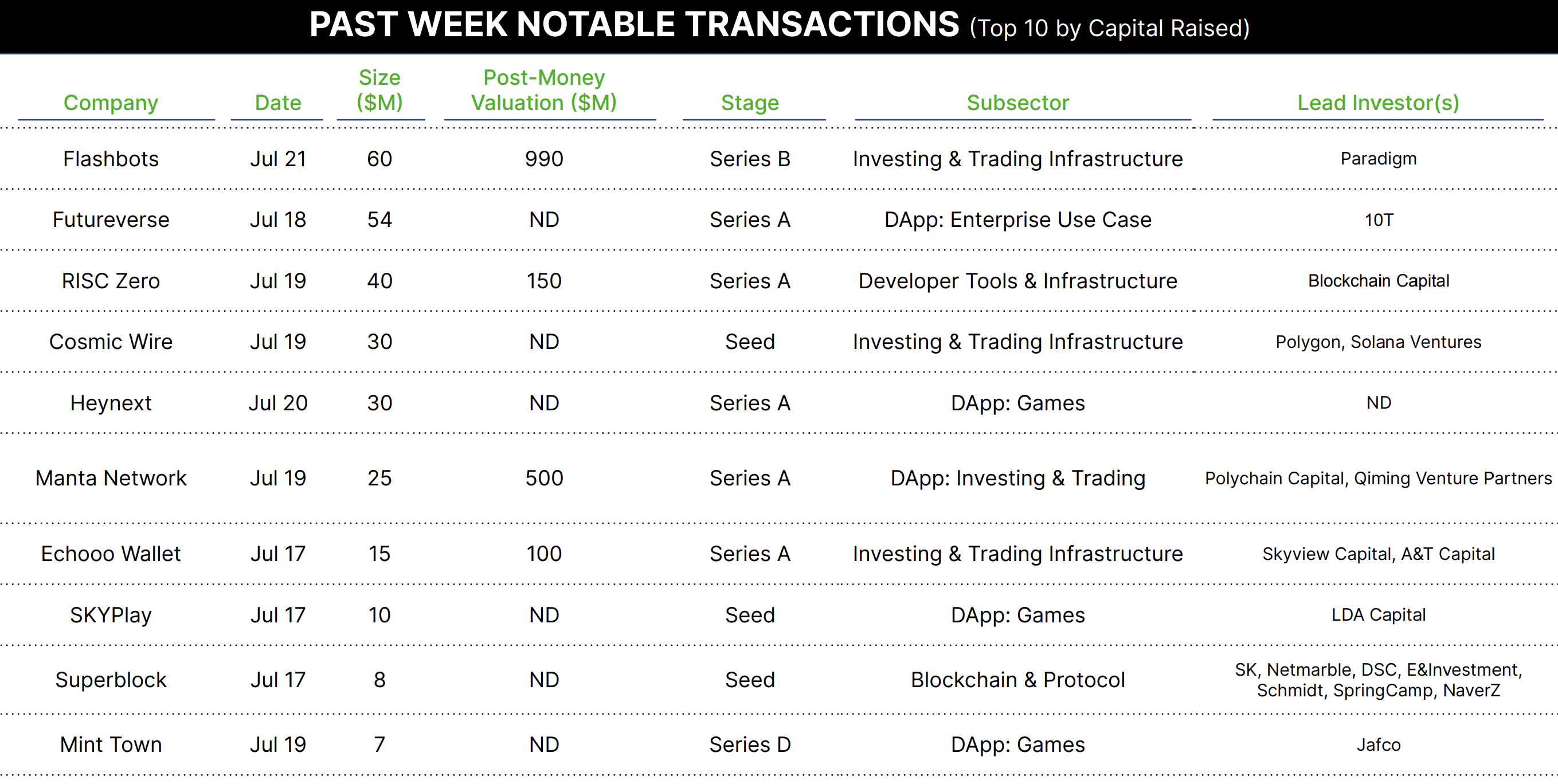

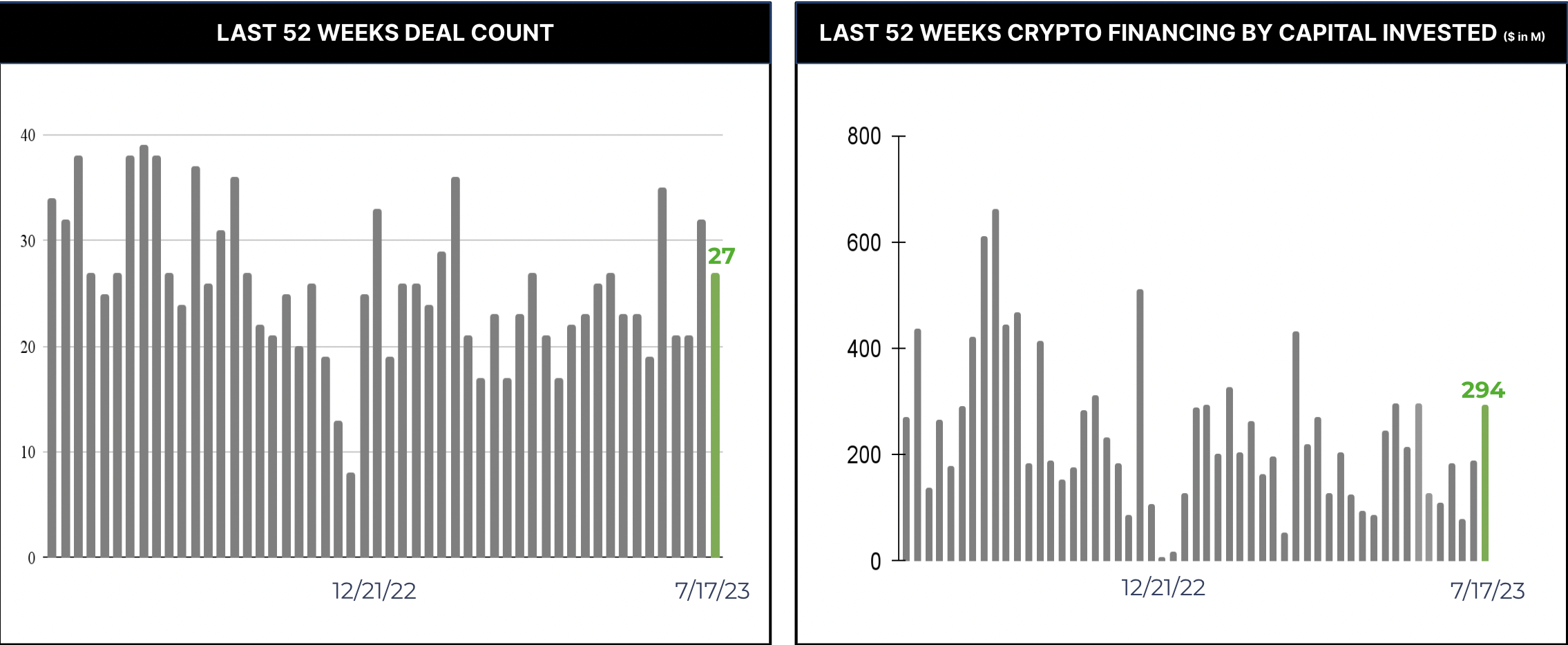

27 Crypto Private Financings Raised ~$294M

27 Crypto Private Financings Raised ~$294M

Rolling 3-Month-Average: $185M

Rolling 52-Month Average: $241M

Segment Overview

A solid week above the short & long-term rolling capital averages driven by several larger-sized rounds while deal count remains near average. Fundraising continues to be dominated by earlier stage firms with later stage remaining scarce.

Selected Highlights

Futureverse raised $54MM from 10T and Ripple. Futureverse is a group of 11 (!) companies focused on the metaverse. One focus is gaming apps, with AI also thrown into the mix.

Why Notable? Notable for size raised. While Futureverse has numerous components, traction in the metaverse has not matched the hype. Also not disclosed but Ripple often invests using the XRP token, which would make sense here since XRP is also used within the Futueverses’ environment.

RISC Zero raised $40MM from a wide selection of blockchain-focused investors at a $150MM post-money valuation. RISC Zero creates developer tools to build zero-knowledge proof software. Zero-knowledge proof provides ways to validate transactions while keeping the parties private.

Why Notable? Notable for its assembly of investors led by Blockchain Capital. 11 other investors joined the cap table, all blockchain forward investors. The firm sits squarely in the infrastructure component, an area that continues to attract investors.

Manta Network raised $25MM at a $500MM post-money valuation. Manta Network is a large collection of products focused on privacy, particularly in the DeFi space by utilizing zero-knowledge proofs in many of their products, Manta is a parachain on the Polkadot ecosystem.

Why Notable? Notable for another infrastructure firm attracting capital, and for its seemingly lofty valuation.

Patterns

Several firms focused on privacy this week, specifically firms touting their zero-knowledge proof capabilities in DeFi. This segment has had a few successful raises in recent quarters and it is notable that several have hit this week. Most of the raises are broadly categorized under the infrastructure label, a consistent segment in our weekly reviews.