Three transactions were announced this week, none with announced valuations or of material size.

Xalles, a pink sheet fintech holding company, acquired CashXAI, an early-stage network of self-service cash-to-digital-currency kiosks in Mexico. CashXAI has major plans to expand across Mexico, the U.S. and internationally.

Taki Games merged with Unite, a Polygon-based web3 gaming company to further the transition of its web3 mobile casual game business from Solana to Polygon network. Taki is not the only game company to announce a shift to Polygon this week, as Polygon is viewed as a strong L2 Ethereum scaling solution for web3 games, due to a large user base and low gas fees. Concurrently, Taki announced a partnership with Quickswap, a decentralized exchange (DEX) on Polygon, to launch TAKI liquidity pools. These liquidity pools will allow seamless transfers of TAKI tokens between the Solana and Polygon networks.

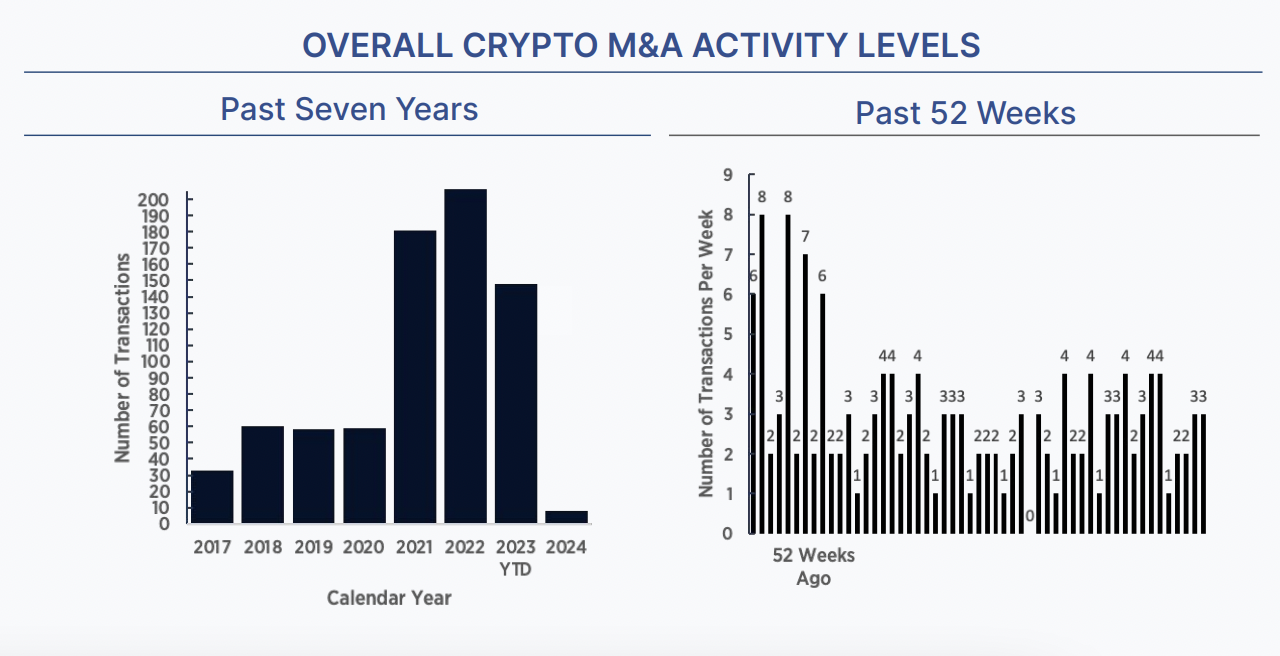

We recently published our Year-End 2023 Crypto M&A and Financings Report which highlighted the activity of the past year, in detail and led by data, and took a look towards what is next. You can download the full report here.

One of our themes addressed developer tools & infrastructure, where Mysten Labs is a leader. Mysten’s first product, Sui Blockchain, is a newish layer 1 blockchain network that could pose a threat to Solana. Which brings us to the most interesting deal announced this week: NAVI Protocol, the #1 liquidity protocol on the Sui blockchain, acquired Volo, a premier liquid staking service provider (liquid staking allows users to earn yields on their staked SUI tokens while maintaining liquidity). According to NAVI, this move marks the first time a protocol in the Sui ecosystem will offer combined borrowing, lending, and liquid staking services. Mysten itself has raised some $330M, led by FTX. Other details on this transaction have not been announced.