A blockchain is the banking system.

That statement is far too simplistic but perhaps serves as a useful metaphor. Simply put the most basic function of the banking system is to accurately maintain a record of fiat money. Let’s call it, the source of truth. Pretty simple if it is recorded as a record in a single bank’s database, far more complex when that fiat is spent, transferred or invested. Today there are 4,577 just in the United States and the number of financial institutions that must maintain a record of fiat balances are many tens of thousands globally.

The implications of a single, globally accepted source of truth is profound. It will take decades to unwrap the impacts and, just like the early Internet in the early 2000’s, we are only now beginning to piece together the myriad of implications and new use cases.

Another, just as important function of the global banking system, is to allocate capital from those with “excess capital” to those who need capital. Again, simply put, a bank takes deposits and loans (“invests”) those deposits. Systems like Ethereum, Solana and many others are designed to allow that function to be built upon their respective blockchains. This specific function has been the most prolific use case in crypto to-date showing itself in a broad variety of ways. These include the infamous creation of new “investable” tokens to support a myriad of new blockchains and protocols to more prosaic peer to peer lending platforms.

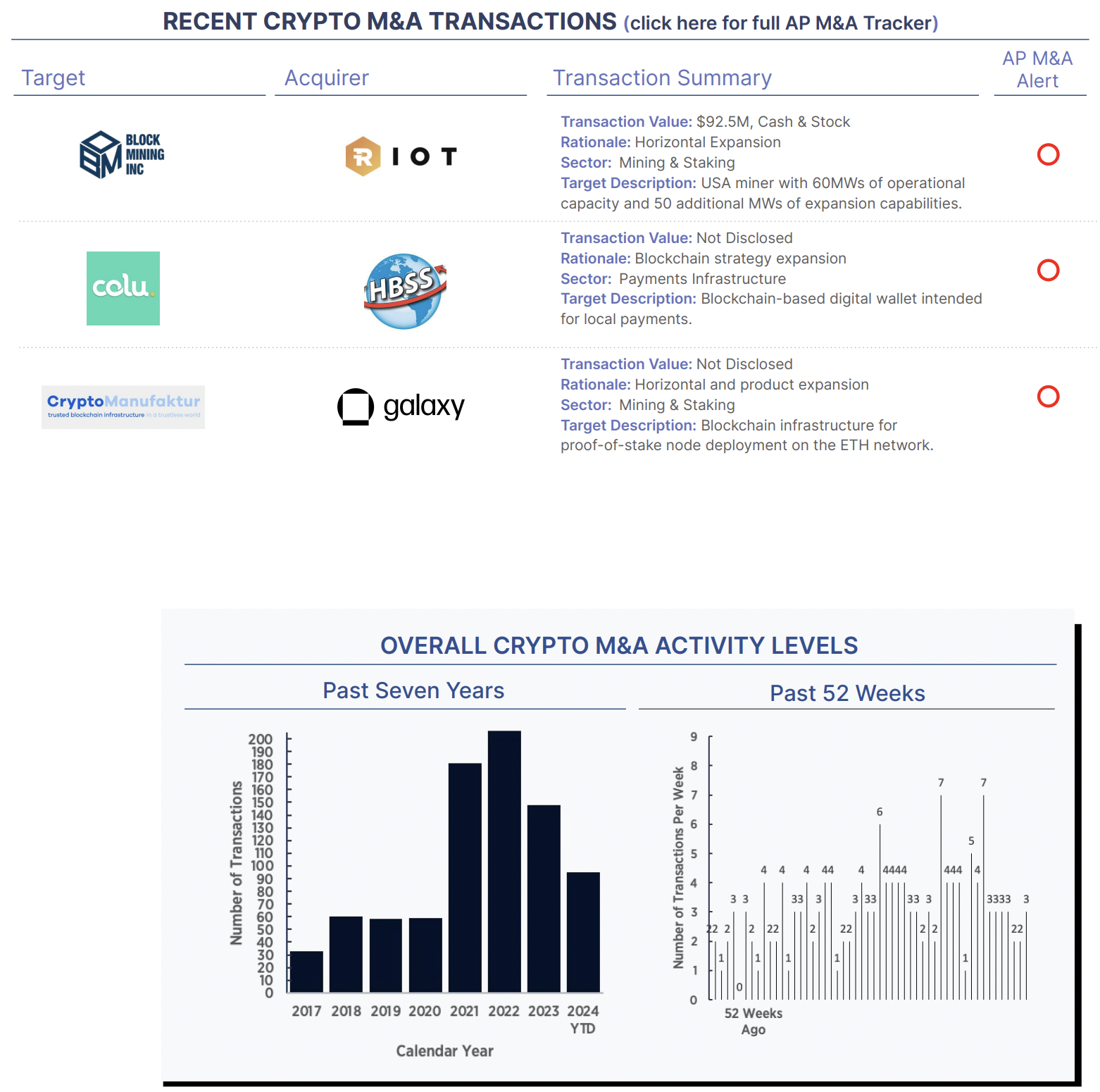

This topic comes up this week with Galaxy Digital’s acquisition of CryptoManufakur’s assets. Fundamentally the running of a blockchain is a collective activity. With proof of work blockchains like Bitcoin, it’s mining, which theoretically can be done with a simple, relatively low-cost computer any anyone. With blockchains based on staking, it’s simply another way to run a computer to track the blockchain with a different mechanism to ensure rewards and penalties for acting as an honest participant. Getting back to the initial metaphor, in essence, miners and staking node operators represent the new banking system being built as we speak.