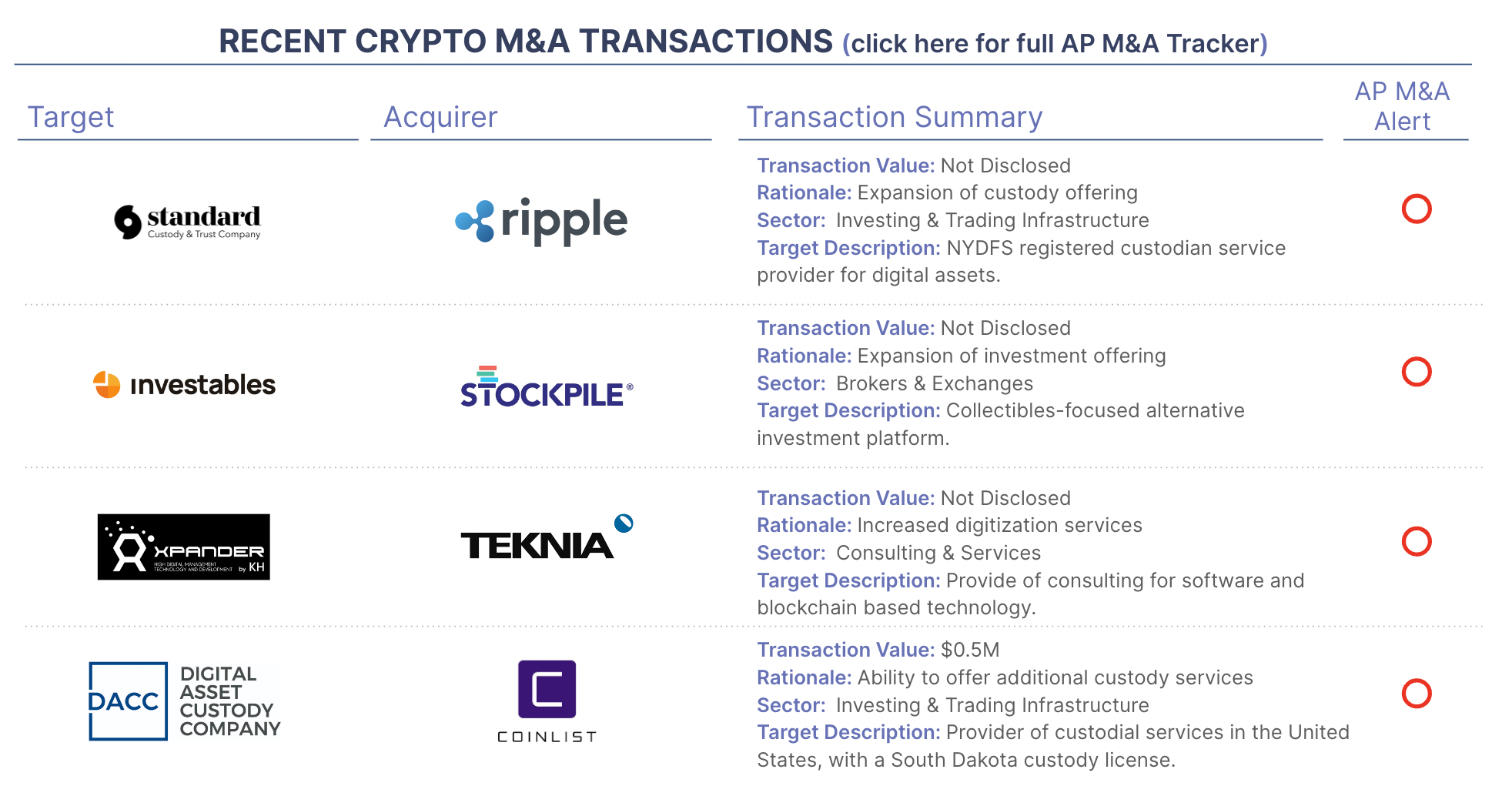

A few smaller deals were announced this week plus one more strategic.

Stockpile, the financial app for kids and parents, has acquired the asset of Investables, a fractional alternative investing platform focused on collectibles. Stockpile has raised $45M to date, most recently from Mayfield Fund and 8 Roads, and allows kids to invest in equities and crypto (powered by Baakt) with parental approval.

FTX will sell Digital Custody Inc. (DCI) to CoinList for $500k, 95% less than FTX paid in 2022. In a twist, DCI’s original CEO will provide financing to CoinList for the purchase. DCI holds a custody license from South Dakota.

Teknia, a manufacturer of components for mobility solutions (car parts) headquartered in Spain, acquired XPander, a Spanish digital consultancy with blockchain technology.

Ripple continues to build out their custody capabilities with the acquisition of Polysign’s subsidiary Standard Custody & Trust. Standard Custody holds a New York Limited Purpose Trust Charter, one of just nine New York licensed crypto trust charters. Ripple knows Standard Custody well – the architects of Standard Custody’s technology are Arthur Britto and David Schwartz, co-creators of the XRP Ledger. Schwartz is Ripple’s current Chief Technology Officer, and Britto was the founder of PolySign. In 2022 Polysign acquired MG Stover, a well-regarded institutional fund administrator, servicing hedge funds, money managers, VCs, and private equity funds. The strategy was to build a trusted, regulatory-compliant crypto asset custody business by combining the existing relationships of MG Stover with Polysign’s regulated “through the front door” custody services—however, timing matters. Crypto winter hampered client wins and Coinbase dominated during this period with its well-regarded custody services and aggressive pricing. This is also a cautionary tale on the challenges that come from venture debt. In this case, debt covenants created a crisis that resulted in their lender assuming control of a portion of the company. From Ripple’s perspective, this acquisition nicely complements their custody technology acquisition of Metaco with U.S. licenses allowing custody services.

Events

If you missed us at the Satoshi Roundtable two weeks ago, Architect Partners will next be at ETH Denver (2/29 – 3/3), and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.