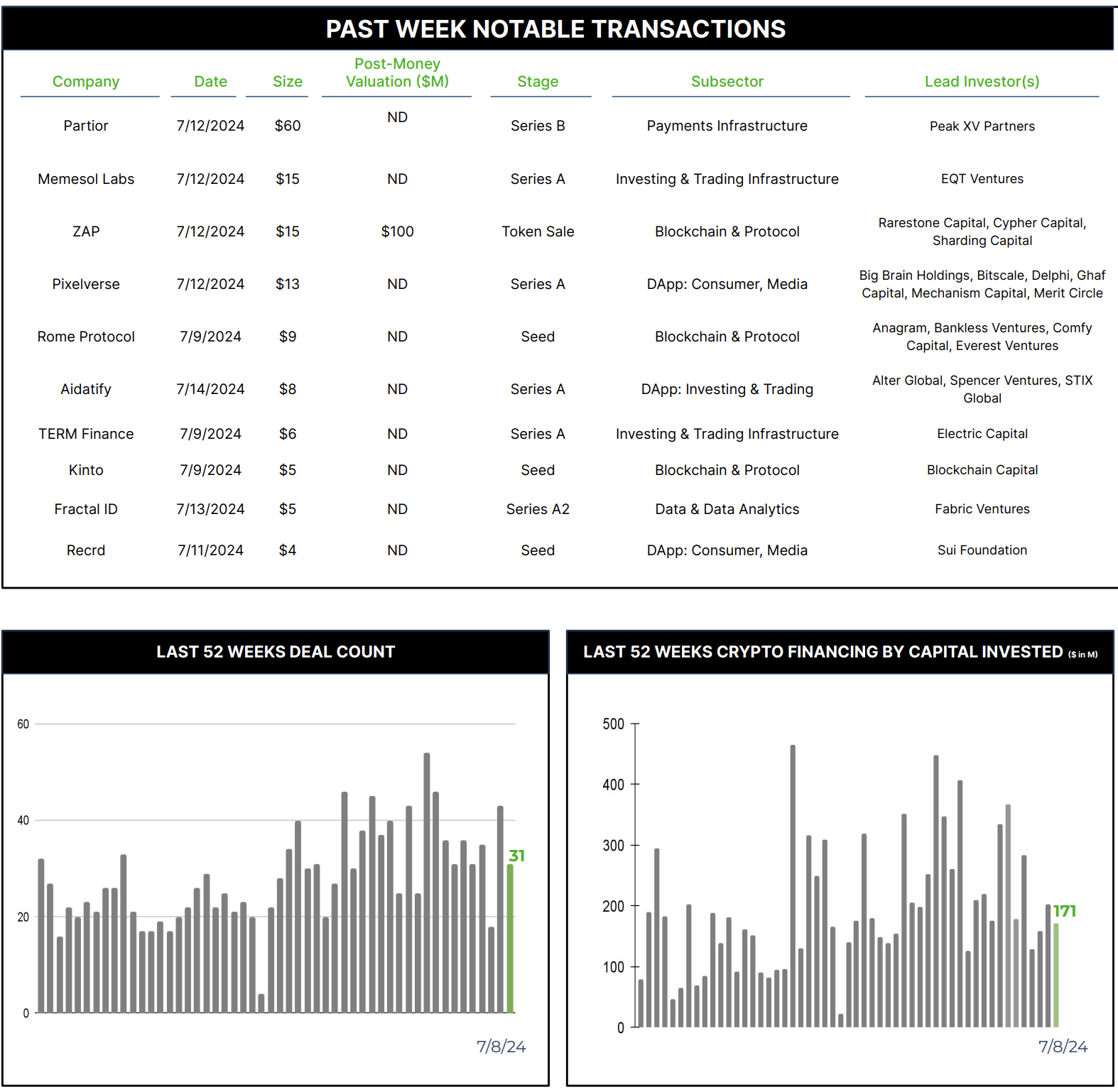

31 Crypto Private Financings Raised ~$171M

Rolling 3-Month-Average: $213M

Rolling 52-Week Average: $199M

Partior is a blockchain-powered platform that was created to provide the global financial infrastructure with unified clearing and settlement. Developed as a joint venture between JP Morgan, DBS Bank, and Standard Chartered, Partior leverages distributed ledger technology to create a “global unified ledger” that enables real-time, cross-border, multi-currency clearing and settlement for banks and payment service providers. The platform’s key strength lies in its ability to facilitate atomic settlement, where all legs of a trade, including currency and securities, are exchanged simultaneously, significantly reducing settlement risk and operational complexities associated with traditional sequential processing methods.

The value proposition of Partior extends beyond mere efficiency gains. By providing a shared ledger that enables transfers with real-time settlement finality, the platform offers instant liquidity and transparency to its users. This is particularly valuable for emerging market currencies and cross-border transactions, where settlement risks and operational inefficiencies have historically been more pronounced. Partior’s network can interoperate with real-time local currency payment and RTGS systems globally, offering enhanced liquidity management and 24/7 availability. This interoperability positions Partior as a potential game-changer in the financial industry, bridging the gap between traditional banking systems and the emerging world of digital assets.

As the financial industry continues to evolve towards more digital and interconnected systems, Partior’s blockchain-based approach positions it well. The platform’s recent successful proof of concept for foreign exchange PvP settlement, involving major banks like JP Morgan, DBS, and Mizuho, demonstrates its potential to address critical settlement risks in the FX market. With its ability to automate settlement processes through smart contracts and unlock new business opportunities, particularly in emerging markets, Partior is poised to play an important role.

This $60 million Series B funding, led by Peak XV Partners, with participation by Valor Capital Group, Jump Trading Group, and existing investors, JPMorgan, Standard Chartered, and Temasek, further underscores investor confidence in its vision and potential to drive meaningful change in the industry.