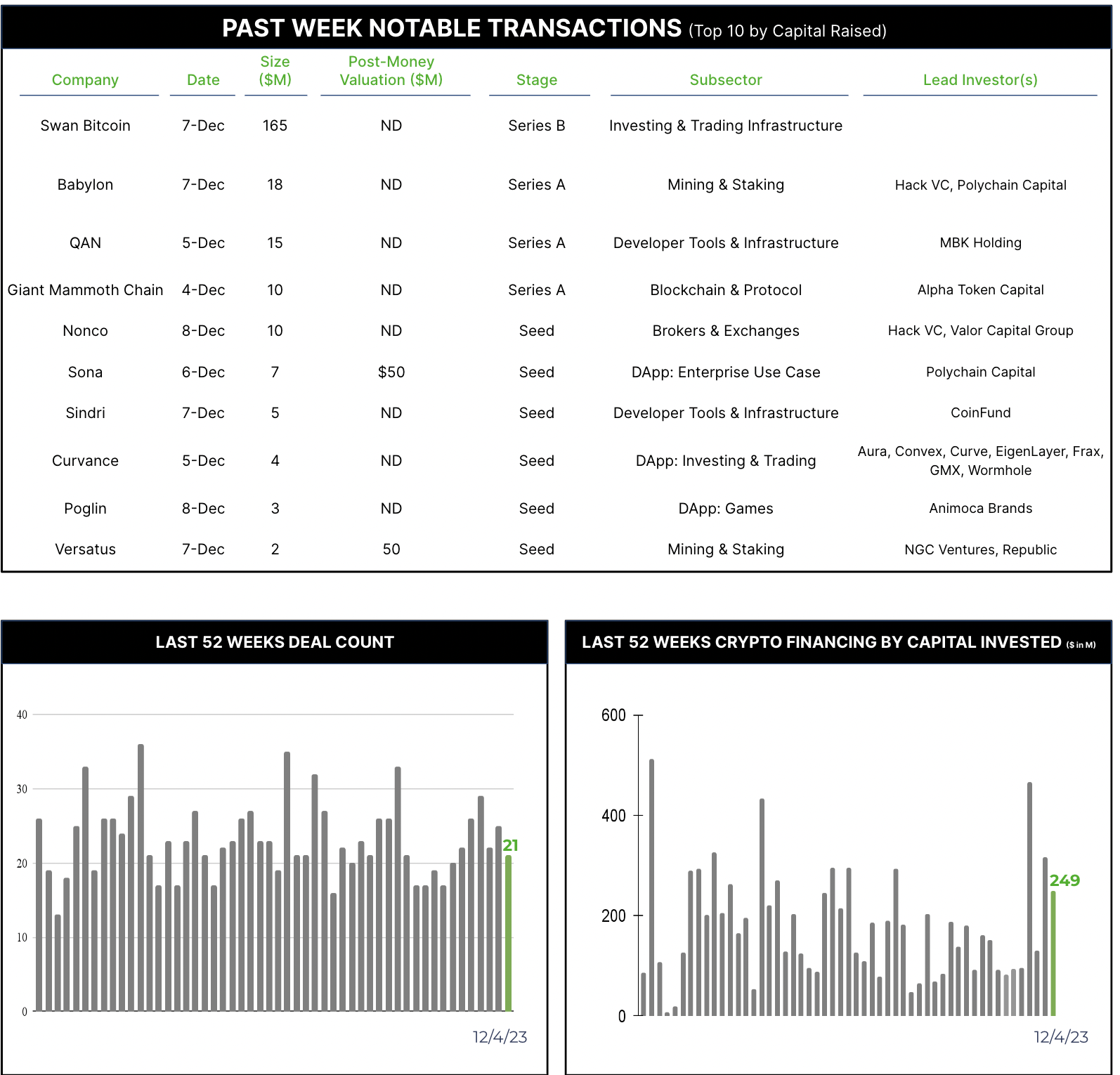

21 Crypto Private Financings Raised ~$249M

Rolling 3-Month-Average: $166M

Rolling 52-Week Average: $179M

Private financings announced this week came in with a healthy $249M raised across 21 deals, representing consistent deal flow and a robust amount of capital after a few banner weeks. The majority were smaller and earlier stage deals, with the $165M announced by Swan Bitcoin standing out as the sole larger raise.

Swan is an investment platform founded in 2019 that provides asset management services to investors seeking to accumulate bitcoin. This week they announced a pair of financings completed in 2023 – $40M to fund expansion plans and another $125M to support PE and venture investing across the Bitcoin ecosystem – with an additional $150M planned for 2024.

At the core, Swan develops investment software to facilitate consistent accumulation of Bitcoin with low costs and friction. They are focused exclusively on Bitcoin investment and savings, and intend to use their new expansion capital to move into institutional products. This will include bitcoin-backed lending products, a potentially controversial move after high-profile meltdowns among the likes of Celsius, BlockFi, and Genesis. But the wake has left a void of lending capacity, and Swan feels well-positioned to enter the space as a trusted institutional-grade player after withstanding and emerging from the crypto carnage of 2022. They intend to do so with two key differentiators from other failed crypto lenders – first, focusing exclusively on Bitcoin-backed loans, and second, by insisting they will never rehypothecate funds to invest or lend client assets outside of their own accounts.

Details, including valuation and participation, on the round(s) are scant, but the investor validation from a sizeable raise during a sparse year for big rounds seems clear. And this is yet another example of the ongoing evolution from speculation to investment, which we believe to be a healthy sign of maturation for Bitcoin and the crypto asset class in general.