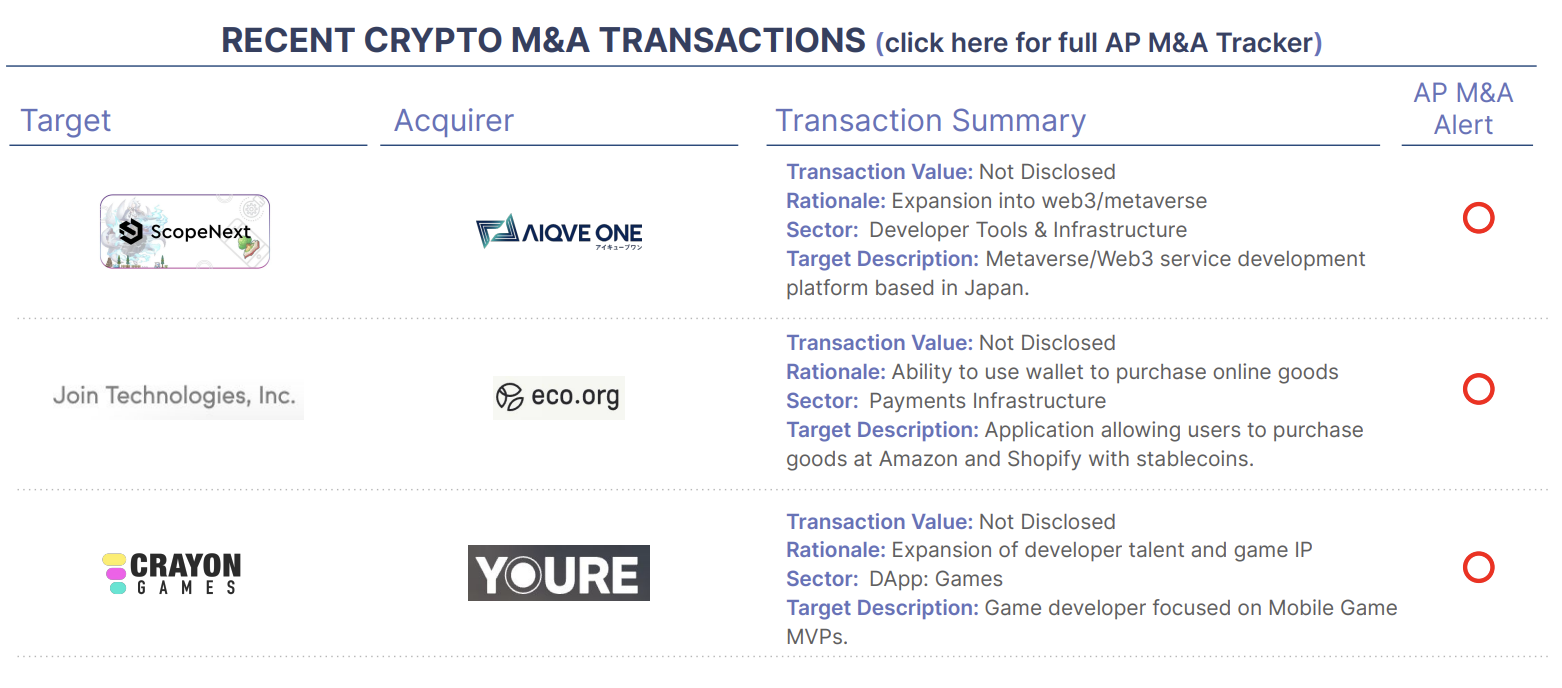

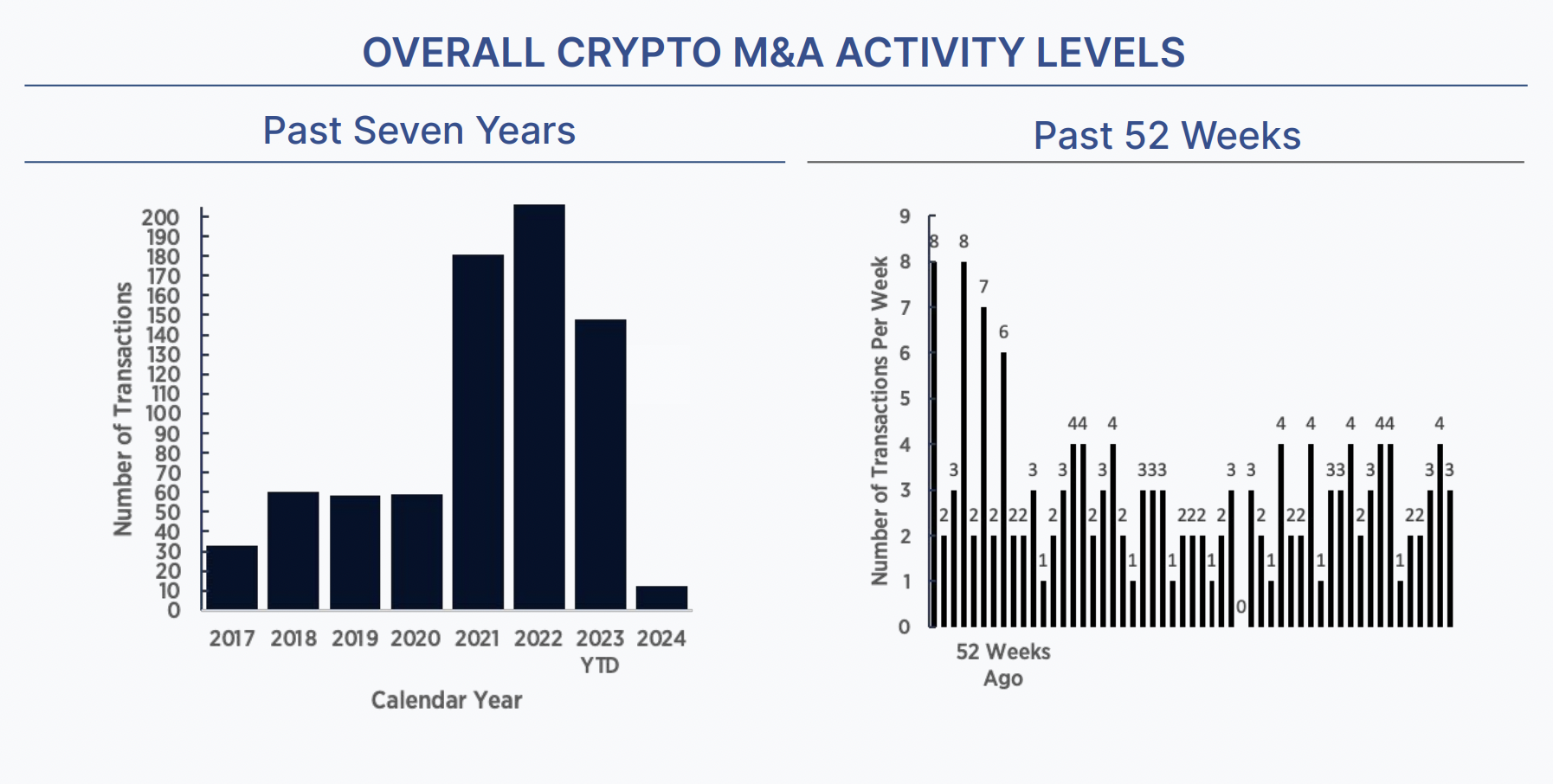

We’ve been on a roll of about 3 announced crypto M&A transactions per week for the past year or so, and this week does not break the pattern.

Probably the most interesting deal this week was Eco’s acquisition of Join, a web3 shopping app. Eco provides a digital cryptocurrency platform that can be used for simple payments, and has raised $95M from a blue-chip list of crypto investors including a16z, Coinbase Ventures, Founders Fund, Lightspeed and Pantera. Price was not announced.

Eco’s flagship product is Beam, a crypto peer-to-peer payment tool for the mass market. Beam offers an Optimism/Base self-custody wallet with 800,000 users that works quite simply – transactions are charged fixed, low fees in the same asset being sent, and onboarding is quick and easy with an X login – no need for seed phrases, etc. Gas and transaction fees are paid in stablecoins.

Join has built a shopping app that lets you purchase anything online with crypto — no need to swap or sell your tokens. From Join’s web site, it doesn’t appear that the app is currently available. The company was originally backed by investor Balaji Srinivasan and by a grant from Base.

Beam views payments as crypto’s killer use case, and with the addition of Join, users will soon be able to shop anywhere online with stablecoins. This combination has some fans: