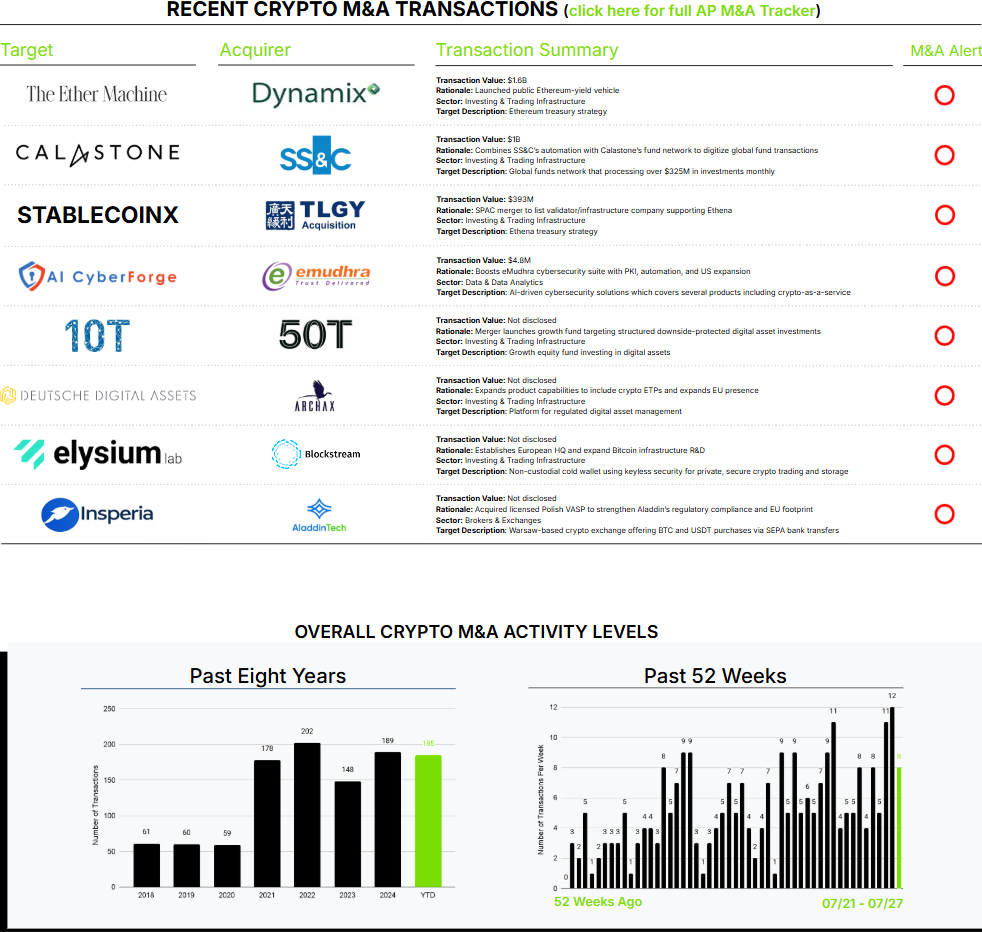

July 21st – July 27th

PERSPECTIVES by Eric F. Risley

Stablecoins Have Beaten Bitcoin

Blockstream’s acquisition of Elysium Labs brought to mind the “Bitcoin vs. everything else” debate.

So far, the vision of Bitcoin as a form of payment has been unrealized. Stablecoins have won. As highlighted in our recent Crypto Payments & Infrastructure: The Strategic Opportunity, stablecoins represent $7.1 trillion in annual normalized volume of transactions. By comparison, Bitcoin’s payment-optimized L2, the Lightning Network, volume remains in the low single-digit billions per year. So far, stablecoins have won due to:

- U.S. Dollar Preference: Virtually all stablecoins are pegged to the U.S. dollar, the dominant, often preferred, global currency.

- Lack of Price Volatility: The U.S. dollar peg eliminates concern over Bitcoin’s price volatility.

- Spending vs. Investing: Bitcoin is widely seen as an appreciating investment, not something used for day-to-day payments.

- Low fees, quick settlement, easy, and now with regulatory clarity: Sending stablecoins is fast, costs just pennies, and is now widely integrated into exchanges, apps, and wallets, appealing for all parties in the transaction. Recently advanced stablecoin legislation offers the comfort of regulatory legitimacy.

What could change over the next few years to reverse this trend? Well, Bitcoin has a number of important differentiators and perhaps relative advantages. These include the lack of a centralized issuer reducing or eliminating counterparty and censorship risks, privacy advantages, finality of transactions, and inflation protection. We will explore this topic in more detail next week.