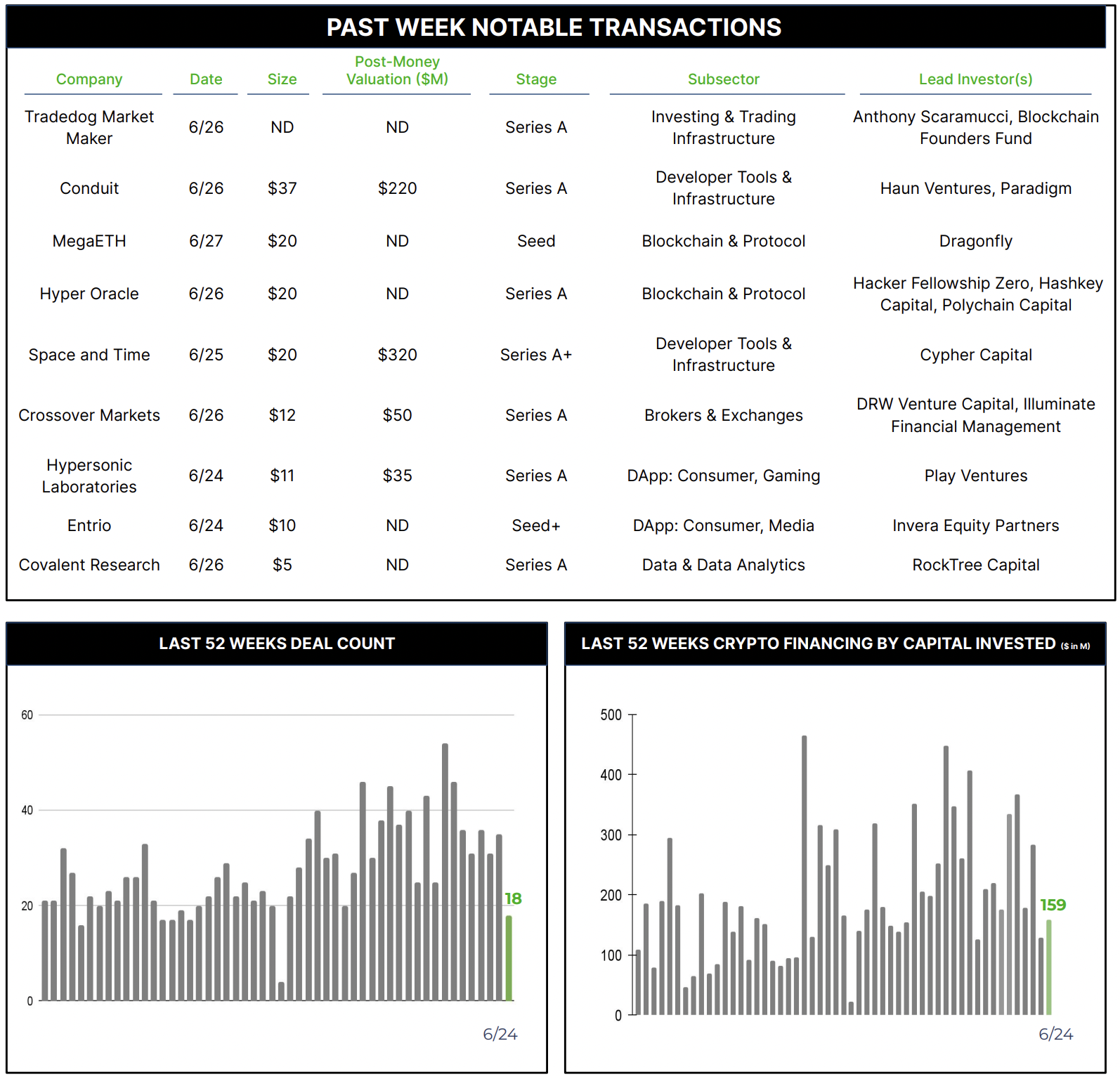

19 Crypto Private Financings Raised ~$158M

Rolling 3-Month-Average: $253M

Rolling 52-Week Average: $195M

In order to take advantage of the powerful capabilities created by blockchain/crypto technologies, the market growth of Web3 applications, especially enterprise applications, is directly tied to the quality and flexibility of development tools. As a leader in the development tools market, Space and Time (SxT) functions as a verifiable compute layer for Web3, combining a decentralized data warehouse with powerful data processing capabilities. This allows developers to build decentralized applications that can handle complex data operations while maintaining the trust and transparency that are fundamental to blockchain technology.

One of the most significant features of Space and Time is its Proof of SQL technology. This innovative zero-knowledge proof system ensures tamperproof computations at scale, allowing developers to run queries against both on-chain and off-chain data with cryptographic guarantees of accuracy. This is particularly important for applications that require high levels of trust and transparency, such as those in financial services or regulatory compliance. The ability to provide verifiable results for complex queries enables more sophisticated and reliable decentralized applications.

Among many other features of their development tools, Space and Time importantly bridges the gap between blockchain data and traditional enterprise systems. By offering easy integration with platforms like Microsoft Azure, SxT enables businesses to leverage the benefits of decentralized data warehousing without completely overhauling their existing infrastructure. This seamless connection to blockchain data opens up new possibilities for enterprises looking to build Web3 applications while maintaining their current compute power and security measures.

Because Space and Time’s versatility makes it an important tool for a wide range of Web3 use cases, they attracted another $20M in capital by Cypher Capital, with a $320M post-money valuation. While unannounced, this deal was posted in Pitchbook.