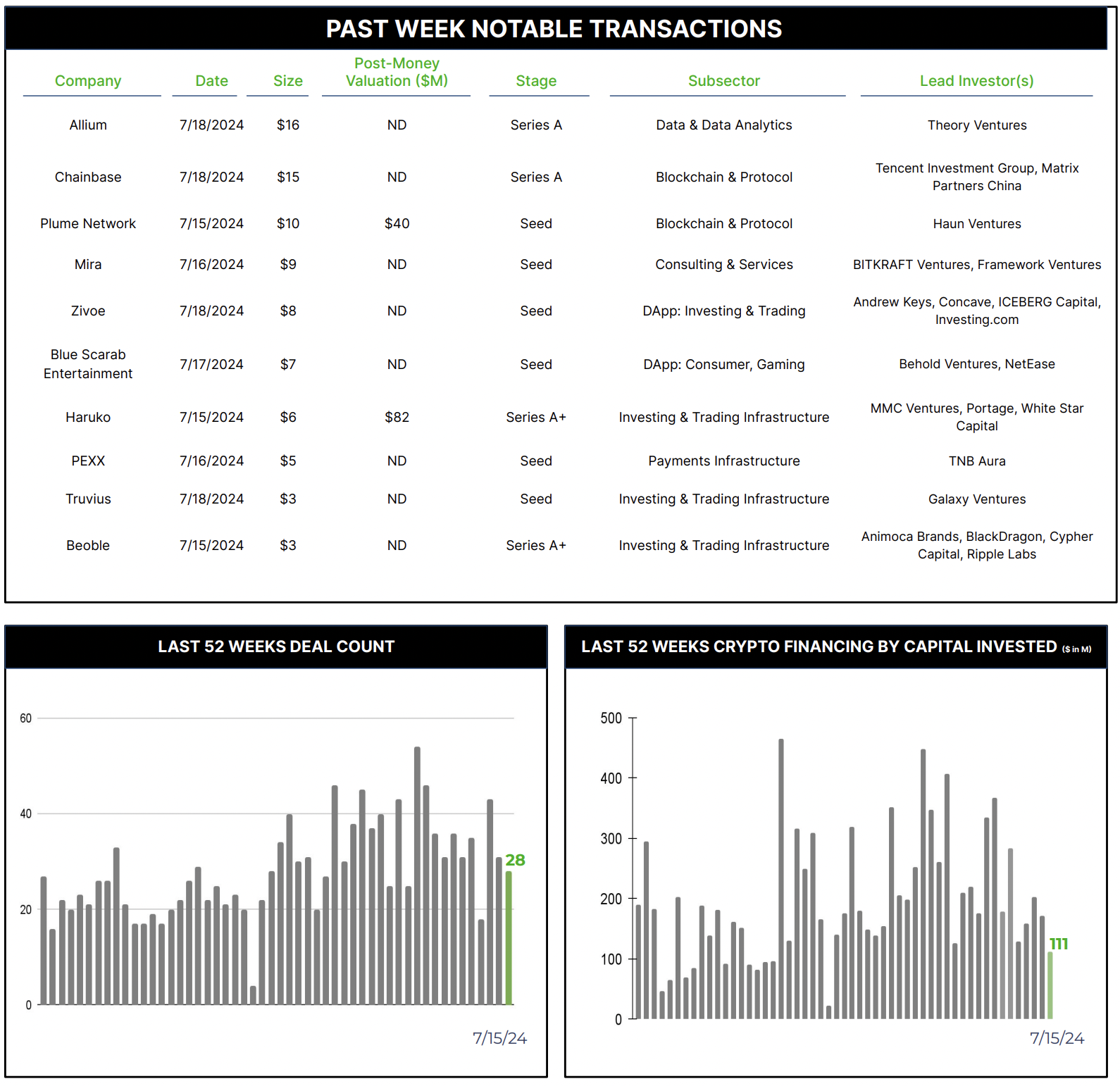

28 Crypto Private Financings Raised ~$111M

Rolling 3-Month-Average: $208M

Rolling 52-Week Average: $198M

The cryptocurrency and blockchain venture capital landscape continues to experience a notable focus on early-stage investments, as evidenced by recent funding patterns. The past four weeks in particular has shown a pronounced emphasis on this trend with only a handful of larger-scale deals bucking this trend.

During this period $265 million was allocated to the four largest transactions, representing significant outliers in the current investment climate. The remaining $445 million was distributed across 110 deals, resulting in an average investment size of approximately $4 million per transaction.

The concentration of capital in a small number of large deals, juxtaposed against the proliferation of smaller investments, indicates a bifurcated market strategy among venture capitalists. While firms are still willing to make substantial bets on a few established players, the majority of investment activity seems to be focused on diversifying portfolios across a broader range of early-stage ventures.

As the blockchain and cryptocurrency sectors continue to evolve and mature, this investment pattern suggests that VCs are positioning themselves to capture value from the next wave of technological advancements and market opportunities. The focus on early-stage companies could potentially lead to a more diverse and resilient ecosystem in the long term, albeit with increased competition for later-stage funding as these startups mature.

Allium, a company specializing in on-chain data infrastructure and services within the blockchain technology domain, has garnered significant attention, and announced a $16 million Series A led by Theory Ventures, with participation from seed investors Kleiner Perkins and Amplify Partners.

Founded in 2022, Allium has quickly established itself as a critical player in the blockchain data space. One of the primary reasons for Allium’s success is its flagship product, Allium Developer, which powers real-time blockchain applications with impressive query speeds. This product enables engineers to fetch account history, balances, and other on-chain data without being limited by static APIs, providing a competitive edge in the rapidly evolving blockchain landscape. The ability to handle real-time data streams and support multiple blockchains, including Ethereum, Polygon, and Solana, further enhances Allium’s appeal to developers and enterprises seeking robust and scalable data solutions.

Overall, Allium’s combination of cutting-edge technology, comprehensive data solutions, and strategic market positioning has made it an attractive investment opportunity, leading to its successful $16 million funding round.