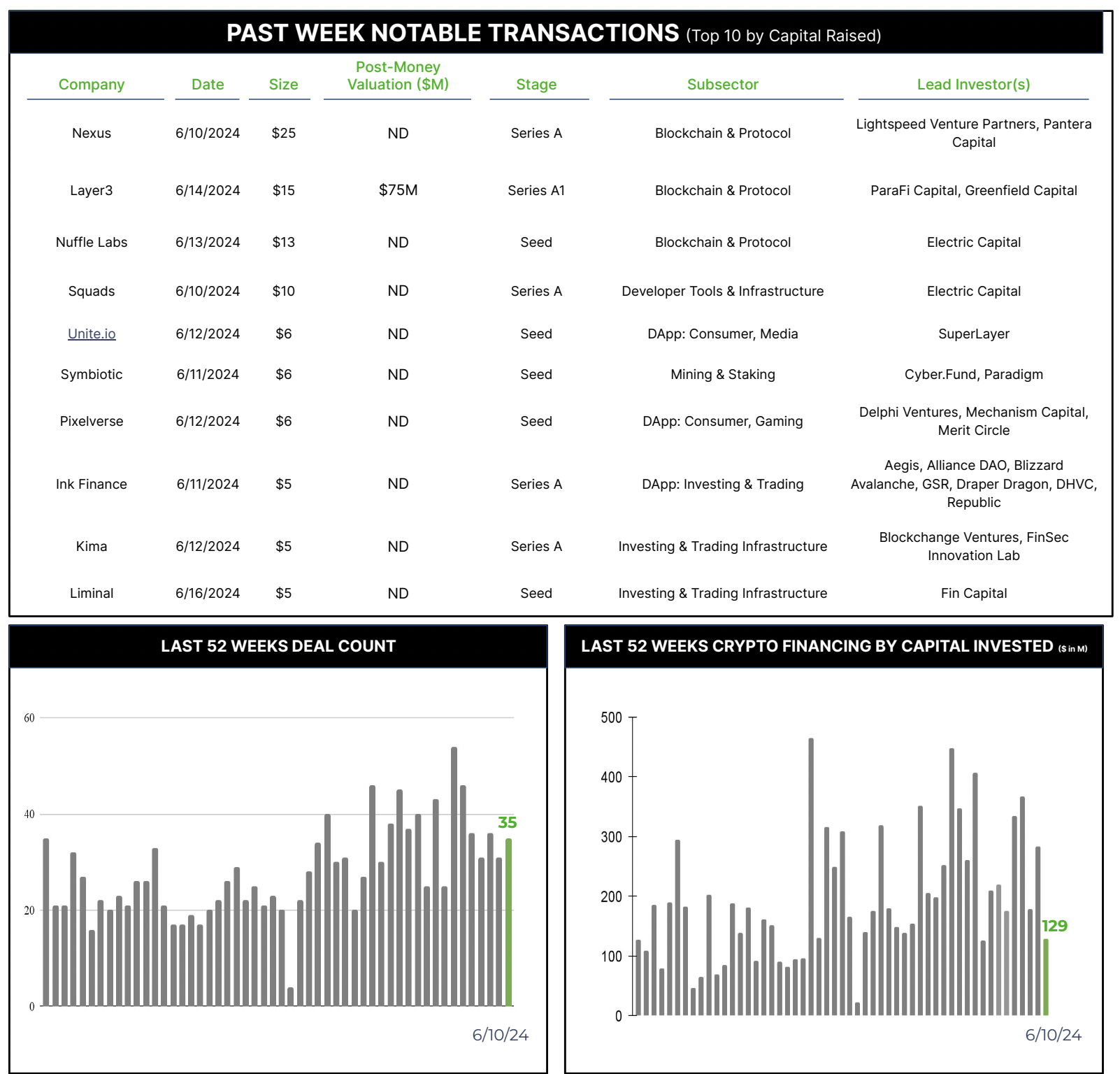

35 Crypto Private Financings Raised ~$129M

Rolling 3-Month-Average: $253M

Rolling 52-Week Average: $195M

This week, once again, we saw the dominance of early-stage investments. And while there were multiple interesting companies, we’re going to focus on the growing importance of zero-knowledge proofs.

By aligning with blockchain principles like decentralization, transparency, and privacy preservation, zero-knowledge proofs are an important innovation that has found a natural home in the crypto space. The unique challenges and opportunities presented by blockchain networks have accelerated the research, development, and adoption of ZKP technologies to enhance scalability, security, and functionality.

Zero-knowledge proofs (ZKPs) are a powerful cryptographic technique that enables one party to prove to another that a statement is true without revealing any additional information. This enhances security and privacy by allowing verification of data integrity and validity without exposing the underlying sensitive data itself. ZKPs eliminate the need to share passwords or personal information during authentication, reducing attack surfaces and risks like identity theft.

ZKPs have numerous applications for enhancing security across various domains – blockchain/crypto for enabling private transactions and scaling, secure multi-party computation, identity management, voting systems, supply chains, and more. In blockchain, ZKPs underpin critical scaling solutions like zk-rollups that batch transactions off-chain while preserving trust and privacy. ZKPs are a key enabler for bringing enhanced privacy, trust, and scalability to decentralized systems.

There are many approaches to the ZKP market, with Nexus Laboratories being one of the pioneering companies focused on making zero-knowledge cryptography more accessible and scalable for developers. Their core product is a zero-knowledge virtual machine that optimizes and parallelizes verifiable computation across a network of machines. Nexus recently raised $25M (co-led by Lightspeed Venture Partners and Pantera Capital, with participation from Dragonfly Capital, Faction Ventures, and Blockchain Builders Fund) to expand their cutting-edge ZKP tools and support early production deployments, especially for zk-rollup scaling solutions on Ethereum, although the company says their solution is designed to work across different blockchain chains and zero-knowledge (ZK) rollup ecosystems.

With techniques like compact proof aggregation, Nexus aims to drive down the costs of ZKP generation by orders of magnitude compared to current solutions. By lowering the barriers to adoption, Nexus can enable more widespread use of ZKPs across decentralized networks, AI, cloud computing, and any application requiring robust data integrity and privacy. Nexus is building key infrastructure to unlock the full potential of ZKPs for securing the next generation of internet services and applications.