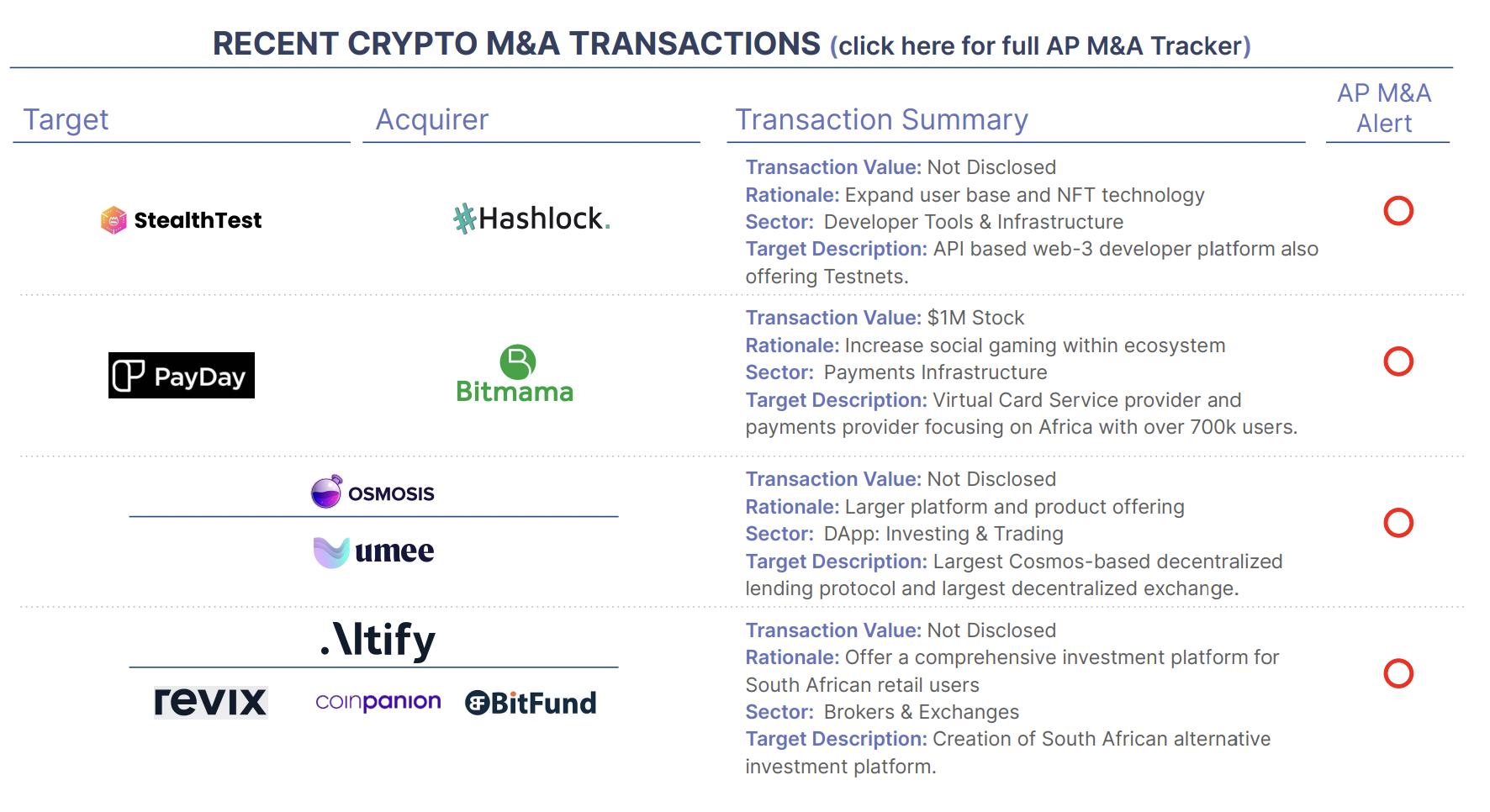

By our count, this week, the world’s 5th protocol merger was announced. Osmosis and Umee, both decentralized finance protocols, announced the intention to merge efforts, both of which share a commitment to the Cosmos ecosystem.

Final thought, we’d argue that most “protocols” are better described as open-source projects. Strictly speaking, a protocol is a set of rules governing interactions between computers or people. Certainly, every crypto project uses protocols but virtually all are building software that “does something useful” for a user on top of the protocol(s). In our view, that should have a different designation. Some may use open source projects, some may use dApp, and some may simply use “software, product or service that does [ ]”, but all are better than the term protocol.