February 3rd – February 9th

PERSPECTIVES by Eric F. Risley

Let’s talk security.

Simple principles like protecting the sanctity of users privacy and ensuring that their crypto holdings are not stolen. Last year, according to Cyvers, over $6.3B was lost in Web3 hacks, fraud, and scams.

Security is table stakes and crypto has not delivered satisfactorily … yet.

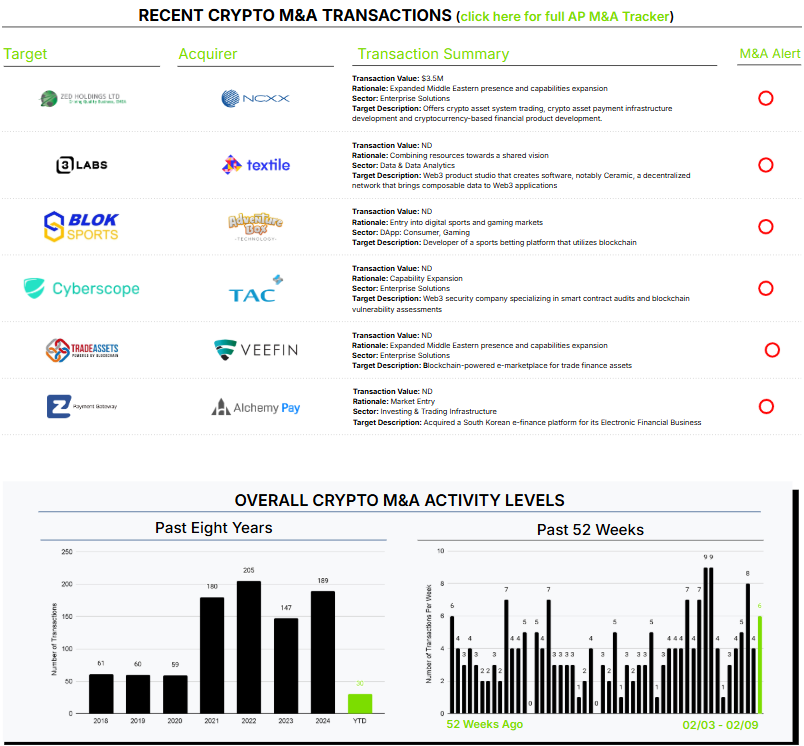

A clear trend has emerged over the past six months that these first principle problems are being acknowledged and are starting to be addressed. This week another block in that trend was laid. Smart contract audit and blockchain vulnerability assessment specialist Cyberscope was acquired by TAC. This follows four other recent, significant Web3 security M&A transactions:

| Target | Acquirer | Date | Acquisition Price ($M) | Target Description |

| Wallet Guard | Consensys | 07/03/2024 | $40 | Open-source browser extension tool featuring a multi-layered defense from phishing detection to transaction simulation |

| Blowfish | Phantom | 11/20/2024 | 55 | Real-time fraud detection, transaction simulation, and user alerts |

| Hexagate | Chainalysis | 12/18/2024 | 60 | Web3 browser security designed for analyzing transactions before users sign them, flagging cybersecurity and financial risks |

| Alterya | Chainalysis | 01/13/2025 | 150 | AI-powered Web3 Fraud prevention |

Smart contract audits are critical, but also according to Cyvers, 4x more assets were actually lost last year due to access control violations versus code vulnerabilities. Better real time threat detection and response solutions are needed to protect against this attack vector.