July 14 – July 20 (Published July 23rd)

PERSPECTIVES by Todd White

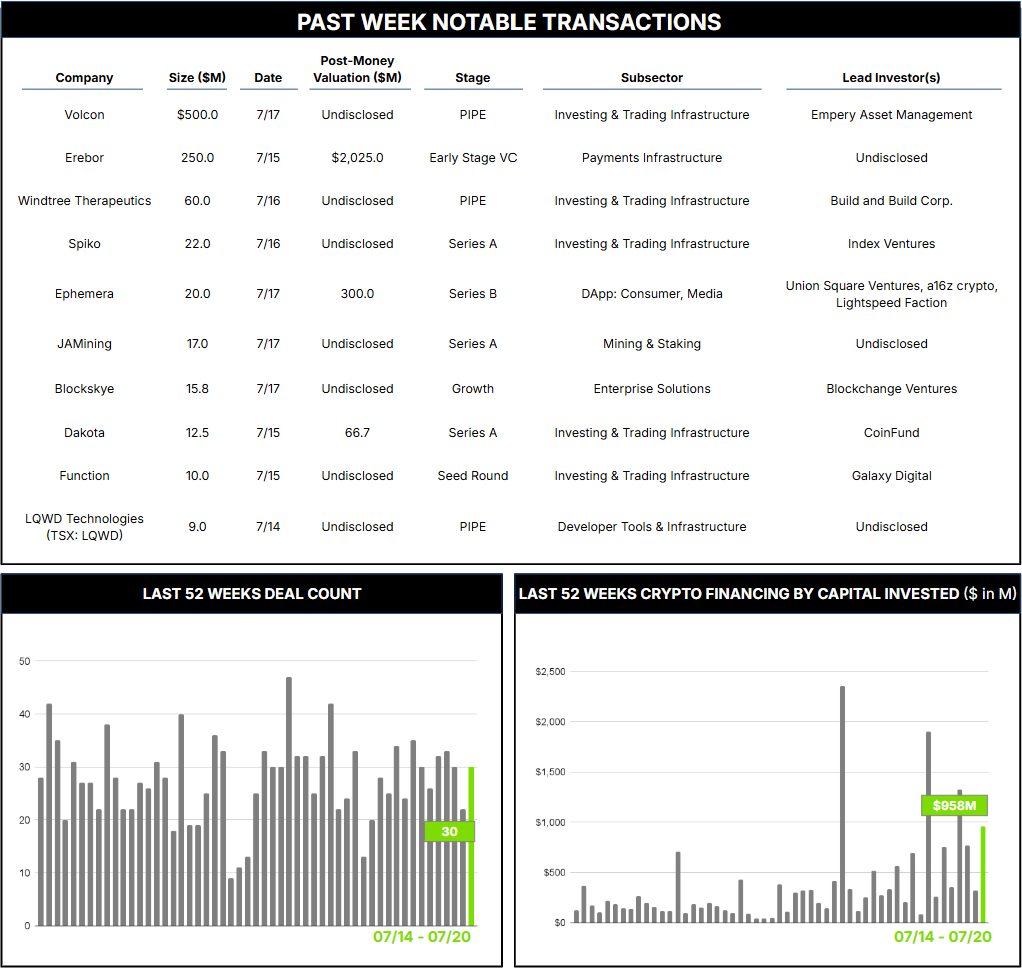

30 Crypto Private Financings Raised: $957.6M

Rolling 3-Month-Average: $654.2M

Rolling 52-Week Average: $366.7M

The tokenized MMF space is gaining momentum with the potential to streamline transactions, reduce operational frictions and enable new use cases, such as using tokenized funds as collateral in financial transactions. Traditional money market funds, which typically invest in low‑risk, short‑term securities such as U.S. Treasuries, commercial paper and repurchase agreements, have become a backbone of institutional cash management. Moving these funds on‑chain through tokenization has the potential to enhance the efficiency, transparency and utility of these funds by enabling real‑time settlement, 24/7 trading and enhanced transferability.

Unlike stablecoins, which are primarily a medium of exchange and often do not generate yield, tokenized MMFs offer returns derived from their underlying assets, making them attractive for institutional investors such as hedge funds, pension funds and corporate treasuries. The recent passage of the GENIUS Act on July 18 2025, which provides a regulatory framework for stablecoins but prohibits interest‑bearing stablecoins, may drive further interest in tokenized MMFs as a yield‑bearing alternative.

Earlier today, Goldman Sachs and Bank of New York Mellon (BNY Mellon) announced a collaborative initiative to launch tokenized MMFs for institutional investors. This platform combines BNY’s LiquidityDirect and Goldman Sachs’ Digital Asset Platform (GS DAP) and allows clients to subscribe to and redeem tokenized MMF share classes, with ownership recorded on Goldman’s private blockchain. Major asset managers, including BlackRock, Fidelity Investments, Federated Hermes, BNY Investments Dreyfus and Goldman Sachs Asset Management, are participating in the initial rollout, signaling strong industry support. This development adds credible players to an already growing space that includes Franklin Templeton, BlackRock and WisdomTree, as well as Web3‑native firms Ondo Finance, Superstate and Maple Finance.

Yet each of these groups is focused on U.S.‑dollar products. Other markets, such as the euro area, have been slower to develop. While abrdn’s Euro Money Market Fund offers tokenized interests issued on Algorand by Archax, and Franklin Templeton has a Luxembourg‑listed U.S. Treasury fund, the broader world of euro deposits remains relatively untapped. Paris‑based Spiko estimates there are €25 trillion in idle European bank deposits that would benefit from enhanced yield, capital efficiency and transferability.

Paris‑based Spiko is seeking to change that, offering both euro‑ and USD‑denominated funds in tokenized form that have been approved by France’s markets regulator. Its architecture permits transfers via stablecoins as an alternative to traditional wires and permits flexible subscriptions and redemptions in either digital or fiat currency. In its first year since launch, the firm accumulated a reported $400 million in AUM and $900 million in working capital processed through its platform from organic growth alone. Spiko announced $22 million in Series A funding last week to ramp up distribution efforts, expand API capabilities for improved use cases and reach markets beyond France.

Yet another development in the convergence of digital and traditional financial‑market infrastructure.