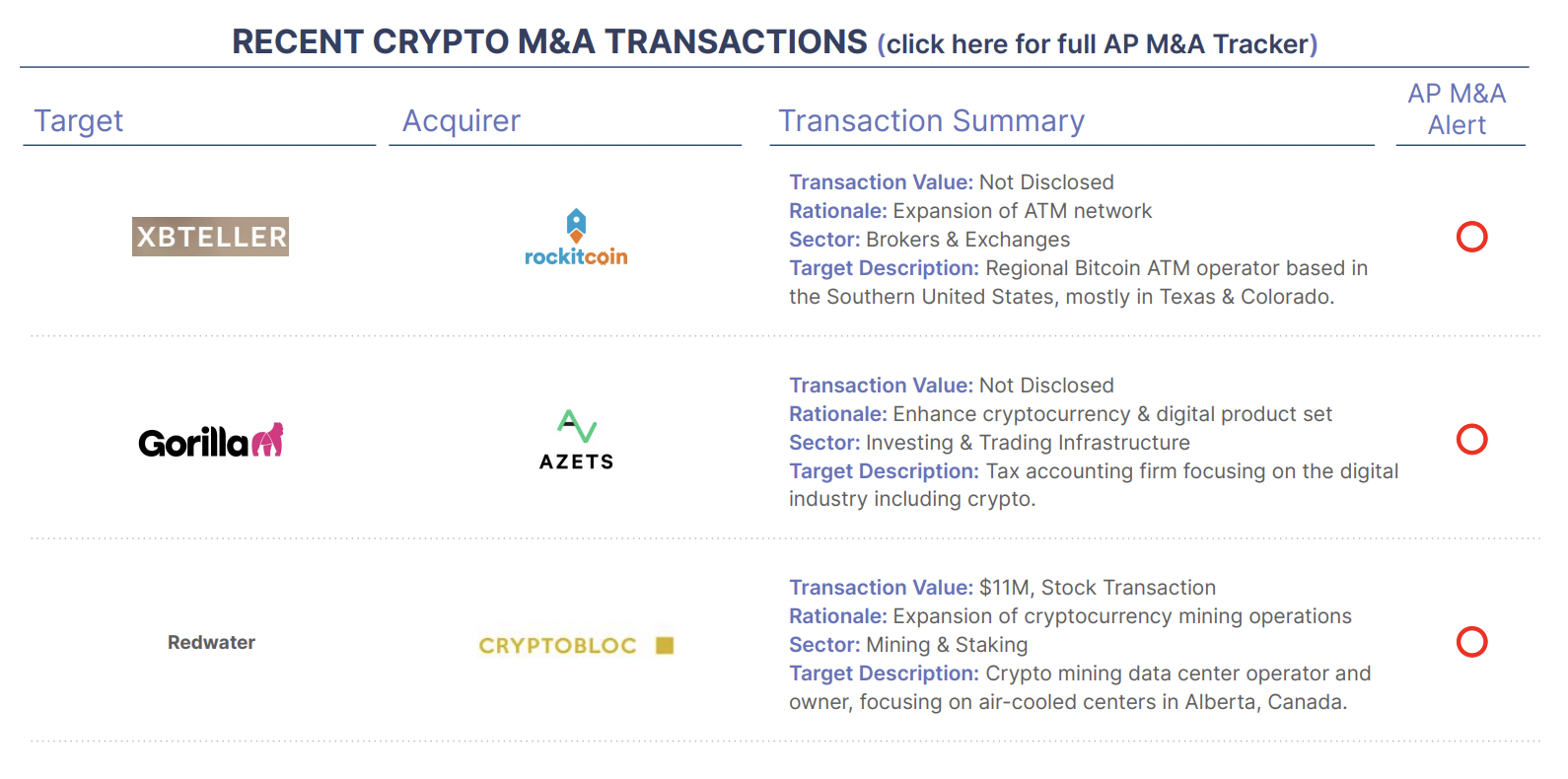

RockItCoin, a Bitcoin ATM operator, has acquired XBTeller, a Bitcoin ATM operator with 22 ATMs in Colorado. This acquisition expands RockItCoin’s nationwide network to over 2,000 ATMs. The acquisition comes at a time when the Bitcoin ATM industry is consolidating, so larger operators like RockItCoin are able to make it easier and more consistent for consumers to buy and sell Bitcoin and to capitalize on the growing demand for crypto. Fiat to crypto onramps of all types are critical to the growth of the cryptocurrency market, and both crypto ATMs and online onramps like Banxa, Moonpay, and Zero Hash are important as crypto expands to the next billion users.

Azets, a top 10 UK accountancy group, has acquired Gorilla Accounting, a 45-person strong, crypto-focused accountancy firm for entrepreneurs, sole traders, and small companies. Gorilla Accounting will retain its brand and continue to operate as a separate entity within the Azets Group. The acquisition will allow Azets to offer enhanced crypto expertise to its SME clients, while Gorilla Accounting clients will gain access to additional accountancy advice and services from Azets’ network of specialist advisors. Accounting and tax for crypto companies have become dramatically more complex in the past several years as much-needed regulations and enforcement are helping to professionalize the crypto industry. This merger highlights the importance of traditional accounting firms expanding their crypto expertise on behalf of their clients.

CryptoBlox Technologies, a cryptocurrency mining company, has acquired Redwater, a company specializing in air-cooled data centers which will allow CryptoBlox to expand its cryptocurrency mining footprint in Alberta, Canada.

Redwater has also obtained development rights to a prime location in Sturgeon County, Alberta, for its operations. The site will be used to mine cryptocurrency using waste gas from oil production. The acquisition is valued at $11 million, which includes an earnout based on reaching certain milestones.

As an update to our report last week, BitGo’s acquisition of Prime Trust was terminated after the companies were unable to find a path forward. The cancellation is a sign of the challenges facing the cryptocurrency industry.