July 21 – July 27 (Published July 30th)

PERSPECTIVES by Todd White

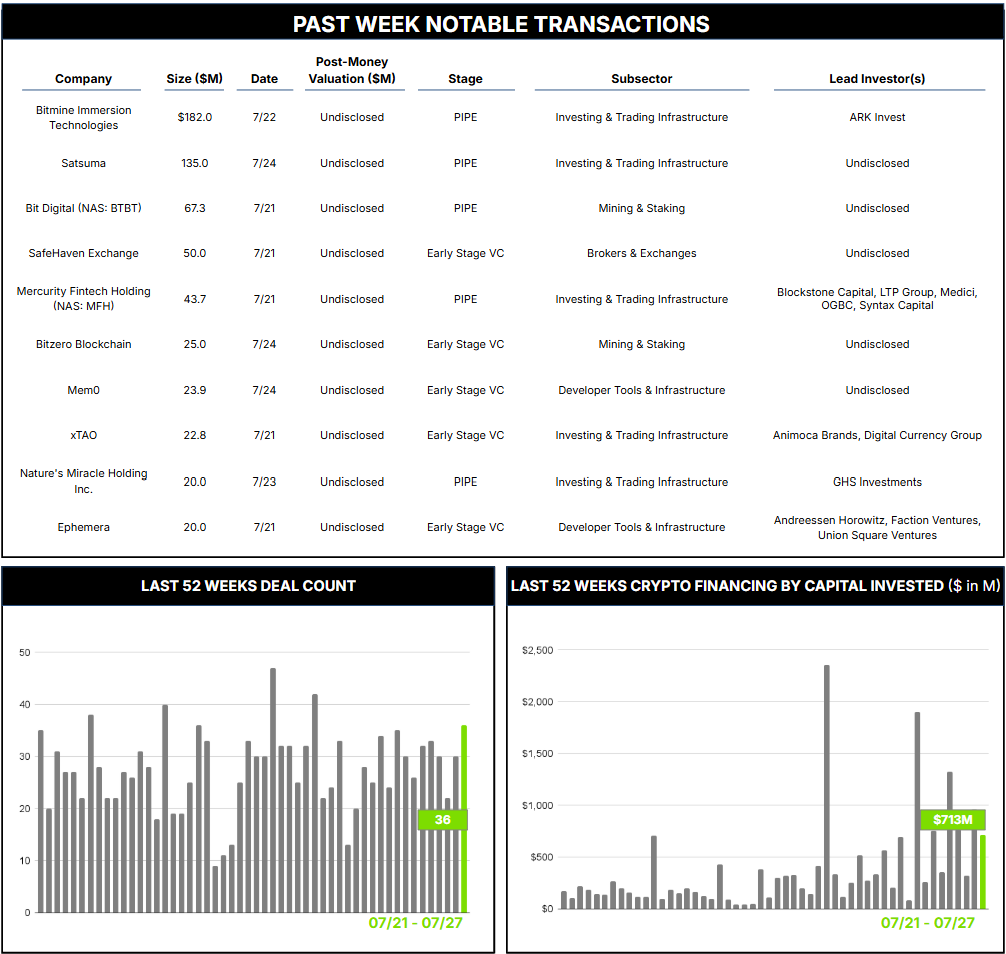

36 Crypto Private Financings Raised: $712.9M

Rolling 3-Month-Average: $693.3M

Rolling 52-Week Average: $373.3M

The Bittensor network is a decentralized platform that combines artificial intelligence (AI) with blockchain technology to create a marketplace for machine learning models and data. It has a unique architecture that consists of a main blockchain called Subtensor and a series of “subnets,” specialized decentralized marketplaces focused on different digital commodities such as AI models, compute, data, storage and more. Anyone can participate as a Miner (providing AI models or resources), a Validator (ranking contributions) or a Subnet Owner (shaping subnets for specific use cases). Instead of one company controlling everything, Bittensor lets anyone contribute their AI skills or data and uses its Yuma Consensus mechanism to align incentives and reward contributions.

Originally founded in 2021, Bittensor has evolved to include diverse subnets for text generation, data curation and specialized inference, with numerous additional projects under development. The economic model revolves around TAO, the native token designed similarly to Bitcoin, with a predetermined capped supply to create structural scarcity. TAO is used to facilitate transactions within the Bittensor ecosystem, including user service fees, network rewards and staking, and provides for governance in a permissionless framework.

The TAO token’s market capitalization is currently about $3.5 billion. While pricing has been volatile, the capped supply presents potential for outsized gains if the network takes off. This outlook has attracted interest in TAO as a treasury asset, with groups such as Safello and TAO Synergies seeking to launch TAO-centric treasury company strategies.

One such group is Satsuma Technologies, a UK-listed company specializing in AI infrastructure and subnet development for decentralized applications within the Bittensor network. The company rebranded earlier this month from TAO Alpha PLC, a name linked to the smallest Bitcoin unit, satoshi. It also initiated a Bitcoin treasury strategy by acquiring an initial 28.56 BTC, bolstered by a £100 million (approx. $135 million) convertible note round to fund what will become one of the largest single Bitcoin treasury acquisitions by a British firm.

This is notable for several reasons. It quickly positions Satsuma as one of the largest UK crypto-treasury firms and potentially, at least for the moment, within the top 25 globally. Yet the company’s core business remains focused on infrastructure and AI agents for the TAO-native Bittensor network, running validator nodes and maintaining a subnet marketplace that, among other things, pairs alpha tokens with TAO in liquidity pools. The choice to accumulate BTC as its treasury asset is therefore an intriguing one, with proceeds from its cash-flowing core business deployed away from TAO and into Bitcoin instead. Does this suggest potential for integration between the Bitcoin and TAO communities? Or is it merely a bet that Bitcoin’s long-term upside is more attractive? Time will tell.